- Warren, longtime scourge of Wall Street, wants crypto to perform the same anti-money laundering checks as banks.

- With multiple crypto bills on Capitol Hill, the state of play is in flux as some Democrats show signs of balking at the hard line taken by SEC Chair Gary Gensler.

- The Warren-Marshall Senate bill may be outflanked by a stablecoin measure in the House.

In these trying times for crypto, perhaps no lawmaker is a greater nemesis than Senator Elizabeth Warren. The Democrat from Massachusetts has lambasted digital assets as “a haven for illegal activity” and “a fourth-rate alternative to real currency.”

Still, her crusade may end up helping the very players she has long scrutinised — Wall Street’s money managers and banks.

Killed in its cradle

As BlackRock, Fidelity, and other giants move to capture the market for Bitcoin and other digital assets, their compliance with a legislative proposal Warren is backing could give them a boost.

“The bill is inadvertently forcing crypto towards centralisation,” Liz Boison, a founding member of the US Department of Justice’s National Cryptocurrency Enforcement Team, told DL News.

“If crypto is considered the democratisation of finance, this would kill it in its cradle by making it another feature that TradFi can offer,” she added.

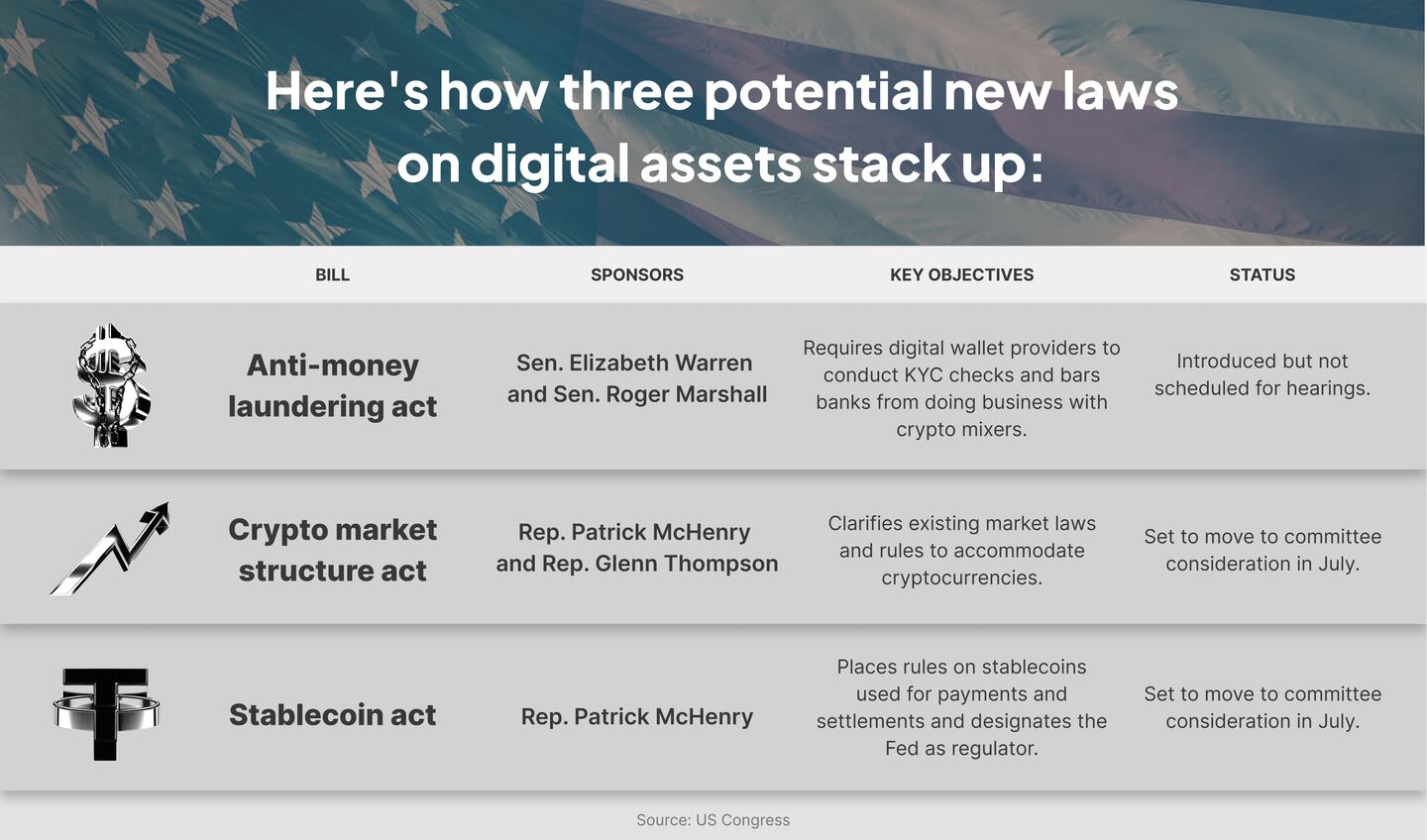

The Warren-Marshall bill is one of several initiatives in play in Washington as lawmakers labour to tame the crypto industry.

While the US Securities and Exchange Commission is trying to shut down some major players, including Coinbase and Binance’s US arm, Warren looms as an equally potent threat to an industry struggling to recover from a recent series of scandals.

NOW READ: The ‘CryptoQueen’ is said to be dead but $4bn OneCoin fraud case springs back to life

Her primary weapon is legislation that would recast digital assets as a national security issue and require crypto companies to comply with the same know-your-customer and anti-money laundering rules that apply to TradFi.

It would also bar financial institutions from doing business with crypto mixers, popular services that anonymise transactions.

This is anathema for crypto supporters, who are probably happy that her bill has stalled.

Politically toxic

Still, industry leaders worry that Warren may have the clout necessary to define crypto as a politically toxic issue and neutralise efforts to pass favourable legislation.

“Crypto plays into her hand so well,” Ron Hammond, director of government relations at the Blockchain Association, an industry body, told DL News. “The bill that she’s leading isn’t going to go anywhere, but the more people dunk on it, the more credence it gets. She’s tactical. She’s smart.”

‘The bill that she’s leading isn’t going to go anywhere, but the more people dunk on it, the more credence it gets. She’s tactical. She’s smart.’

— Ron Hammond

Warren may be a liberal firebrand, but she has joined with Kansas Republican Senator Roger Marshall to sponsor the Digital Asset Anti-Money Laundering Act.

And while the bill is struggling to find co-sponsors, no one expects Warren to stop criticising crypto.

Dark underbelly

“The dark underbelly of crypto is its critical link in financing terrorism, human trafficking, drug dealing, and helping rogue nations like North Korea and Iran,” Warren said at a Senate hearing in December.

Warren’s office did not respond to requests for an interview.

Crypto bills address everything from stablecoins to market structure, and it’s hard to gauge which, if any, will become law. Still, they are putting pressure on crypto outfits just as TradFi giants, no strangers to regulation, are making inroads into the asset class.

NOW READ: Stablecoin laws could give US an edge — if they ever get off the ground

This may seem ironic, given that Warren, a former bankruptcy law professor at Harvard University, has devoted decades to crusading against Wall Street for ripping off consumers.

Now she’s set her sights on decentralised finance as the latest scourge.

“DeFi is the most dangerous part of the crypto world,” Warren said in her most fulsome comments last year. “This is where the regulation is effectively absent and — no surprise — it’s where the scammers, the cheats and the swindlers mix among the part-time investors and first-time crypto traders.”

Outspoken champion

Such statements may drive crypto Twitter nuts, but Warren, 74, has long been driven by a desire for consumer protection, first as a legal scholar and then as a senator.

She has written that most of her career has been spent studying a simple question: Why do American families go broke?

To that end, she has become an outspoken champion for middle-class families. Warren has authored books on personal finance and, with her folksy manner, made well-received appearances on Dr. Phil, a daytime TV program.

Warren made a splash in the early 2000s by taking on banks and credit card companies. She lost her first battle, preventing lenders from making it harder for families to file for bankruptcy.

Then in 2009 she defeated JPMorgan Chase, Bank of America, and other powerful financial institutions by shaping and helping pass a law that protected households from onerous credit card rates and practices.

NOW READ: A 162-page bill would give the CFTC big chunks of US crypto markets. Here’s what else is in it

When subprime mortgages poleaxed Wall Street in 2008 and triggered the worst economic calamity since the Great Depression, Warren was the prime mover behind a new regulatory agency, the Consumer Financial Protection Bureau, and was elected to the Senate in 2012.

Warren argues that her crypto bill makes a common-sense case that the industry should follow the same know-your-customer (KYC) and anti-money laundering policies as banks, payment providers, and other consumer finance firms.

The bill would also direct the Financial Crimes Enforcement Network (FinCEN) to watch over crypto.

‘DeFi is the most dangerous part of the crypto world.’

— Senator Elizabeth Warren

Critics counter that KYC-AML compliance would kill many DeFi businesses and is contrary to the prevailing anonymous ethos. They add that crypto is already subject to FinCEN scrutiny.

“Her view is that there are no know-your-customer/anti-money laundering rules,” Hammond said. “But there are definitely KYC/AML rules in crypto, every single company has to abide by them.”

Still, the Warren-Marshall legislation may be outflanked by rival bills on the Hill. Rep. Patrick McHenry, the Republican chair of the House Financial Services Committee, has authored legislation that would place new rules on stablecoins.

That bill, for which he is seeking consensus from both parties, would be a better approach than Warren’s, said Boison, who is a partner at Hogan Lovells.

Democrats appear receptive to the stablecoin measure. Maxine Waters, ranking member on the House Financial Services Committee, and Treasury Secretary Janet Yellen have signaled that stablecoins deserve bespoke legislation. McHenry plans to offer a reworked version of his bill in the committee this month.

READ MORE: Crypto lobbyists hope Maxine Waters is wavering on Gensler’s crackdown

“A stablecoin bill or something that’s more consensus-building is going to be a better vehicle for passing any crypto legislation,” Boison said.

Warren’s hard line may be costing her support among allies, including Senator Sherrod Brown, a Democrat from Ohio. Brown shares Warren’s view that crypto is rife with fraud, but may be open to more tailored regulation, such as that proposed by McHenry.

“It’s clear there have been abuses in the crypto industry that we must address. I’m continuing to look carefully at all the different legislative approaches my colleagues have put forward and talk to the regulators,” Brown said in a statement to DL News.

“We need a regulatory framework for crypto that puts consumers and the safety and soundness of our financial system first.”

‘This bill is kind of a thought piece, a firestarter.’

— Liz Boison

Gary Gensler’s crackdown may also be sowing doubts among the Biden Administration’s supporters in Congress.

The SEC chair has declared that virtually every digital asset, including stablecoins, is a security or investment contract subject to the same laws as stock, bonds, and other TradFi instruments.

NOW READ: How the SEC’s showdown with Coinbase will change the crypto market for everyone

Crypto advocates are hoping that his campaign against Coinbase, Kraken, and other American crypto companies may prove too strident for lawmakers.

Brian Armstrong, the CEO of Coinbase, has been steadily making a case that crypto needs its own bespoke rules because blockchain technology makes tokens different from normal securities. That argument may be gaining traction.

“Coinbase has done a really good job of getting the narrative out, telling their side,” Hammond said.

Pragmatism and savvy

Nevertheless, crypto advocates don’t count Warren out.

She is known for her pragmatism and savvy when it comes to legislating, and her alliance with Marshall, a military veteran and arch-conservative, was a bold move.

By aligning cryptocurrency with national security issues around terrorist financing and isolating North Korea, it may be hard for fellow senators to oppose the measure.

NOW READ: Crypto bill author McHenry says SEC should have ‘taken out’ Binance years ago

Warren also knows how to make a splash on social media. On March 29, she tweeted a re-election campaign ad quoting a Politico headline that she was building an “anti-crypto army.” The line went viral and vaulted her into a position where she may help define the crypto narrative.

Warren’s “bill is kind of a thought piece, a firestarter,” Boison said.

Controlling the story at this early stage in the legislative process can be just as important as the provisions of the bill itself.

Even though Wall Street may be an ultimate beneficiary of Warren’s efforts, she appears determined to regulate crypto in a way that few in the industry will like.

Have a tip about crypto regulation? Contact the author at joanna@dlnews.com.