- Federal agencies must get rules finished by mid-year, as a new, possibly Republican, administration could overturn them.

- For the SEC, that means prioritising climate disclosure regulations.

- That could push regulations affecting DeFi into next year — when the political calculus will be different.

A version of this story appeared in our The Guidance newsletter. Sign up here.

New Hampshire voters go to the polls this week in their primary, and former US President Donald Trump seems poised to win the Republican nomination.

That’s a signal for the Securities and Exchange Commission to step on the gas and finalise its top-priority rules before a Republican possibly takes the White House.

However, that won’t include new crypto rules, according to sources who speak with the SEC, and the agency’s own agenda.

Instead, it is pushing to get climate disclosure rules — a political hot potato — over the finish line.

It might surprise DeFi degens steeped in crypto lore that the SEC has priorities other than cracking down on crypto.

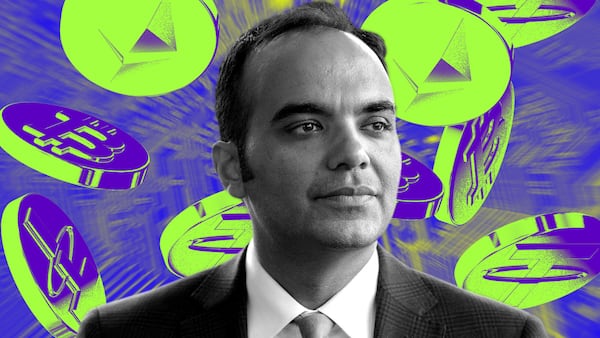

After all, Chair Gary Gensler has emerged as crypto’s main bogeyman, as his agency’s lawsuits against exchanges like Coinbase have dominated headlines.

But crypto is a mere $1.6 trillion industry worldwide. The SEC oversees markets that trade about $358 trillion annually in the US alone.

Gensler has, in other words, bigger fish to fry.

Let’s get into it.

The marquee regulation of the Gensler era will be the climate disclosure rules.

However, the SEC is running out of time to ram them home.

Federal agencies have until mid-year at the latest to adopt final rules they think might be unpopular with Trump or his government.

A new administration has the power to scuttle any rules it doesn’t like and that aren’t adopted well before the next Congress.

What are these climate rules about?

A few years back, firms like BlackRock and Vanguard started to market funds that invested in renewable energy or avoided water polluters.

Regulators realised, however, that many firms just repackaged normal funds, slapped a green wrapper on them, and sold them for higher fees.

The SEC pushed back on greenwashing in March 2022, proposing new rules to force public companies to disclose detailed information about factors like greenhouse gas emissions.

Companies howled, and lobbyists threatened to sue. The granularity of reporting would be burdensome and costly, they said.

Republican politicians joined in, bringing a culture wars flavour to the debate. They accused BlackRock — absurdly — of going woke, and raked Gensler over the coals.

If Trump were president again, he’d no doubt overturn these rules as a first order of business.

So the SEC must work hard to get them on the books by its own April deadline.

What’s that got to do with DeFi?

The SEC put out another proposal in 2022 — this one focusing on rules governing securities exchanges.

The jumbo document was, on the face of it, focused on the US Treasuries market, and didn’t contain a single mention of crypto.

But as Gensler considers most crypto assets to be securities, it was clear that DeFi projects would be swept in too — prompting industry-friendly SEC commissioner Hester Peirce to accuse the agency of trying to create an “unmarked backdoor” to DeFi regulation.

A backlash ensued, and the SEC re-opened the proposal for public input, from April to June, adding crypto-specific questions.

The commission has remained silent on the exchange regulation since then.

The SEC didn’t respond to requests for comment, but sources say the agency must prioritise the most politically fraught issues — and that’s the climate rules.

The DeFi proposal has fallen by the wayside. And it could be a different SEC that picks it up again in the next Congress, perhaps one that is more sympathetic to DeFi.

Email me joanna@dlnews.com, or Telegram @joannallama.