- The Bank of International Settlements will push forward CBDC privacy research, says Innovation Hub head.

- Tokenising promissory notes to get rid of paperwork is another priority for 2024.

- Stablecoin network may also see a minimal viable product this year.

Investigating how to secure privacy for central bank digital currencies — a top criticism of state-backed digital assets — will be one of the Bank of International Settlements’ priorities in 2024.

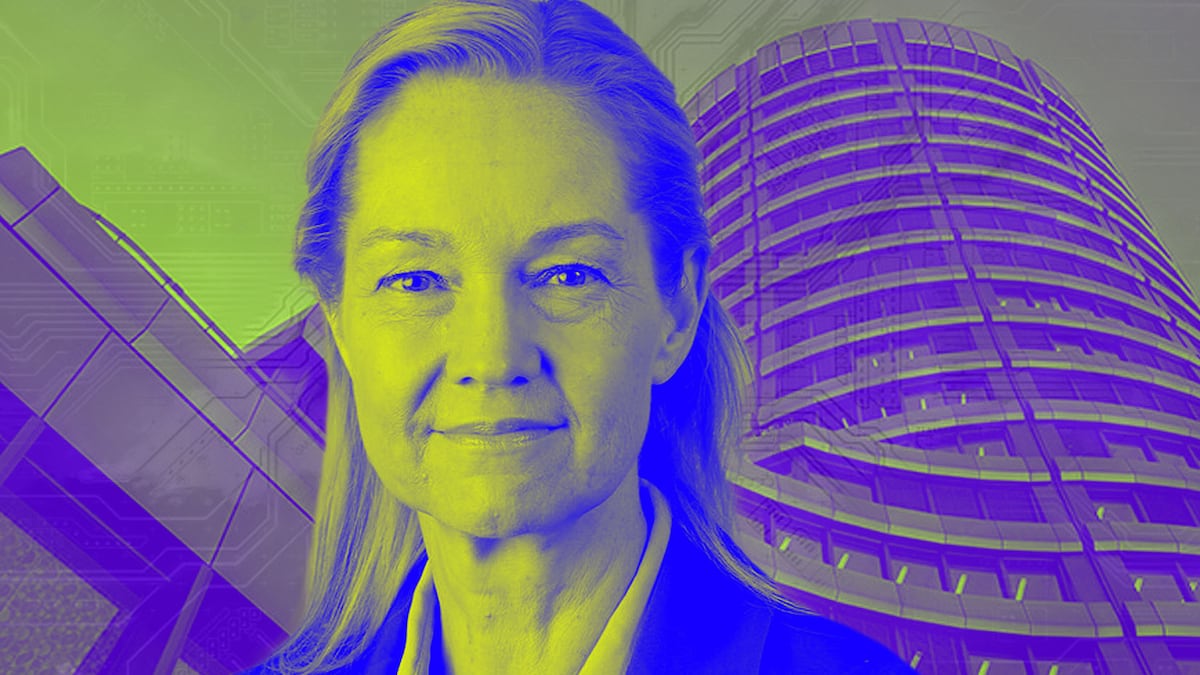

“We want to look into what sort of privacy enhancing technologies are out there that could be used in a retail services system,” Cecilia Skingsley, head of the BIS Innovation Hub, said in a BIS seminar on Monday.

The research comes under the Innovation Hub project known as Project Aurum, based out of the organisation’s Hong Kong Centre. The project collaborates with the local financial regulators, and academics, according to the BIS.

Project Aurum, first launched in 2021 to explore the front and back end of a multi-use CBDC, will begin a “new phase” to investigate privacy in retail payments.

The BIS Innovation Hub also said that it will release a minimal viable project, a so-called MVP, that aims to facilitate cross-border payments compatible with multiple different CBDCs, known as mBridge.

The Financial Stability Board, which is hosted by the Basel-based BIS, lists the implementation of its recommendations for regulating crypto assets on its 2024 work programme.

The international body, which reports to the G20, finalised its recommendations for crypto assets in July.

Together with other international standard-setting bodies and regional authorities, the FSB is “working to make sure that these regulations are implemented consistently and globally,” FSB Secretary General John Schindler said on Monday.

Privacy concerns and conspiracies

Privacy is a major concern for CBDC watchers around the world, fuelling conspiracy theories that central banks will gain access to unprecedented levels of citizens’ sensitive data, such as their spending habits.

Many of the concerns in the West arise from the far more advanced system developed and adopted in China, where programmable features ring alarm bells for privacy advocates.

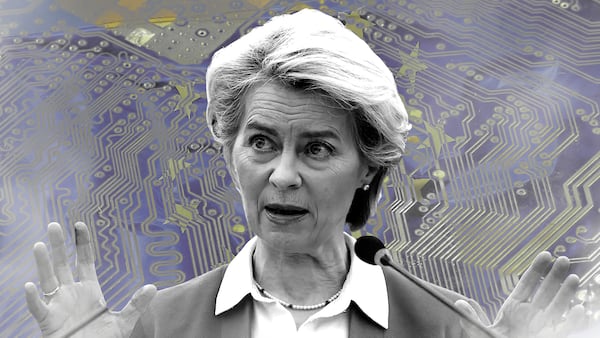

For example, the European Central Bank faces a backlash for developing a digital euro. Top EU officials have defended the project from concerns it is a “Big Brother” surveillance project and “a conspiracy.”

In the US, former President Donald Trump has pledged to “never allow” a CBDC to be issued if he’s elected for a second term.

US Republican lawmaker Tom Emmer has labelled the prospect of a digital dollar as “a CCP-style surveillance tool” and campaigned for a bill that would limit the Federal Reserve’s power to issue a CBDC.

In the UK, the digital pound is also a crux of culture wars.

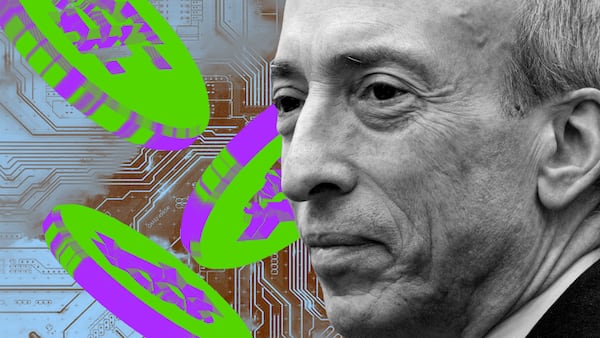

Yet, developers of the technology behind several CBDC projects, such as R3 CEO David E. Rutter, have labelled the public criticism against these projects as “fear-mongering.”

Global financial system upgrade

The so-called bank for central banks’ Innovation Hub develops and researches new tech that could upgrade the global financial system.

“Central banks are actively examining the potential for novel technologies to help deliver on their mandates,” Skingsley said in a release.

Cross-border payments

BIS will also continue its work on cross-border payments through the project dubbed mBridge.

“Once the MVP is finalised, we need to have a good look at the lessons learned and see together with a partner in central banks,” Skingsley said in the Monday seminar.

The exact timeline could not be disclosed, she added.

Tokenisation agenda

Developing tokenised promissory notes onto distributed ledger technology is also on top of the 2024 work programme at the Innovation Hub.

“It’s a test of tokenisation to get rid of fairly cumbersome paper handling in the world of development banks mostly,” Skingsley said.

This project works in collaboration with the Swiss National Bank and the World Bank Group, with the International Monetary Fund as an observer.

Have a hot tip about CBDCs? Contact the author at inbar@dlnews.com.