- Bitcoin nears an all-time high anticipated by market watchers.

- Experts say this is thanks to regulators approving Bitcoin ETFs early this year.

The crypto industry is euphoric as Bitcoin’s bull run has brought its price back to highs last reached in November 2021.

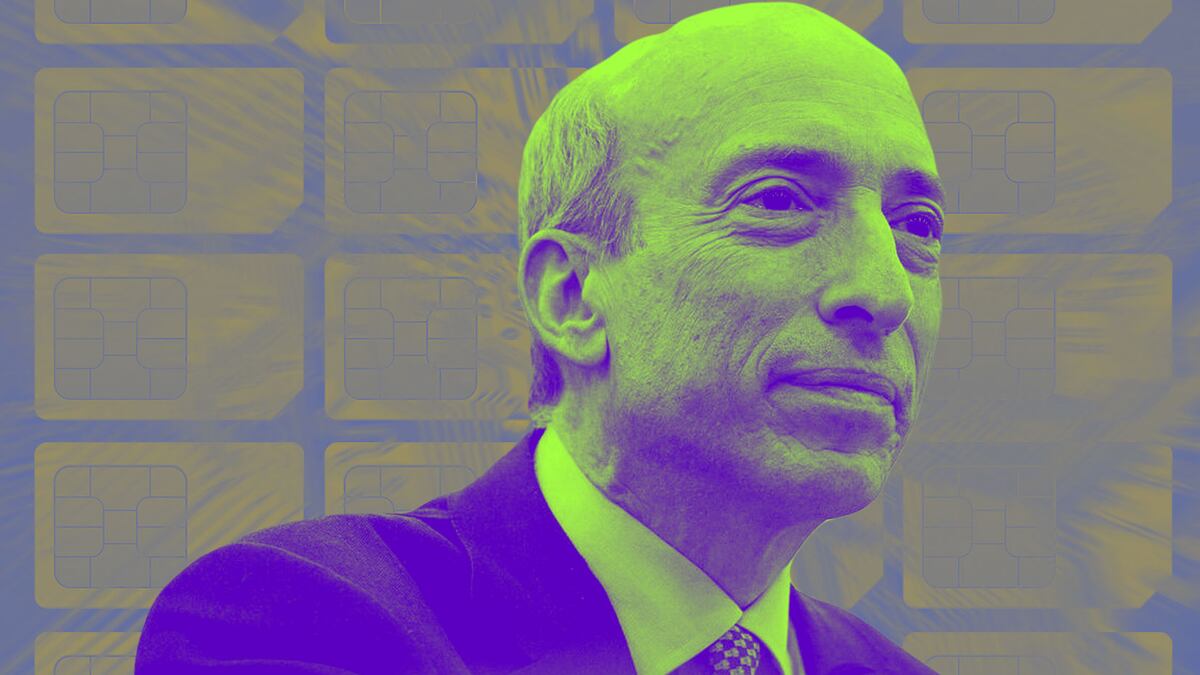

And it’s all thanks to Gary Gensler, experts say.

Since the Securities and Exchange Commission chair gave the nod to 11 highly anticipated spot Bitcoin exchange-traded funds in January, the price of Bitcoin has been soaring.

“Gensler should be really proud. This is a big achievement,” Bloomberg Intelligence analyst Eric Balchunas told DL News.

Balchunas said the ETFs have provided a safe and easy way for investors to get exposure to Bitcoin.

“ETFs rock! They’re really good at what they do, especially compared to what was out there before them,” he said.

“They’re easy access, cheap, liquid, tax efficient. And they have a lot of safeguards in place; they’re regulated and they have legal documents and risk disclosures attached to them.”

No wonder investors are piling in.

Bitcoin has soared along with daily trading volume for BlackRock’s new iShares Bitcoin Trust, which has smashed records and has crossed $10 billion in flows.

It’s nonetheless ironic that the industry has Gensler to thank for the ETFs, and therefore the rally, which has seen Bitcoin jump almost 40% this year and temporarily crossed $63,000 this week.

The hard-charging chair’s tenure has been marked by a crackdown on crypto businesses, with Gensler asserting repeatedly that the industry is rife with fraud and non-compliance.

He made it clear in approving the ETFs that he was doing so only because told to by the courts.

Victory lap

Gensler should have taken a victory lap after approving the ETFs, Balchunas said.

”ETFs are a way to limit the audience that fraudsters and hucksters get.”

They’re a win for consumer protection, which is after all the SEC’s mandate.

“We always thought the SEC was blind to the fact that the ETFs would help it achieve this goal,” Balchunas said.

“It doesn’t take a genius to see that putting these ETFs out there and having by-the-book, legit companies running them with tons of compliance is a good way to limit the amount of damage that fraudsters and hucksters can do.”

It’s likely that Gensler thought approving ETFs would legitimise Bitcoin and crypto more generally.

‘It’s not like they put heroin in an ETF.’

The chair said SEC approval of the ETFs does not equate to an endorsement of Bitcoin itself, and that “investors should remain cautious about the myriad risks associated with Bitcoin and products whose value is tied to crypto.”

However, Balchunas noted, the SEC had already legitimised crypto. After all, investors could buy from Coinbase — a listed company — and the SEC had already approved Bitcoin futures products.

“It’s not like they put heroin in an ETF. You can get Bitcoin at exchanges that are publicly traded,” he said.

“It was already pretty legitimised, ETFs are just a better way to do it.”

New image for Bitcoin

Rebecca Rettig, chief legal and policy officer at Polygon Labs, told DL News that the current bull run is a result of a new image for Bitcoin.

“It’s very clear that there’s acknowledgement that not just Bitcoin, but the industry is being taken more and more seriously,” Rettig said.

And, traditional financial markets are talking about Bitcoin’s flight, thanks to ETFs, she said.

Still, she said “crypto markets are evolving and nuanced, and so nothing is ever attributable to one thing alone.”

Bitcoin’s halving coming up in April is another potential price driver. The halving is programmed to occur once every four years to reduce the amount of new Bitcoin that can be created by miners.

After the last halving, in 2020, Bitcoin’s price soared more than 600%.

Have a tip? Reach out at joanna@dlnews.com and inbar@dlnews.com