- The chair of the US derivatives watchdog told lawmakers his agency needs more money to police crypto.

- He was testifying as a senator teased new crypto legislation.

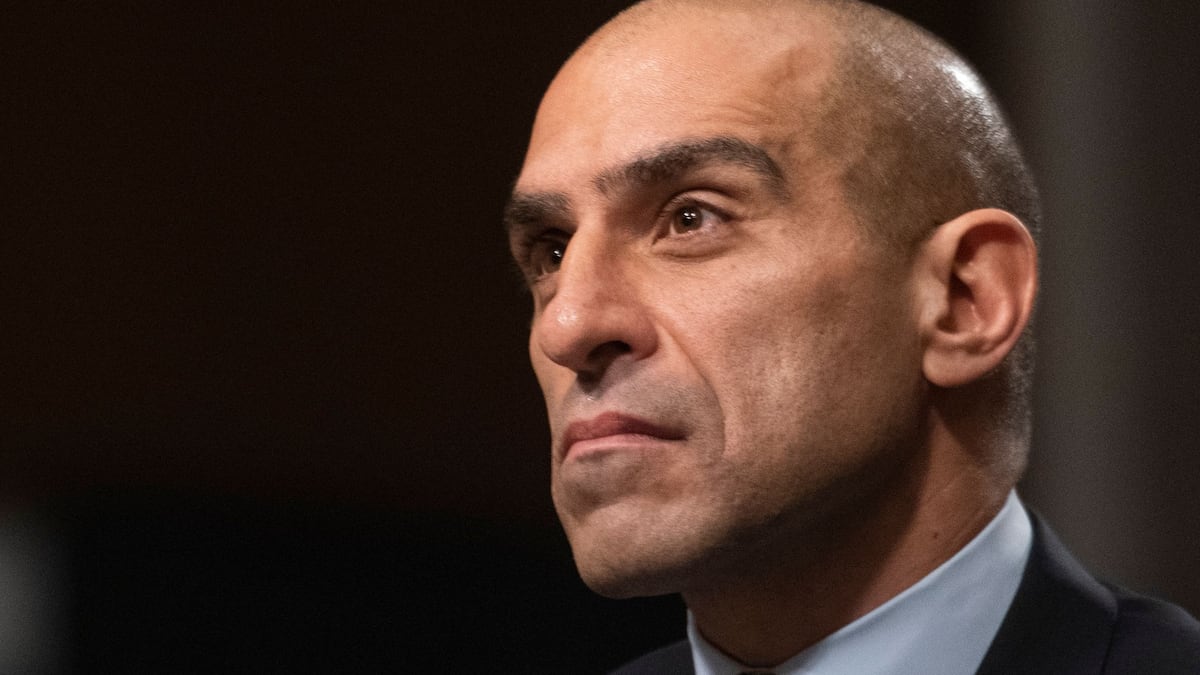

The US derivatives watchdog needs more power to police spot crypto markets and keep investors safe — but it also needs more money, its chair told Congress on Wednesday.

In the tax year ending in April, about 50% of enforcement actions brought by the Commodity Futures Trading Commission were against crypto businesses, the agency’s chair Rostin Behnam said.

That is “a staggering statistic for an agency that oversees trillion-dollar markets — to have to allocate half of its resources to a market it doesn’t regulate and does not get appropriated funds for,” said Behnam, who spoke during a hearing in the Senate Agriculture committee on Wednesday.

The CFTC, as the derivatives regulator, has limited authority over crypto spot markets.

Behnam told lawmakers that if the government decided to change that, and give it full jurisdiction over crypto, the CFTC would need more budget for personnel and cybersecurity.

If Congress passes legislation, the CFTC would need an extra $60 million for year one and around $35 million more in year two, while it waited for new income from crypto registrants to kick in.

That’s on top of the CFTC’s normal budget.

Behnam asked Congress in April for $399 million and 725 full-time employees for to fund the agency’s normal course of duties in 2025.

Committee chair Senator Debbie Stabenow called the hearing, during which she teased a new crypto bill that would give the CFTC more authority over crypto spot markets.

Stabenow said the bill would emphasise protecting retail investors, and would also seek to adequately fund the CFTC. She said it will be submitted to committee members for review by the end of the week.

Limited resources

Behnam welcomed the idea of crypto legislation.

“If you measure the crypto economy by market capitalisation, upwards of 70% to 80% of the market are non-securities, which means there is no direct federal oversight,” he said

“So despite what some may believe, this leaves this giant gap — this vacuum — and ultimately customers at risk for loss of money.”

The comment may have been referring to Behnam’s counterpart at the Securities and Exchange Commission, Gary Gensler, who believes that most crypto assets can be adequately policed under existing securities legislation.

Behnam said, however, that while the CFTC welcomes more statutory authority, it will need commensurate resources.

Limited powers

The CFTC’s limited mandate over spot crypto means that while it has a powerful enforcement programme — bringing 135 actions against crypto businesses over the past decade — Behnam said, it can only be reactive in protecting investors.

“We’re never able to be on our front foot in these situations. We’re always just responsive to tips, complaints from individuals who have typically already been defrauded,” Behnam said.

A proper regulatory framework would compel crypto businesses to register with the CFTC, whether as brokers, exchanges, or custodians, and submit them to a thorough disclosure regime.

“Those are the types of regulatory tools that enable us to eliminate — if not reduce significantly — market fraud and manipulation,” Behnam said.

Reach out to the author at joanna@dlnews.com.