- Scammers promise to show how to create a smart contract that allows them to take advantage of MEV, an obscure, automated trading strategy.

- The scams add to the stigma of an industry that already suffers from the perception it is ridden with fraud.

- Even some who are aware of the phenomenon have fallen victim.

You too can get rich in crypto. And it’s easy: A bot will do all the work.

If it sounds too good to be true, that’s because it is. Still, many new crypto entrants continue to fall for a scam with its origins in the 2021 bull market, which then sends them scrambling to forums for help.

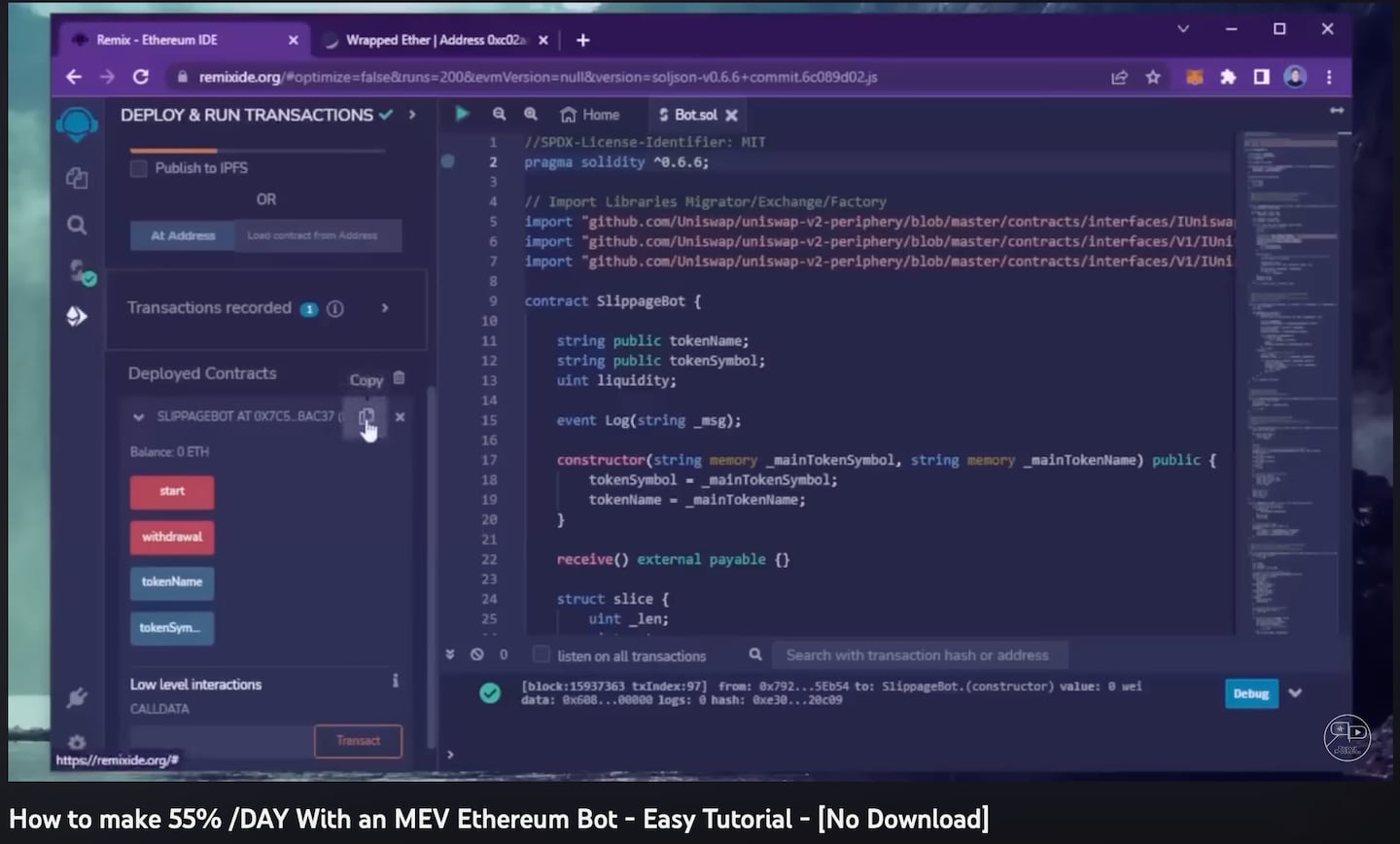

Scammers promise to show their victims how to create a smart contract that allows them to take advantage of an obscure, automated trading strategy.

The scammers provide lines of code, show victims how to deploy the contract and instruct them to deposit some Ether — starter capital needed to fund any sophisticated trading bot.

That Ether is promptly routed to the scammer’s wallet. Because crypto transactions are peer-to-peer, there is no intermediary, like a bank, to reverse fraudulent transfers.

In an industry that suffers frequent multimillion-dollar hacks, the amount lost in these MEV bot scams is relatively small.

Trading Strategy CEO Mikko Ohtamaa said victims are usually instructed to deposit 1 Ether, sometimes less. On Friday, Ether was trading at slightly more than $1,700.

Still, the cumulative impact adds to the stigma of an industry that already suffers from the perception it is ridden with fraudsters, Ohtamaa said.

“The problem is more of the number of reports and people asking for help, because that’s starting to be a problem on some forums,” he said. “And of course, the answer is, your money is gone, so there’s nothing we can do.”

NOW READ: Rookie DeFi traders bear the brunt of bot attacks: ‘Even small trades are at risk’

The scams target people with basic knowledge of software and the crypto industry. MEV, short for “maximal extractable value,” is a niche field of knowledge that is difficult to explain to a lay user, which adds to the confusion.

What MEV comes down to is Ethereum users searching for transactions waiting to be processed in a “waiting room” called the mempool, then paying validators to order transactions in a block so that they benefit. For example, if you buy a particular token, an MEV searcher could order transactions to buy it before you and also sell after you. MEV can often look like a typical arbitrage play, taking advantage of momentary differences in price between decentralised exchanges.

“People in financial occupations in blockchain — like trading — might have heard of MEV and how it works, but don’t know much about coding, smart contracts, and potential security vulnerabilities,” Nikita Kirillov, a researcher at crypto auditing firm Pessimistic Security, told DL News.

Even some who are aware of the phenomenon have fallen victim, letting their guards down after seeing YouTube videos with plenty of likes, comments, and views, one person said on Ethereum Stack Exchange, a popular coding-oriented Ethereum forum.

NOW READ: BlackRock’s Bitcoin ETF surprise sets up battle with Gensler’s SEC

To combat the issue, Kirillov suggests spreading awareness and reminding people to be wary of those who promise easy money and smart contracts that they cannot read and understand.

Ohtamaa hopes the issue can be addressed at the infrastructure level. YouTube could remove flagged videos more promptly, and Remix — a legitimate application that is nevertheless leveraged by most MEV bot scams — could give users prompts that would force them to think twice before using copy-and-paste software.

Remix already features a scam alert that tells users to “beware of online videos promoting ‘liquidity front runner bots.’”

The alert links to a blog post published in January 2022 that details the scam and notes that Remix “has become the main pinch point for this scam.”

The number of people who fell victim to the scam probably declined after the alert was posted, according to Andrew Vermouth, a Remix spokesman.

While Remix has no way to track the number of people who fall for an MEV bot scam, the number of complaints it gets regarding such scams may serve as a proxy.

“After posting that Medium article and linking to it from a scam warning on our IDE’s home tab, we have seen far fewer instances of users contacting us and trying to recover their funds,” Vermouth told DL News. “These scams had a kind of peak around when we posted the article.”

Since then, some scammers have taken to copying the Remix website “complete with our support channels linked, but of course with the scam warning removed,” Vermouth said.

NOW READ: ‘Sandwich bots’ filch millions off unwitting investors during meme coin rally

While Kirillov has seen few people talking about the scam on social media, he agrees that it is part of a larger industry problem — scams are harder to rectify in crypto than in traditional finance.

“Crypto scams are a huge issue and a big blocker for the masses because when something bad happens it is usually [irreversible], unlike in centralised banking systems,” he said.