- A regulatory crackdown is taking its toll on Binance’s inflows.

- Deposits at rival OKX jumped almost 2%.

- It’s the latest sign lenders are reducing exposure to cryptocurrencies.

Binance is bleeding user deposits as the top global crypto exchange grapples with the loss of its banking and payments provider partners and mounting regulatory pressure.

DefiLlama data shows that over the past month, customers withdrew a net $1.8 billion worth of cryptocurrency assets from Binance, which is the equivalent of 3.3% of its total deposits. More than $13.2 billion has left the exchange since last November.

By comparison, OKX, the next biggest exchange tracked by DeFiLlama with $9.9 billion in assets, has enjoyed a 1.9% jump in deposits in the last four weeks.

Slew of challenges

Binance’s outflow coincides with a slew of challenges confronting the exchange’s years-long dominance as the industry’s go-to trading hub.

The regulatory crackdown in the US — including a lawsuit filed against Binance by the Commodity Futures Trading Commission — is doing more than generating bad headlines. It’s also making banks skittish about doing business with outfits that deal in Bitcoin and its ilk.

Blocking customers

In March, Binance told customers that its UK banking partner for British pounds, Skrill Limited, will stop offering its services to the exchange’s users on May 22. This left Binance customers in the UK without a way to deposit and withdraw funds denominated in sterling.

On May 18, Westpac, a major Australian lender, said it was blocking customers from Binance and other crypto exchanges from using its accounts. The reason: to curb losses from scams.

NOW READ: Crypto investors cry foul as Finblox converts deposits to tokens to offset 3AC losses

The same day, Binance announced it was axing PayID — a popular way for users to send money between their bank accounts and Binance — for Australian customers. Binance said it took the action due “to a decision made by our third-party payment service provider.”

Since the changes to Binance’s UK and Australian services, customers have withdrawn a net $400 million worth of crypto from the exchange. In the same period, depositors ploughed more than $93 million into OKX. Other big crypto exchanges, such as Bitfinex and Huobi, also registered sizable inflows.

Legal woes

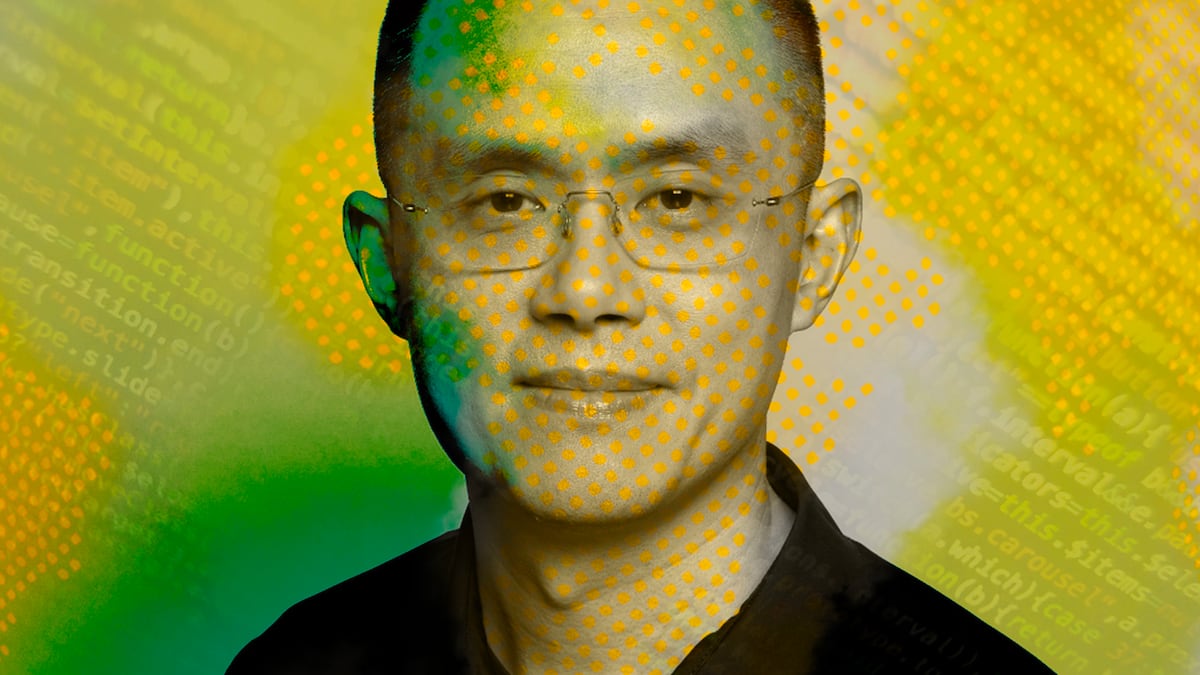

Binance is also dealing with mounting regulatory pressure. In March, the CFTC, which oversees the US derivatives market, charged Binance and its founder Changpeng Zhao with failing to register as a derivatives and commodities dealer, and for unlawfully turning a blind eye to money laundering taking place on the exchange.

NOW READ: Airdrop hunters send crypto bridge Stargate to new highs

As banks must adhere to strict anti-money laundering checks, the CFTC’s action may have contributed to the exodus of Binance’s banking and payment provider partners.

With Binance’s access to payment systems disappearing, the exchange has reportedly started looking into alternatives.

In a recent appearance on the Bankless podcast, Zhao said Binance had looked into purchasing its own bank to overcome its payments problem. But he said owning such a venture was ultimately too high risk and would open Binance up to more regulatory scrutiny.

Instead, Zhao said, Binance “may make small investments in a few banks.”

“Hopefully that influences them to become more crypto-friendly,” he said.