- Hong Kong police are investigating a crypto platform called Hounax that is suspected of taking $19m off investors.

- Legislators have criticised the Securities and Futures Commission for failing to crack down on unregulated platforms.

- New case follows probe of JPEX exchange that led to arrest of 66 people.

Another suspected crypto scam has left Hong Kong residents with substantial financial losses and is driving calls this week for stricter oversight of digital asset platforms in the city.

On Saturday, police launched an investigation into Hounax, a crypto trading platform officials say has defrauded at least 145 Hong Kong residents, resulting in combined losses of approximately HK$148 million (US$19 million).

Scammers impersonated investment experts and lured people to invest in virtual currencies on its platform with the promise of high returns, said Rick Chan, the commercial crime bureau superintendent.

Irate lawmakers

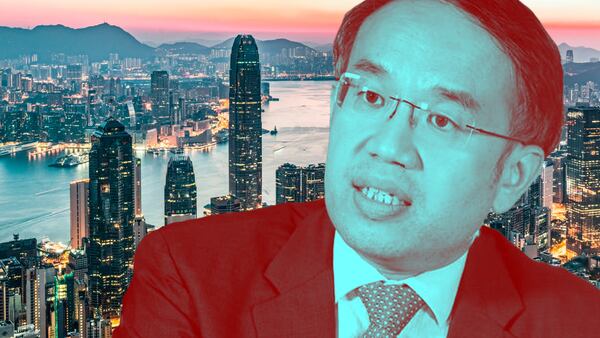

But on Monday, Doreen Kong, a Hong Kong legislator, voiced her frustration with the Securities and Futures Commission, which is responsible for watchdogging financial fraud.

She criticised the agency, which is known as the SFC, for relying on a roster of suspicious platforms to protect consumers.

“How can they just rely on an alert list and say they have issued a message to the public?” Kong said on RTHK, Hong Kong’s public broadcaster. “It’s like telling people that it’s every man for himself.”

SFC Chief Executive Officer Julia Leung responded in a briefing that the agency is “constantly checking social media for platforms that have not applied for a licence.”

Investors and lawmakers alike are chafing at the slow pace of a crackdown on shady crypto platforms.

The Hounax probe follows on the heels of the collapse of JPEX in September. More than 2,500 Hongkongers lost an estimated HK$1.5 billion (US$192 million) on JPEX. Local media has described it as one of the city’s largest financial fraud cases to date.

While 66 individuals have been arrested in connection with the JPEX case, charges have not been filed as the investigation continues. Officials have yet to disclose who is even behind the mysterious exchange.

The SFC added Hounax to a roster of suspicious platforms on November 1. On Monday, officials revealed they had been investigating Hounax since October.

Hong Kong Chief Executive John Lee urged investors to trade on licensed platforms. Lee said that the administration is considering revisions to current legislation to better tackle investment firms that are fraudulent.

Legislator Johnny Ng proposed a motion to bolster the city’s defences against cyber fraud. It is slated for debate on Wednesday.

What is Hounax?

Hounax is a little known exchange that has attracted a following in Hong Kong even though it lacks the metro advertisements, influencers, and flamboyant OTC crypto counters used by JPEX. Police have not established a link between them.

Hounax makes difficult-to-substantiate claims and has an opaque operational structure. In July, Hounax boasted more than 8 million registered users across 100 countries and claimed an average daily transaction volume exceeding 1 billion US dollars.

Hounax did not issue a statement in response to the police probe.

Its social media pages and website have been deleted and cached snapshots of its site reveal little about who runs it.

It has issued press releases in the past refer to people by job titles without names, with the exception of a market director named “Gabriel Junior Robinson,” who has no other online presence.

It claims to be headquartered in Australia and Singapore and possess multiple compliance licences.

Safety of funds

In a July press release, Hounax claimed to have a Money Business Services in the US that “signifies that Hounax’s operations are under a strict regulatory framework, further ensuring the safety of users’ funds.”

Yet every licence issued by the US Financial Crimes Enforcement Network warns that the inclusion of a business on its registrant roster “is not a recommendation, certification of legitimacy, or endorsement of the business by any government agency.”

It appears Hounax is trying to use easy-to-obtain licences to bolster its credibility. JPEX did the same thing.

Got a Hong Kong crypto story? Get in touch at callan@dlnews.com.