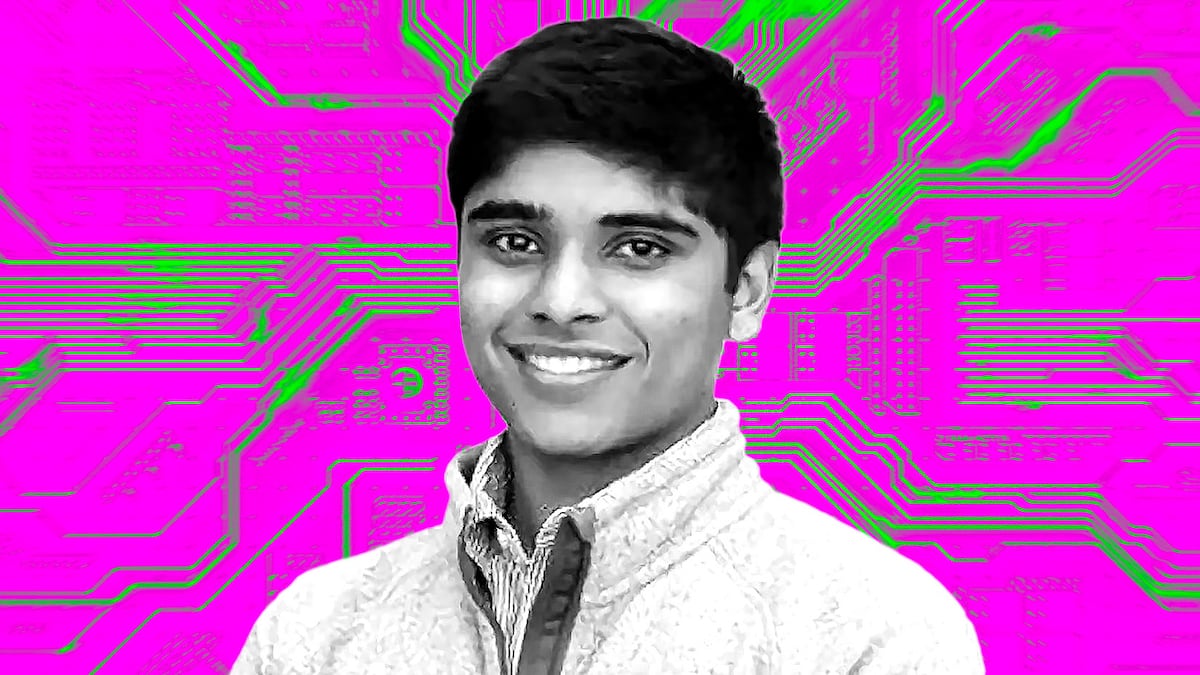

- Former FTX head of engineering Nishad Singh testified today that Bankman-Fried would “unilaterally” spend funds on unnecessary investments.

- Singh is the third member of Bankman-Fried’s inner circle to be called by the prosecution as a witness.

- Because of his social skills, Singh quickly became a sort of “human buffer” between Bankman-Fried and the rest of the team.

A third member of Sam Bankman-Fried’s inner circle took the stand to testify against the former crypto mogul on Monday, criticising Bankman-Fried’s lavish and unnecessary spending.

FTX’s ex-head of engineering Nishad Singh told the court today that he found Bankman-Fried to be a “formidable character” and that he felt “intimidated” by him.

“I had a lot of admiration and respect for him,” said Singh “Over time a lot of that eroded.”

Singh told the court that Bankman-Fried would “unilaterally” spend funds from the crypto trading firm he founded in 2017, Alameda Research.

Singh said he found FTX’s spending “embarrassing,” reeking of “excess and flashiness.” When he would complain to Bankman-Fried, he rarely got a response.

But on the occasions the FTX head did address Singh’s complaints, Bankman-Fried was dismissive, saying Singh didn’t have the full context in which the purchases were being made.

On one occasion, “when I thought he had been fleeced for $20 million,” Singh said, Bankman-Fried grew angry, and said FTX’s real issue wasn’t excessive spending, but employees like Singh, who were seeding doubt within its ranks.

A ‘toxic’ investment

Bankman-Fried notably decided to invest hundreds of millions of dollars in Michael Kives’ venture investment firm, K5 Global, after showing up to a party hosted by Kives — a party which Hillary Clinton, Jeff Bezos, Leonardo DiCaprio, Katy Perry, and four members of the Kardashian family also attended.

At one point, the government presented a message Bankman-Fried had sent others at Alameda, detailing the party he had attended at Kives’ house.

“[Kives] is, probably, the most connected person I’ve ever met,” Bankman-Fried wrote.

After a subsequent meeting with Kives’ partner Bryan Baum, Bankman-Fried sent a term sheet to FTX leadership, in which he detailed plans to invest up to $1 billion in K5.

Singh knew of the negotiations, but said Monday he was surprised by the amount. He asked Bankman-Fried if they could back out, but was told the deal was “basically done.”

Singh said he believed the investment would be “toxic to FTX and Alameda culture,” given the firms’ own discouragement internally of politicking and social climbing.

Spreadsheets shared by the prosecution show that several of the endorsement deals and sponsorships were paid for by Alameda Research, or Alameda Research Ventures.

‘The law is what happens…’

Singh’s testimony finds echoes — as well as dissonances — in some of the passages of Michael Lewis’ new book about Bankman-Fried, “Going Infinite: The Rise and Fall of a New Tycoon.”

“The law is what happens, not what is written,” Singh said he soon realised after starting to work for Bankman-Fried, according to Lewis.

Speaking of a loophole Alameda Research had found in its early days to exploit an arbitrage opportunity in South Korean crypto markets, Singh told Lewis: “It was borderline illegal, but in practice, who goes after you when you do this? No one.”

Fast-forward to today and now Singh has pleaded guilty to one count of wire fraud, three counts of conspiracy to commit fraud, one count of conspiracy to commit money laundering, and one count of conspiracy to defraud the US by violating campaign finance laws.

Bankman-Fried has pleaded not guilty to the eight charges levelled against him, including fraud, money laundering, and conspiracy.

Bankman-Fried’s on-again, off-again girlfriend, Ellison, and FTX co-founder and former CTO Gary Wang have also testified against Bankman-Fried.

Ellison said that Bankman-Fried had “directed” her to take $14 billion from FTX customers to pay back Alameda loans after Wang told the jury that they “allowed Alameda to withdraw unlimited funds.”

Who is Nishad Singh?

Born in India, Singh moved with his family to California as a child. He went to Crystal Springs Uplands School in Hillsborough, then graduated from the University of California, Berkeley, majoring in electrical engineering and computer science.

Singh met Bankman-Fried through his younger brother, Gabriel Bankman-Fried, with whom he was best friends at school, according to Lewis.

Singh called Bankman-Fried in 2017 after learning that he’d quit his job at quantitative trading company Jane Street Capital to found crypto trading firm Alameda Research in order to “generate even more money for effective altruism” — a cause which Singh and Gabriel Bankman-Fried had begun espousing in college.

Effective altruism is, in short, a utilitarian philosophy with the goal of maximising the good one can do. One of the ways to do, the movement argues, is to make as much money as possible and then give it all away

Singh quickly became a key element of Bankman-Fried’s organisation — thanks notably to his people skills — according to Lewis who describes him as a “human buffer” between Bankman-Fried and the rest of the team.

“In spite of being emotionally inattentive, I’m much more emotionally attentive than Sam,” Singh told Lewis. “People kept complaining about that thing where he is looking at his computer while he’s talking to you and giving you half answers.”

Key man at FTX

By the time FTX launched in 2019, Singh had firmly cemented himself as the enterprise’s de facto manager.

All FTX programmers reported directly to Singh, even though Gary Wang was the company’s chief coder, according to Lewis. Like Bankman-Fried, he slept at his desk in FTX’s Hong Kong office.

“If Nishad got hit by a bus, the whole company would be done,” an FTX executive was quoted as saying in court documents.

Singh was FTX’s third largest shareholder. Bankruptcy filings indicate that Singh took out over $543 million in personal loans from Alameda Research.

Bankman-Fried also used Singh as a sounding board, writes Lewis. “When there was something new to buy, Sam often found it useful to talk it over with [FTX head of product] Ramnik [Arora] and Nishad.”

In one episode, Lewis recounts how Singh and Arora tried to talk Bankman-Fried out of giving Elon Musk $1 billion to help him with his Twitter acquisition.

“Would it be impolite to [offer] $75 million?” Singh reportedly asked.

FTX’s demise

When, in mid-June, Ellison discovered an anomaly in Alameda’s FTX account, it was with Singh that she shared her concerns, writes Lewis. In September, she pulled him aside again to tell him she was growing worried about Alameda’s market exposure. He then relayed the message to Bankman-Fried.

FTX collapsed two months later.

“Can you make it you, or you and Gary who people blame?” Singh messaged Bankman-Fried, according to Lewis, on November 9 — the same day Binance announced that it wouldn’t be acquiring FTX after all.

Per Lewis, Singh requested a meeting with Bankman-Fried and Wang to figure out how the trio should deal with the police and lawyers. The meeting was reportedly inconclusive.

The company’s in-house psychiatrist, George Lerner, “determined that Singh was a suicide risk and arranged for him to be escorted out of the country” back to his family in San Francisco. Indeed, on Monday, Singh testified that he’d been suicidal for some days in November 2022 as FTX and Alameda fell apart.

Singh’s lawyers did not return requests for comment for this story.

Got a tip about the Bankman-Fried trial? Reach out to tcarreras@dlnews.com or aleks@dlnews.com