- Hong Kong introduced new regulations for exchanges in June, following years of uncertainty about crypto.

- That hasn’t stopped the creation of a vibrant crypto culture.

- The metropolis teems with crypto storefronts offering over-the-counter trading in Bitcoin, Ether, and altcoins.

Some days it seems like everyone in Hong Kong has a crypto story.

The son of the security guard in my apartment block bought three restaurants with money made from Bitcoin investments. I tell a Romanian importer at a bar that I write about crypto and he pulls up the leg of his jeans to reveal a Bitcoin tattoo on his calf. A medical student at Hong Kong University tells me her friends made “so much money” trading tokens — but she knows little about crypto herself.

Signs of Bitcoin and its ilk are, quite literally, everywhere in this metropolis of 7 million. An environmental group advertises its NFT collection on a billboard by the Star Ferry terminal where you cross to Hong Kong Island from Kowloon.

Crypto crazed

The crypto scene in Hong Kong these days is striking, given the existential levels of angst now rippling through the industry.

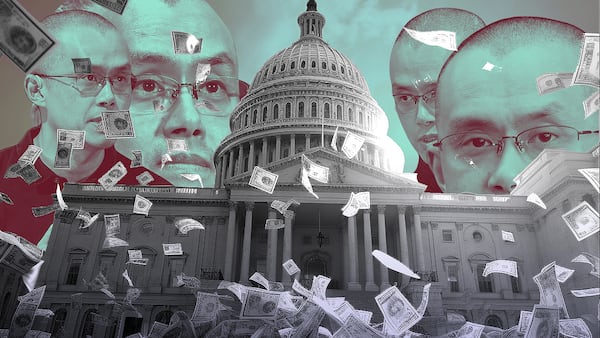

It’s true, Bitcoin is up more than 60% this year and ETH has jumped 40%, but with US regulators clamping down on the likes of Coinbase and Binance, and DeFi regularly roiled by hacks and heists there’s an unmissable vibe that the revolution is in trouble. So why is Hong Kong so crypto crazed?

Hard to say, but the evidence is ample. Walking through Central, the city’s business district, on a Saturday night, there’s a sign by the mid-level escalators for Bitcino, “where Bitcoin meets casino and drinks.”

The Bored Ape Yacht Club’s ApeFest is coming to Hong Kong later this year. Convenience stores stock an NFT magazine created by local enthusiasts. The app I use to top up my phone credit shills the metaverse at me.

NOW READ: Why Lebanon just can’t quit Justin Sun’s Tron — it’s ‘100% mixed up’ with Tether

In contrast to other cities, where it isn’t easy to find crypto-related things, in Hong Kong they’re hard to avoid. You might find the occasional cafe in Singapore with an Azuki on the wall or countries like Thailand that give you NFTs when you visit certain tourist spots, but Hong Kong is next level.

It’s hard to believe that not too long ago there was a perception that crypto was dead in Hong Kong.

It’s hard to believe that not too long ago there was a perception that crypto was dead in Hong Kong.

In 2021, Henri Arslanian, former chair of the FinTech Association of Hong Kong, told The Financial Times that every large crypto company in the city had “already started a contingency plan to relocate their business due to the uncertainty.” He moved his firm, Nine Blocks Capital, to Dubai last year.

Then the Hong Kong’s Securities and Futures Commission announced plans to regulate exchanges. In June, the city launched a task force for promoting web3. Politicians including Johnny Ng are staking their reputations on this being the future in the city.

Why Hong Kong changed its mind about crypto is still not clear. Some put it down to improved understanding among regulators. Some say the government got a case of FOMO as Singapore and Dubai started trying to coax away their companies.

Still others say it’s the guiding hand of Beijing — though, given China’s hard line on crypto, this raises more questions than it answers. Beijing, after all, has banned speculating on tokens and mining Bitcoin.

But perhaps the strangest thing you may notice in Hong Kong is how many over-the-counter crypto shops there are.

‘Call Me Bitcoin Queen’

Foreign exchange outlets on Nathan Road now sit side by side with booths bearing names like Crypto King. The T symbol for Tether hangs at the entrance to Chungking Mansions, a notorious 60-year-old tower block that houses an eclectic collection of hostels, rent-by-the-hour rooms, phone repair shops, currency traders, fake watch sellers, doss houses, and cheap curry kitchens. Now it’s added crypto to its list of amenities.

The forex and remittance shops are still more popular than their crypto counterparts — one shopkeeper rolls his eyes when I ask about his crypto neighbour — but occasionally a person saunters over to one of the crypto desks.

The crypto shops are far more audacious than their forex counterparts. The crypto shop Coiner ran an ad campaign in 2021 featuring photos of the founder, Priscilla Ng, and the caption “Call Me Bitcoin Queen” (perhaps an unfortunate choice of title given the “Cryptoqueen” moniker often attached to OneCoin fraudster Ruja Ignatova).

Launched three years ago, Coiner has three branches in Hong Kong, one of which also doubles as an art gallery for NFTs. It’s not even the biggest player in terms of branches. Another competitor, One Satoshi, has nine.

Bitcoin orange

Meanwhile, Bored Garden is probably one of the only businesses in the world that sells both Tether’s USDT stablecoins and hamburgers. The Bored Ape Yacht Club-themed restaurant in Central doubles as an over-the-counter shop. Like Coiner, it has a fondness for using Bitcoin orange.

When it comes to crypto in Hong Kong, it’s hard to pin down your typical user and their motivations, a staff member at one shop tells me. But they can offer some insights. Tether is more popular than Bitcoin and Ether. Customers aren’t necessarily tech savvy — several shops have run educational programs in the past to teach people about crypto.

NOW READ: Hong Kong regulators say crypto firms lie about submitting licence applications

And a lot of customers come from mainland China, particularly since the border opened earlier this year.

Hong Kong has long been the first port of call for Chinese citizens wishing to get their money out of China. In theory, you can only move out $50,000 per person, per year. This has led to some convoluted schemes for moving money involving gold, jewellery and even strapping wads of cash to your body to pass through customs.

Ten years ago, I used to hear stories about taking money through the border by buying necklaces in Shenzhen and then trading them for cash at a sister shop in Hong Kong. It might have been an urban legend, but it demonstrates the desire a lot of people have to get their funds out of the country. Despite the ban in China, crypto remains a popular way to do so.

This popularity with mainland visitors may become an issue for storefront crypto businesses. Some now refuse to take mainland customers, citing the crypto ban in China. Scrutiny of crypto is ramping up: From January to April, more than 675 crypto scams were reported to police, involving some HK$416.6 million ($53.2 million).

Regulatory changes

As exchanges face regulatory changes that will allow them to operate compliantly in the city while servicing retail customers, little has been said about OTC trading. Yet facilitating the purchase of cryptocurrency for mainland citizens is unlikely to be allowed to continue long-term.

For now, the crypto party is back in full swing.

At the Central Market, I get to chatting with someone who runs an NFT fashion company. A devotee of Hedera Hashgraph, a crypto network, chews my ear off for 30 minutes about how it’s a superior technology to traditional blockchain.

Invariably, people ask me what token they should invest in next. I reply that I don’t have a clue.

Callan Quinn, DL News’ Hong Kong correspondent, covers the crypto industry in Asia. Have a tip? Contact the author at callan@dlnews.com.