Multiple actions by regulators in April showcase efforts to curb DeFi, says a VanEck executive.

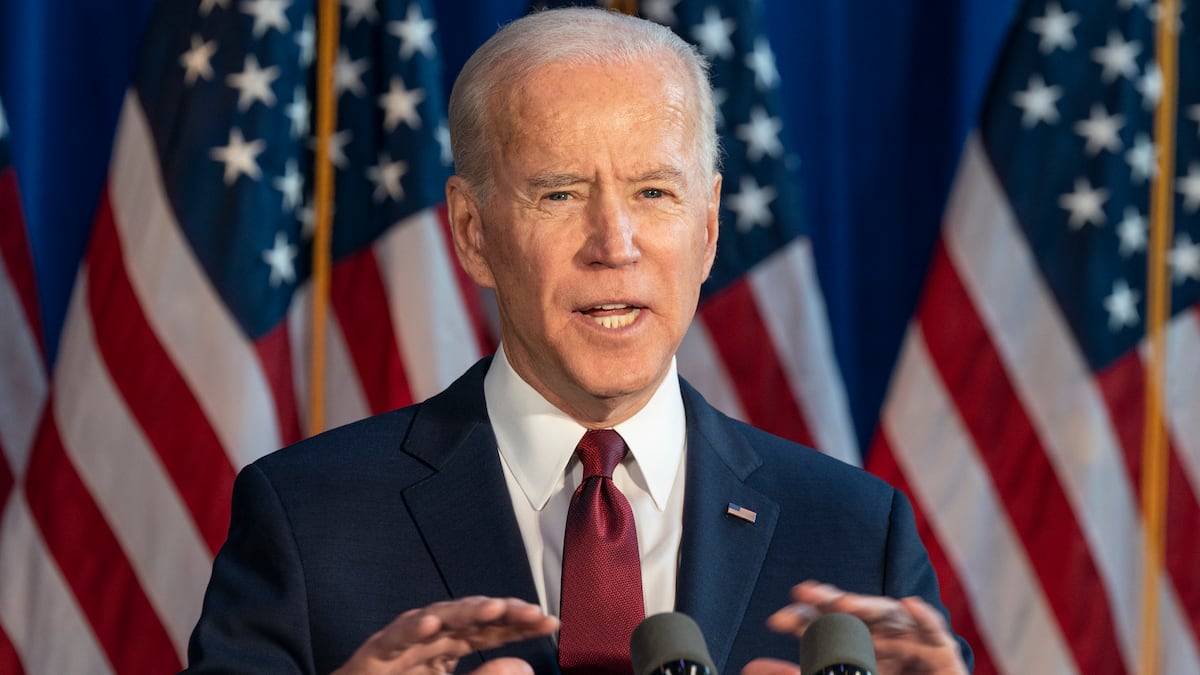

Decentralised finance and self-custody are under threat by the actions of Joe Biden’s administration.

That’s according to Matthew Sigel, head of digital assets research at VanEck, who pointed to actions undertaken by regulators under Biden’s watch — calling them overly aggressive and, at times, providing little recourse for crypto firms.

They also played a large part throughout April in subduing investors’ confidence in digital assets, the research head told DL News.

”The Biden administration is hurrying to make DeFi and self-custody functionally illegal in the US before voters can express political intentions at the ballot box,” Sigel said.

His comments come as the race for the presidency nears, with former Republican President Donald Trump likely squaring off against incumbent Democrat Biden in November.

“A cooling of speculative froth amid more troubling macro signals,” compounded investor apathy, Sigel said.

Regulators’ actions last month led to several high-profile cases, which he said singled out DeFi projects and custody solutions, he said.

Uniswap on notice

That included the Securities and Exchange Commission issuing a warning to the Uniswap Foundation on April 11, alleging it has been operating an unregistered exchange.

Uniswap’s founder, Hayden Adams, has promised to fight the SEC, claiming the regulator is unwilling to provide clarity or a path to registration to those operating lawfully.

Other US actions

Sigel suggests other actions taken against the DeFi sector last month can be blamed on Biden.

They include: the Internal Revenue Service’s proposed reporting requirements for un-hosted wallets, which the industry says includes an overly broad definition of brokers; and an SEC warning letter alleging Ethereum developer Consensys broke securities laws via its MetaMask wallet.

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.