- Binance says that the CFTC is trying to extend its regulatory reach across the globe through its lawsuit against the exchange.

- The crypto exchange accused the CFTC of ignoring the “fundamental legal principle that US law governs domestically but does not control the world.”

- Binance is seeking to dismiss the lawsuit.

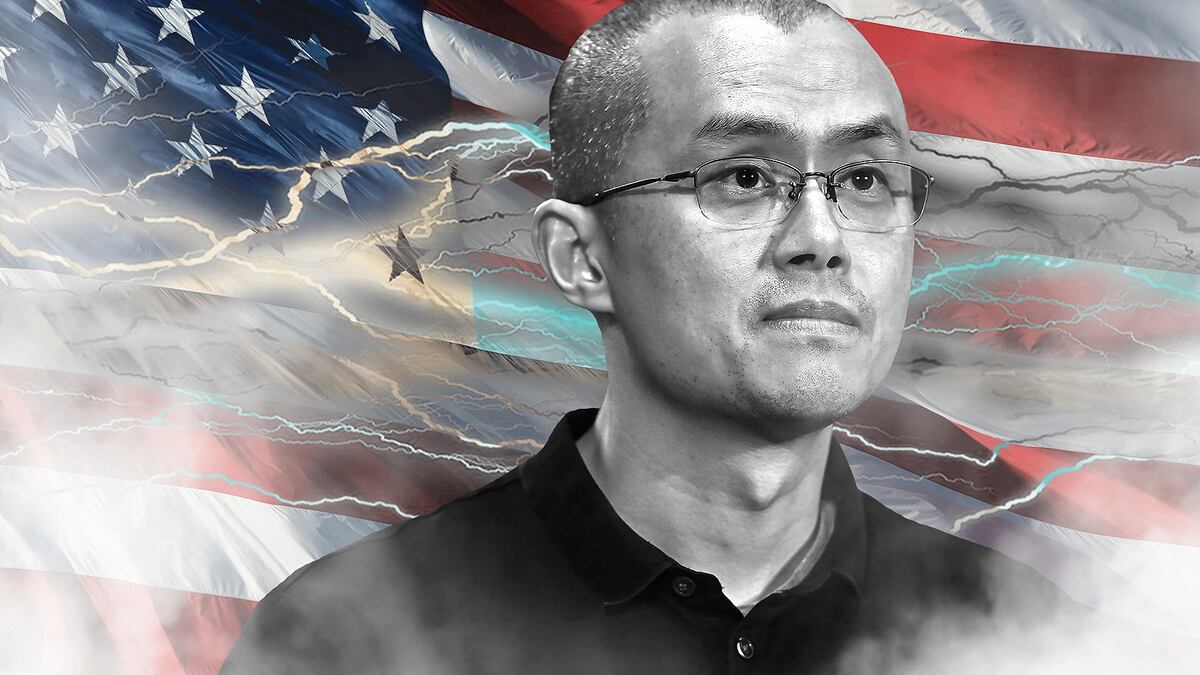

The Commodity Futures Trading Commission is using its lawsuit against Binance as a “Trojan horse” to gain “worldwide regulatory reach,” according to a court filing late on Monday made by the crypto exchange and its CEO, Changpeng “CZ” Zhao.

The filing is Binance’s latest bid to dismiss the agency’s lawsuit against it, which alleges the crypto exchange is running an illegal derivatives trading business. The agency also accused Binance of taking steps to help customers avoid ignoring compliance regulation.

In its filing, Binance argued that the CFTC was relying on “new and broad arguments that would allow it to regulate any activity in cryptocurrency (or other assets) related to a derivatives product anywhere on the globe.”

The company accused the US regulatory agency of seeking to regulate individuals and corporations based outside of the US, while ignoring the “fundamental legal principle that US law governs domestically but does not control the world.”

“Congress did not make the CFTC the world’s derivatives police, and the Court should reject the agency’s effort to expand its territorial reach beyond what is permitted by the law,” said the filing.

Binance further stated that the lawsuit would have consequences “far beyond this case and not intended by Congress.”

“We do have broad enforcement authority when it comes to fraud and manipulation in commodity markets,” CFTC commissioner Summer Merzinger told CoinDesk today at the State of Crypto conference. “That’s the enforcement power we’re using here.””If there are US persons, US markets involved, we do have that authority to go in and make fraud and manipulation charges,” Merzinger added.

Dismissing lawsuits

Binance, the world’s largest crypto exchange by volume, has already tried to dismiss the CFTC’s lawsuit on the grounds that neither the company nor Zhao were subject to US law, which the CFTC disputed in a September filing.

Their argument rested on the facts that Zhao is a Canadian citizen and Binance’s holding company is based in the Cayman Islands.

In June, Binance and Zhao were also hit with a lawsuit from the Securities and Exchange Commission, which claimed that Binance and Zhao commingled customer funds and violated securities laws.

Legal experts and media reports have indicated that the US Justice Department may follow suit with criminal charges.

Binance’s pushback against the CFTC echoes arguments it has made against the SEC. The company claims the SEC is overstepping its authority, citing the “major questions doctrine” as a reason the lawsuit should be dismissed.

Major questions is a legal doctrine that seeks to curb overreach by government agencies. However, the principle rests on shaky grounds, as it emerged as a stand-alone doctrine in 2017 and therefore doesn’t have much historical precedent.

Binance did not immediately respond to requests for comment.

Tom Carreras is based in Costa Rica. Got a tip about Binance? You can reach him at tcarreras@dlnews.com.