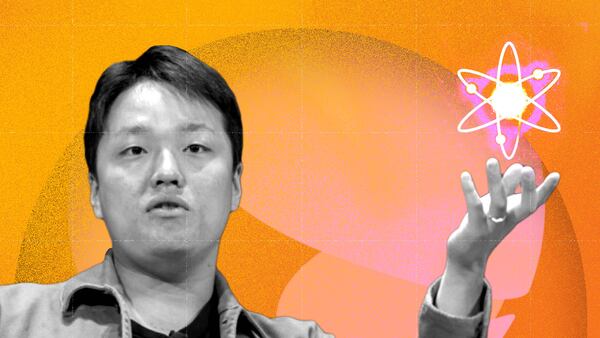

Crypto fugitive Do Kwon’s six month run has apparently come to an end. On Thursday, officials in Montenegro shocked the cryptocurrency world by disclosing that Kwon, the 31-year-old entrepreneur who once vowed to revolutionise finance, had been held at the airport in the Balkan nation’s capital.

Kwon was apprehended with falsified documents, said Interior Minister Filip Adzic. DL News has learned that authorities also arrested an associate believed to be Han Chang-joon, a senior executive at Chai, a mobile payment provider implicated in the alleged fraud at Terra, Kwon’s failed crypto venture.

“Montenegrin police have detained a person suspected of being one of the most wanted fugitives, South Korean citizen Do Kwon, co-founder and CEO of Singapore-based Terraform Labs,” Adzic said on Twitter.

Dodging Interpol

Wanted by prosecutors in his native South Korea in connection with the $40 billion collapse of Terra last May, Do Kwon has been dodging Interpol as he hopscotched around the world. According to the US Securities and Exchange Commission, he withdrew $100 million from a Swiss bank account between June 2022 and February 2023.

Kwon was last known to be in Serbia, and police in Belgrade had been hot on his trail and had begun a pre-extradition process, Branko Stamenkovic, Serbia’s head of the Special Prosecution Office for High Tech Crime told DL News in an exclusive interview Thursday.

Serbian authorities told DL News they are waiting for confirmation from Interpol that the man arrested is Do Kwon.

“I have no idea what logic he had in coming here,” Stamenkovic told DL News. “We were surprised… Maybe he thought because we have no bilateral extradition agreement with South Korea that he would be safe, but we are signatories to the same international treaty. If I knew where he was we would arrest him immediately.”

NOW READ: Meet the professor ‘obsessed’ with tracking crypto fugitive Do Kwon across the blockchain

Stamenkovic made these comments about an hour before Montenegrin authorities announced Kwon’s detention in Podgorica.

South Korean officials appear to have been close to fixing Kwon’s location for some time. In February, prosecutors travelled to Serbia seeking assistance in their pursuit of Do Kwon. Stamenkovic told DL News that Kwon was travelling with another South Korean man.

The Asian nation’s officials shared details of Do Kwon’s movements and Serbian police were following several leads, according to Stamenkovic. But the trail had recently gone cold.

‘It is most likely because of actions undertaken by Serbian Prosecution and police that the suspects fled from the country trying to get refuge in the region.’

— Branko Stamenkovic

It wasn’t hard to leave Serbia, a landlocked nation that shares a porous border with several Balkan countries. Serbian citizens do not need a passport to cross into Montenegro, Bosnia and North Macedonia.

“It is most likely because of actions undertaken by Serbian Prosecution and police for their extradition, arrest and additional evidence, that the suspects fled from the country trying to get refuge in the region,” Stamenkovic told DL News after hearing news of the arrest.

A most wanted man

There has been no announcement on the official government website in Montenegro. “As soon as we get the official confirmation, the [Ministry of Interior] will announce,” Adzic told DL News.

The focus now will turn to whether Kwon can be extradited to South Korea to face fraud charges. After prosecutors issued an arrest warrant for Kwon in September, Interpol released a red notice seeking his detention. Authorities in Singapore, where Terra is based, are also investigating Kwon. And the SEC recently filed a civil action against Kwon and Terra.

NOW READ: Coinbase ‘welcomes’ legal battle with SEC amid signs of widening crypto crackdown

That Kwon materialised in Montenegro is the latest twist in a saga that has both riveted and appalled the crypto community. An effervescent personality, Kwon regaled his million Twitter followers with dreams of creating a quasi-central bank for crypto predicated on Terra’s blockchain network and array of interlocking tokens.

Using a governance token called LUNA, Kwon built an ecosystem complete with an algorithmic stablecoin, UST, and a decentralised savings protocol dubbed Anchor that promised investors annual returns of 19 to 20%. Terra also created a form of crypto derivative called “mirrored assets” that tracked the performance of stocks such as Apple’s shares.

Ecosystem collapse

To assuage liquidity concerns and support the stablecoin, Kwon set up a reserve called the Luna Foundation Guard, which was funded with 50 million LUNA tokens. Investors bet big on Kwon’s ambition: In 2021, LUNA’s value multiplied 136 times and its market cap hit an all-time high of $41 billion in April 2022.

When rising interest rates soured the macroeconomic picture in the second quarter of 2022 and triggered a swoon in the crypto markets, UST could no longer muster enough confidence, or reserves, to support its $1 peg. When it started sliding that May it dragged down LUNA and Anchor and in the space of a couple of weeks the Terra ecosystem collapsed.

Terra collapsed, they allege, because at its core it was a fraudulent scheme to rip off investors.

Investors were stunned by what many called crypto’s “Lehman moment,” in reference to the Wall Street investment bank that sparked the global financial crash of 2008. Just like that prior crisis, the fall of Terra triggered a wave of contagion that poleaxed Three Arrows Capital, a multi-billion dollar crypto hedge fund, the brokerage Voyager Digital, and eventually, FTX, which was the second biggest crypto exchange worldwide when it failed.

Yet Terra wasn’t an innocent casualty of a brutal bear market, officials in the US and South Korea say. It collapsed, they allege, because at its core it was a fraudulent scheme to rip off investors. In February, the SEC painted a picture of Kwon as a PT Barnum-type huckster rather than a crypto visionary in a lawsuit it filed against him and Terraform Labs, his parent company.

NOW READ: The SEC’s Do Kwon case has massive implications for crypto’s legal future

Beginning in 2019, Kwon trumpeted how a mobile payment provider in South Korea called Chai was using the Terra blockchain to process and settle payments. Kwon, who was a founder of Chai, promoted the “real world use case” as a breakthrough in numerous appearances in social media and the financial press.

But the SEC said his claims were false. Chai was processing payments through conventional digital banking systems, not Terra’s blockchain, and Terra faked the payments on its network, the agency said.

“Terraform and Kwon misleadingly used Chai’s growth as a proxy for the growth and success of the Terraform ecosystem as a whole,” the SEC’s complaint states.

Mysterious associate

On Thursday, South Korea’s National Police Agency said that Kwon and a person believed to be former CEO Han Chang-joon of Chai Corporation, a affiliate of Terraform Labs, were arrested by Montenegro authorities and are checking their identities, according to press reports. The police are waiting for a reply after requesting fingerprint information from the Montenegrin authorities to confirm the identifies of Kwon and Han.

When asked by DL News if the person arrested with Kwon is Han, Adzic, the Minister of the Interior, said: “We haven’t received official confirmation yet, but we assume it’s him.”

Updated on March 23 to add details of Kwon’s associate, detention, Serbia’s investigation of his whereabouts, and details of the SEC case.