- Two giant exchanges spent $2.4 million in first half of 2023.

- Crypto industry is tapping top K Street lobbyists to favourably influence policy.

- Digital assets sector ratchets up efforts after spending $22 million in 2022.

Besieged by regulators and anxious about pending legislation, Coinbase and Binance are doing what every big company does in Washington — spending heavily on lobbyists.

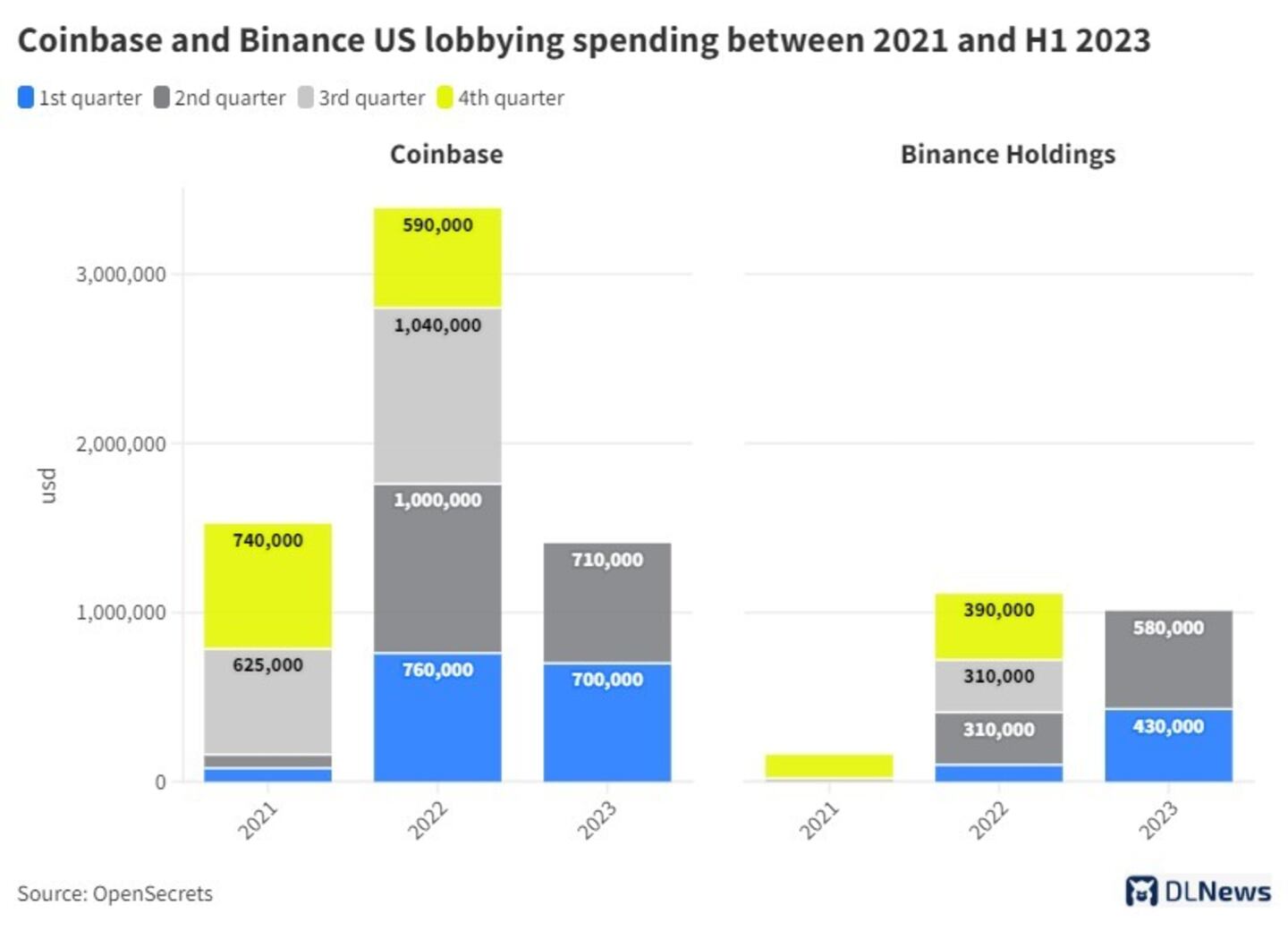

In the first six months of 2023, Binance dished out more than $1 million on swaying the opinions of Capitol Hill lawmakers, which is almost as much as it spent in all of 2022, according to data from OpenSecrets, an organisation that tracks political contributions.

And Coinbase, the top listed crypto exchange in the US, spent $1.4 million in the same period. The company paid lobbyists $3.4 million in 2022, making it a leader in crypto lobbying.

The lobbying surge is a bid to shape the future of an industry that has reached a critical juncture.

The failure of FTX last November and the looming criminal trial of its founder, Sam Bankman-Fried, has cast a harsh light on the lawlessness of the digital assets marketplace.

‘In the wake of the FTX collapse, regulators have redoubled their efforts to establish a regulatory framework for crypto.’

— Olivia Buckley

The subsequent crackdown by the US Securities and Exchange Commission and other authorities is driving the industry to mitigate the damage and, if possible, support legislation that will ensconce crypto in its own legal domain.

“In the wake of the FTX collapse, regulators have redoubled their efforts to establish a regulatory framework for crypto,” Olivia Buckley, researcher at OpenSecrets, told DL News. “Since those efforts are gaining traction and more comprehensive regulation seems somewhat inevitable, crypto firms have a vested interest in shaping new legislation as it advances.”

With a presidential election coming in 2024, the industry is hopeful its spending can help bolster crypto as a pressing issue.

NOW READ: Stablecoin laws could give US an edge — if they ever get off the ground

The sector’s spending has been growing at a rapid clip. In 2022, 60 crypto companies spent $22 million on crypto lobbying in the US, almost triple the amount in 2021, according to OpenSecrets.

Moreover, the number of lobbyists employed by crypto firms almost doubled in 2022 to 283 from 147.

Along with Coinbase and Binance, the big spenders included Ripple, Crypto,com, and the Blockchain Association, the industry’s trade group.

Even though the crypto industry is tiny compared with the traditional finance sector, its lobbying bill accounted for almost 15% of Wall Street’s total spend in Washington last year.

What bills are Binance and Coinbase lobbying for?

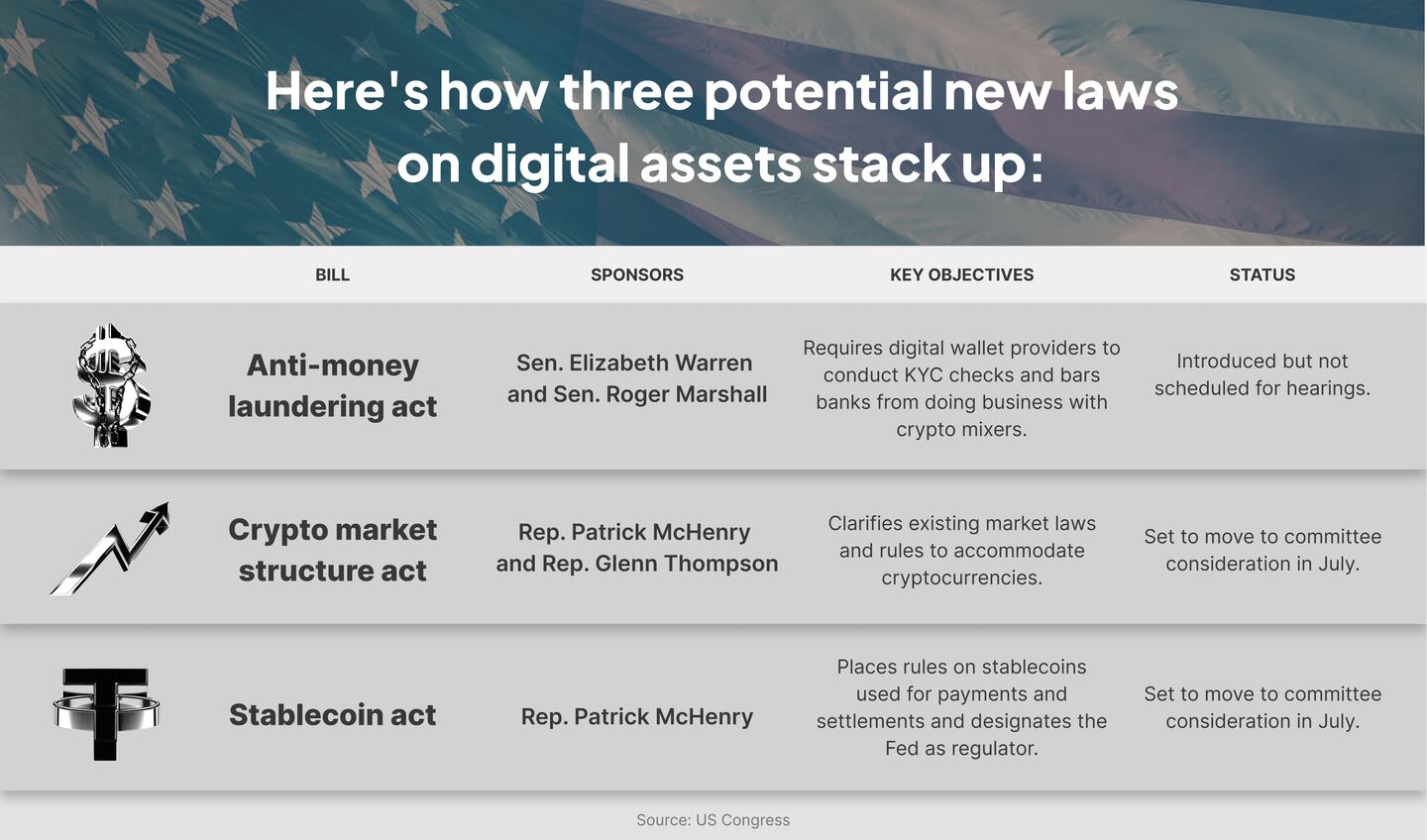

With as many as seven bills floating around in Congress, the lobbying picture is complicated.

Last year, Binance supported the Digital Commodities Consumer Protection Act of 2022, a bill that drew notoriety because it was pushed by Bankman-Fried and FTX and its own splurge of contributions to lawmakers.

NOW READ: A 162-page bill would give the CFTC big chunks of US crypto markets. Here’s what else is in it

If passed, the bill would have categorised digital assets as commodities and place the industry largely under the oversight of the Commodity Futures and Trading Commission, an agency believed to be taking a more lenient approach than the SEC.

While that bill was scrapped at the commencement of the new congress, parts of it still lives on in the new Financial Innovation and Technology for the 21st Century Act.

Binance also backed the bipartisan Responsible Financial Innovation Act, which sought to create a new regulatory framework for the crypto industry.

As for Coinbase, the exchange also supports legislation that would largely define digital assets as commodities.

Coinbase CEO Brian Armstrong, applauded the passing of the Financial Innovation and Technology for the 21st Century Act through a committee in July as “a vote to protect your crypto, American innovation, and national security,”

Along with the rest of the industry, Coinbase opposed further enforcement actions in the wake of FTX’s failure, with Armstrong complaining that it makes “no sense” to punish US companies with more enforcement actions.

The industry and its allies on the Hill have aggressively opposed a bill co-sponsored and re-introduced this summer by Senator Elizabeth Warren, a Democratic Party liberal, and Senator Roger Marshall, a Kansas Republican.

NOW READ: Elizabeth Warren’s anti-crypto crusade may bolster Wall Street’s land grab in Bitcoin market

Citing the need to protect national security, their bill would enforce strict new know-your-customer and anti-money laundering requirements on crypto providers, and direct banks to cease doing business with crypto mixers that mask the identity of users.

Opponents of the bill essentially argue that the industry is too small to be burdened by the same compliance requirements as banks, and would “stifle innovation, hinder industry growth, and force activity offshore to jurisdictions with less adequate security and oversight.”

Well-connected lobbyists

Given the stakes, it’s no surprise to see the crypto industry employing the same tactics long used by other industries.

From their offices on K Street in downtown Washington, well connected lobbyists routinely shape US legislation, and in some cases even write the drafts for new laws themselves.

There’s big money involved: While Wall Street spent $139 million on lobbying in 2022, the pharmaceutical industry spent more than $375 million and the oil and gas industry spent $125 million.

Many top lobbying firms utilise the services of so-called “revolvers” — onetime regulators or lawmakers who leverage their expertise and networks on the Hill to advance the agendas of their clients.

What lobbyists have been hired by Binance and Coinbase?

Binance and Coinbase haven’t been shy about tapping the services of revolvers.

“Hiring former federal employees is one way that companies retaining lobbying firms can exert more direct influence,” Buckley said.

For instance, Lendell Porterfield, a former senior advisor to the Senate Banking Committee, has represented Coinbase, according to OpenSecrets.

NOW READ: French regulators race to get a jump on MiCA and make Paris Europe’s web3 hub

Binance, for its part, has been represented by Jarrod Loadholt, a former senior counsel to the House Financial Services Committee, and Billy Piper, the former chief of staff for Senator Mitch McConnell, the powerful Kentucky Republican and Senate Minority Leader.

Binance enlisted Hogan Lovells, a global law firm that represents companies in the aerospace and defence, insurance, and financial services industries. Binance.US also Fierce Government Relations, which has done work for the likes of Pepsi, Unilever and Apple.

Coinbase, for its part, has enlisted the services of GoDaddy lobbyist Franklin Square Group, and Madison Group, which represents Alphabet, the parent company for Google.

What’s in Congress’ crypto crackdown?

Binance, Coinbase and other crypto firms spending money on lobbying comes at a perilous time for the industry.

Despite Bitcoin’s 72% rally this year, the crypto industry’s overall market capitalisation is still less than half what it was — $3 trillion — at its peak in November 2021.

The crash of Celsius, Terra, and FTX in 2022 sent shockwaves through the cryptoverse last year and triggered a string of criminal charges and lawsuits — not to mention ugly headlines.

That was all longtime industry foes such as Warren and SEC chair Gary Gensler needed to bring the hammer down.

NOW READ: How the SEC’s showdown with Coinbase will change the crypto market for everyone

In twin lawsuits filed earlier this year, the SEC is trying to shut down Coinbase and Binance for allegedly failing to register their businesses as securities exchanges and broker dealers, and for facilitating the trading of digital assets that have not passed through the same approval process as stocks and bonds.

If the SEC succeeds, it could force a wholesale restructuring of the crypto industry.

Leading bill

The markets watchdog is also gearing up for another round in its long-running legal war with Ripple, the cross-border payments platform and another huge crypto lobby spender, in 2024.

That case, like the ones against Coinbase and Binance, hinges on defining precisely what a cryptocurrency is, and which laws govern its usage.

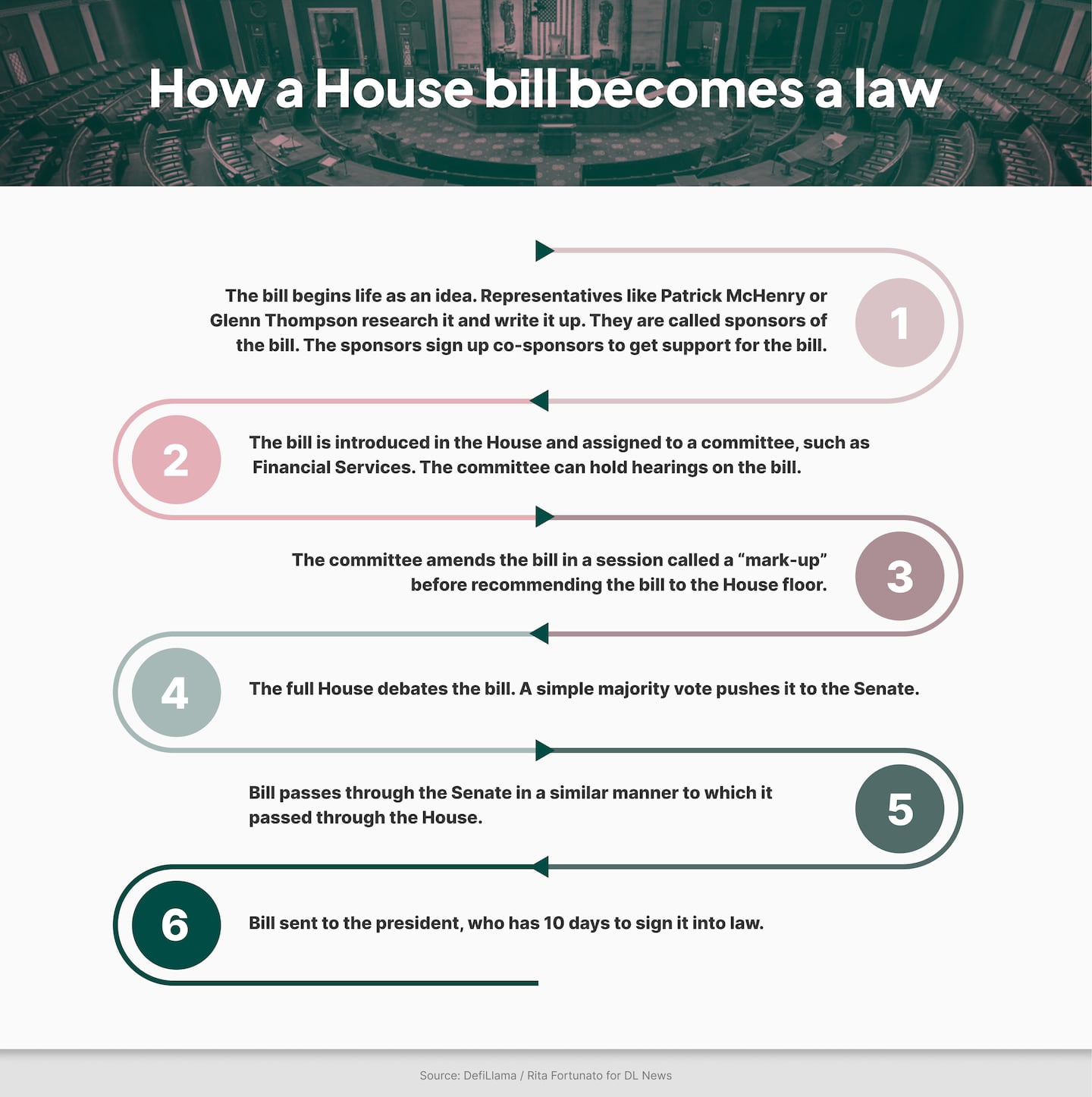

If all this wasn’t enough, the bill that appears to have emerged from the pack with the best chance of getting a full vote is the Clarity for Payment Stablecoins Act, championed by Patrick McHenry, the Republican chair of the House Financial Services Committee.

NOW READ: Crypto bill author McHenry says SEC should have ‘taken out’ Binance years ago

Under this bill, stablecoin issuers must be regulated firms like banks and maintain reserves of safe assets backing the stablecoin on a one-to-one basis, and stablecoin issuers can be licensed by state, as well as federal regulators, something Democrats have objected to

The bill cleared a committee vote this summer and is poised to be debated and voted on by the full House, perhaps as soon as this fall.

If that happens, crypto lobbying may drop into yet another gear and accelerate even more.

Coinbase and Binance did not respond to requests for comment.

Ana Ćurić is DL News’ Belgrade-based investigative journalist and researcher. Joanna Wright is DL News’ London-based regulation correspondent. Eric Johansson is DL News’ London-based news editor.

Do you have tip? Let us know at ana@dlnews.com, joanna@dlnews.com, and eric@dlnews.com.