- Paul Atkins’ confirmation hearing is scheduled for Thursday.

- The crypto industry bets the SEC chair nominee will relax laws around the sector.

- A new letter from Elizabeth Warren hints that Atkins is in for an interrogation.

Paul Atkins is bracing for a grilling.

On Thursday, Donald Trump’s pick to lead the Securities and Exchange Commission is expected to field tough questions about his plans for the top US financial regulator.

This week, Elizabeth Warren, the ranking member of the Senate Banking Committee, set the stage by firing off a 34-page letter.

The missive interrogates Atkins about his role in the 2008 global financial crash, whether he’ll investigate Trump’s businesses, and Atkins’ ties to Wall Street and the crypto industry — particularly his stint as an adviser for FTX.

“Your financial ties to the industries you will soon regulate raise serious concerns about your ability to avoid conflicts of interest as a regulator,” Warren, a Democrat from Massachusetts, wrote.

Atkins, a veteran Washington insider, will have a chance to address these questions at the hearing.

For crypto, the stakes are high.

Although Atkins, 66, is widely expected to be confirmed as the SEC’s next chair, he would take charge at a time when crypto regulation is in flux.

On the one hand, the SEC has already largely ended the crackdown pursued by Gary Gensler, the former chair who sought to make crypto companies comply with the same securities regulations that govern issuers and brokers of stocks and bonds.

The agency has dropped or postponed virtually every enforcement action it filed against Coinbase, Binance, Consensys, OpenSea, Ripple, and other industry players.

On the other hand, the SEC has yet to introduce a detailed blueprint for how it will oversee crypto and protect investors from fraud and other ripoffs.

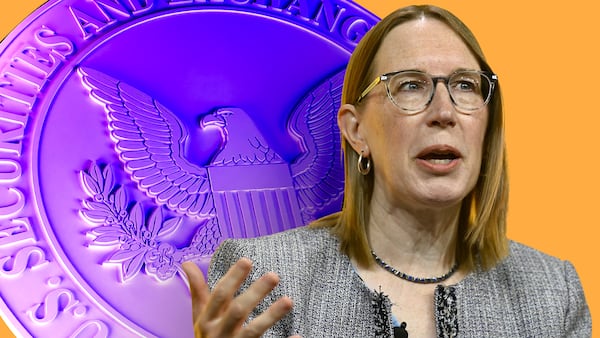

Commissioner Hester Peirce is leading a task force to formulate a fresh approach to the digital assets markets while Andreessen Horowitz, the Silicon Valley VC firm, is already peppering the group with recommendations.

The following statement is attributed to Blockchain Association CEO @KMSmithDC following President-elect Trump's nomination of Paul Atkins for SEC Chairman: pic.twitter.com/I3eUqfB5rB

— Blockchain Association (@BlockchainAssn) December 4, 2024

What is certain is that Trump supports the industry’s argument that crypto is key to the US’s economic security and a source of technological innovation.

So much so, that the president himself, as well as his family, have launched a number of crypto businesses in the last six months.

Indeed, just this week World Liberty Financial, the DeFi project backed by the Trump family, announced plans to release a stablecoin.

And Trump Media & Technology Group, the company behind the Truth Social platform, said it was working with Crypto.com to develop crypto ETFs.

Those ETFs would come under the purview of the SEC. That puts Atkins in the unprecedented position of regulating the president’s businesses just as the agency formulates new rules for the industry.

Atkins is bound to be asked about how he plans to thread this needle in his conformation hearing.

While Atkins is a seasoned Beltway lawyer, his responses to these queries will lay down an early marker for what the crypto industry can expect from his tenure.

Who is Paul Atkins?

A native of Tampa, Florida, Atkins earned a law degree from Vanderbilt University in Nashville. He joined Davis Polk & Wardwell, a global corporate law firm.

In 1990, he joined the SEC on the staff for former chairs Richard C. Breeden and Arthur Levitt.

In 2002, then-President George W. Bush tapped Atkins to become an SEC commissioner.

It was a heady decade in US markets amid the mortgage boom and the SEC, like many other federal regulators, failed to recognise the danger the bubble posed until it was too late.

Warren highlighted this failure in her letter to Atkins this week.

His campaign to deregulate the industry “contributed to the near collapse of the banking and financial system in 2007 and 2008,” Warren wrote.

Leaving the SEC in August 2008, Atkins missed the carnage of the fourth quarter and 2009.

When the smoke cleared, Atkins resurfaced as the founder of Patomak Global Partners, a business consultancy in Washington where he is CEO.

Becoming a fixture in think tank symposia and policy forums, Atkins established his bona fides as a staunch proponent of light-touch financial regulation.

Over the years, he’s repeatedly urged the government to tear up the Dodd-Frank Act, which Congress passed in 2010 to prevent another financial crash at the expense of taxpayers.

Atkins has also prepped private-equity businesses for compliance exams, and helped Chinese accounting firms avert a ban on doing business in the States, according to the Wall Street Journal.

Over the years he’s held roles at firms like electronic securities trading company BATS Global Markets.

For a Washington lawyer, he was also early to recognise the power of crypto.

Since 2017, he has served as the co-chair of the Token Alliance, part of lobby group The Chamber of Digital Commerce.

Patomak is also listed as a creditor in the FTX bankruptcy for a board-advisory consultancy agreement, dated January 2022, 10 months before Sam Bankman-Fried’s crypto empire blew up, according to Bloomberg.

Atkins holds up to $6 million in crypto-related assets, according to Fortune.

A long-time Trump supporter, Atkins served on the president’s transition team in 2016, and was one of the authors behind Project 2025, a 900-page wish list of proposals to consolidate an ultra-conservative social vision.

Come the hearing

On Thursday, Atkins will have an opportunity to lay out his road map for the SEC’s approach to crypto.

In her letter, Warren asks Atkins whether he agrees with the decision to end lawsuits against companies like Coinbase, Kraken, and Consensys.

Warren also raises questions about how Atkins will ensure that the SEC remains independent from influence from the Oval Office.

For instance, she asked if he will comply if the president directs him to open or close an investigation, or if he will allow investigations into Trump’s own business enterprises to proceed.

She also asked him about whether he thought climate change posed a risk to the financial system, and how he aims to protect investors.

Bring the popcorn.

Eric Johansson is DL News’ News Editor. Got a tip? Email at eric@dlnews.com.