- Falling blockchain activity worries Dorsey and others.

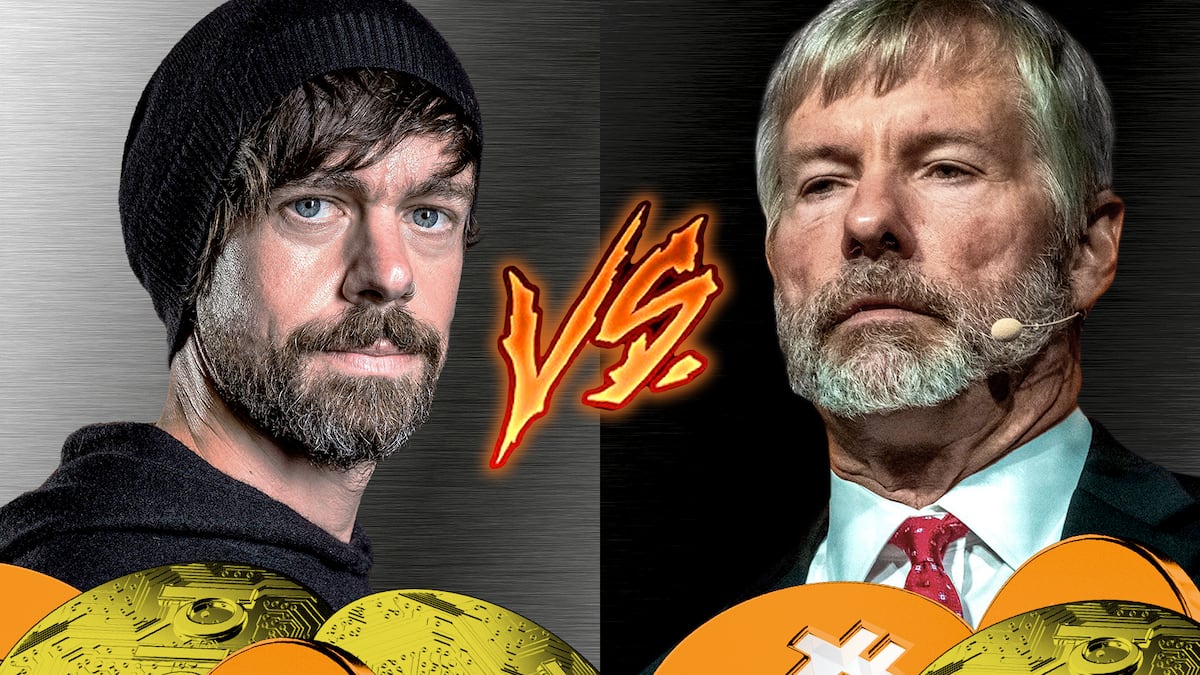

- A perennial debate around Bitcoin fires back up.

- Saylor has a strong argument — Bitcoin is up 11x since 2020.

For years, Bitcoin advocates have tossed and turned over just what, precisely, was the system’s top use case. Is it digital gold, a new online payments system, or just another risk-on asset?

Block CEO Jack Dorsey stoked that fire once again this month when he suggested that Bitcoin is doomed if it becomes nothing more than a speculative asset.

“If it just ends up being a store of value and nothing more than I don’t think it gains relevance at all,” he said on a Bitcoin News.com podcast.

“It has to be payments for it to be relevant.”

‘At some point, I hope Bitcoiners realize this space is more than just podcasts, X Spaces, and ‘number go up.‘’

— Nicholas Gregory

It may be little surprising that Dorsey makes this argument given that Block, formerly known as Square, is a fintech company that processes point-of-sale payments and plans to integrate Bitcoin payments into its model.

Yet Dorsey’s views carry great weight in the crypto world because he twigged onto Bitcoin at the dawn of the blockchain era and has been a staunch and thoughtful advocate for the top cryptocurrency ever since.

Indeed, just a few weeks ago Dorsey was tagged as Satoshi Nakamoto, Bitcoin’s mysterious creator, which he has long denied.

“Jack has a point,” said Eli Nagar, CEO of mining firm Braiins.

“He’s highlighting an important concern: if Bitcoin ends up purely as a passive store-of-value, without meaningful on-chain usage, it risks weakening the incentive structure that secures its network long-term,” Nagar told DL News.

Over the last several weeks, Bitcoin’s network has been processing historically low transaction volumes.

A full block, which includes the set of transactions that occurred in the last ten minutes, will usually comprise anywhere from 2,000 to 3,000 transactions.

But these days, blocks with less than 1,000 transactions have become commonplace.

Just this Tuesday, one block had 55 transactions, while others showed 123, 324, and 423 transactions, according to mempool.space.

Last week, one block had only one transaction.

‘The pizza guy’ problem

According to Jameson Lopp, CTO of crypto custodian Casa, there are two reasons behind the lack of usage: Tax accounting requirements on purchases, the inconvenience of using it for ordinary transactions.

Plus, “nobody wants to be the pizza guy,” he told DL News.

Lopp is referring to Laszlo Hanyecz, one of Bitcoin’s first users, who famously bought two pizzas for 10,000 Bitcoin back in May 2010.

Those pizzas are now worth upwards of $800 million. So why would anyone spend Bitcoin on anything?

‘It’s like ‘Pay me in gold. Pay me with a Picasso.‘’

— Michael Saylor

According to software engineer Nicholas Gregory, the day of reckoning is approaching fast.

“Empty blocks,” he said on March 31 on X.

“At some point, I hope Bitcoiners realize this space is more than just podcasts, X Spaces, and the ‘number go up’ digital gold narrative. If we don’t get people using Bitcoin for real commerce, it’s game over.”

‘It’s not a currency’

But these views clash with other Bitcoin champions, namely Michael Saylor, the executive chairman of Strategy and a relentless Bitcoin bull.

Under his guidance, the company once known as MicroStrategy has acquired a whopping 528,185 Bitcoin, which are now worth $41 billion.

“It’s not a currency, it’s capital,” Saylor said in a December 2024 episode of the Galaxy Digital podcast.

And he criticised those who share Dorsey’s view about the need for Bitcoin to be a form of payment.

“There are a lot of maxis who are like ‘No, we want it to be a currency. We want to be able to pay for coffee with our Bitcoin. Pay me in Bitcoin,‘” he said.

“It’s like ‘Pay me in gold. Pay me in a building. Pay me with a slice of your professional sports team. Pay me with a Picasso.”

Burn the keys

Saylor has even said he will burn the keys to his personal stash of more than 17,000 Bitcoin worth $1.3 billion when he passes away.

Many influential Bitcoin figures side with Saylor, including US Senator Cynthia Lummis, who has been pushing bill that would establish a US Bitcoin strategic reserve.

“I spend dollars and save Bitcoin,” she said recently.

‘It has to be payments for it to be relevant.’

— Jack Dorsey

The debate is bound to intensify in the months to come.

Many investors who first bought Bitcoin via the exchange-traded funds introduced last January may be jarred by its volatility as Donald Trump’s tariffs rattle capital markets.

Many others may be startled to learn that for all its professed exceptionalism, Bitcoin moves in tandem with stocks, which tend to have far less volatility and represent something tangible — shares in a public company.

For the Michael Saylors of the world, this is all normal. It’s how Bitcoin, which has multiplied in value 11 times in the last five years, performs. So get used to it.

For the Jack Dorseys, that’s not good enough. The most profound breakthrough in financial technology this century should do more than behave like a turbo-charged tech stock.

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.