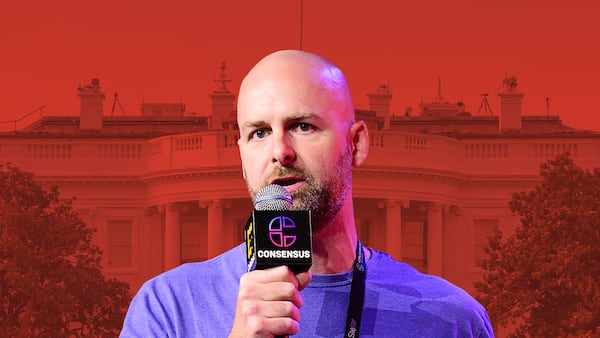

Wolfgang Münchau is a columnist for DL News. He is co-founder and director of Eurointelligence, and writes a column on European affairs for the New Statesman. Opinions are his own.

There is an old story about a Boris Yeltsin interview, in which the interviewer demanded that Yeltsin describe the outlook for the Russian economy in a single word.

“Good”, Yeltsin said. Unused to the idea that a politician would ever follow the instruction, the interviewer harked back, and demanded an outlook in two words.

“Not good,” Yeltsin shot back.

This is how I think about Donald Trump and Bitcoin.

It is good, and not good at the same time.

The internal contradiction about Bitcoin is that on one level it constitutes insurance against financial meltdown, yet it owes its success to financial exuberance.

The same dichotomy applies to the impact of Trump.

Inflation and the Fed

Trump’s policies will be inflationary.

The two most consequential changes I would expect him to pursue are not trade tariffs but a devaluation of the dollar and the exertion of political control over the Federal Reserve.

He will not be able to abolish the Fed’s formal independence, but he could insist on being consulted.

We live in an era of fiscal dominance, where central banks’ freedom of manoeuvre is constrained by governments.

Even the most independently minded Fed chairman could not successfully stand up to Trump.

In any case, Jerome Powell’s term as chairman ends in 2026. If elected, Trump would be in a position to appoint his successor.

It has been harder for the Fed to meet its inflation target than many thought.

Trump’s protectionism, continued geopolitical fragmentation and the aging of western populations will keep up inflationary pressures.

Higher tariffs will drive up prices, reduce trade as others retaliate, and with it, global productivity growth.

A different world

It would be complacent to think of Trump II as a re-run of Trump I, both in terms of what he will do and how he will affect the economy.

There was no global inflation shock during his first term.

We live in a different economic environment.

If you unleash Trumpian economics onto the world today, I would expect the result to be an inflationary boom-bust cycle with the potential for massive financial instability.

In such an environment, it is quite possible that the dollar price of Bitcoin would crash as it did in 2021.

So far, Bitcoin has not turned out to be a good hedge against inflation.

I am not saying this will always be so, but for now I don’t see any reason why Bitcoin’s price would react differently to dollar inflation as it did in 2021.

The risks of a financial crash outweigh all else.

But that observation alone does not answer the question.

Trump may nevertheless end up being very good to the crypto industry in the long run precisely because of his economic policies.

A rational fear of fiat-money debasement constitutes a valid reason to think of Bitcoin as a systemic hedge.

I personally like to think of Bitcoin as an option, an asset that gives me the right to transact if our dollar-based financial system were to falter. It is hard to put a value on this option.

It’s like a binary option where the value approaches either the value of the underlying asset — the total monetary base of the world — or zero.

The value of this option should therefore correspond to the perception of systemic risk.

I think the chance of a deep crisis in our fiat money systems are very high — but I can’t time this.

Trump is good for Bitcoin in the sense that his policies increase that risk.

If people start to fear about the future of the dollar itself, the combination of soft regulation and dollar debasement could drive up the price of Bitcoin beyond anything we have seen so far.

At that point we might not care so much for the dollar price of Bitcoin, but the Bitcoin price of dollars.

Inconsistency

The apparent inconsistency of my assessment of Trump’s impact on Bitcoin is nothing but a mirror image of the fundamental contradiction between Bitcoin as an ordinary risky asset or of Bitcoin as an insurance, or an option.

Right now, I think, the former view prevails. During the 2021-2023 inflationary episode – investors bought into the story that the rise in inflation is temporary.

That is still the consensus.

Investors are also not worried about the impact of economic sanctions on the dollar as a global currency, or the impact of the Russian asset raids recently agreed by the G7 to help fund the war in Ukraine.

If this perception were to flip, this is when the fundamental market dynamics will change.

If, by the time of the next inflation cycle, Bitcoin was perceived as a comparatively safe store of value, there is no reason to expect that investors would react the same way to a rise in inflation as they did in 2021.

We are not there yet. We will be though.

Bitcoin as a hedge?

It is quite possible that we might see one or more repeats of the 2021-23 cycle, before investors think of Bitcoin as a hedge. Even if Trump makes large strides towards dollar debasement, this will not change the world immediately.

There is no other currency that could replace the dollar as a global currency now.

Bitcoin cannot take over the dollar’s and the Fed’s multiple roles in the global financial system.

Some form of a global financial architecture, crypto or otherwise, would have to be in place.

For the time being, the risks of a financial crash outweigh all else. I doubt very much that Bitcoin could maintain anything close to its current valuation if the current asset price bubble were to burst.

Many investors will have to pull out of many classes of risky assets to meet margin calls.

My baseline is that Trump will push us further towards a financial crisis, that this will be very bad for Bitcoin in the short-run, but potentially be very good for the crypto industry in the long-run.