- Coinbase was sued in 2023 for operating as an unregistered securities exchange.

- “SEC staff has agreed in principle” to dismiss the court case, said the company.

- Now the SEC's three commissioners must approve the decision.

After years of battling the Securities and Exchange Commission in court, the agency “agreed in principle to dismiss its unlawful enforcement case against Coinbase,” said the crypto exchange.

The move ends a two-year case where the SEC alleged that Coinbase operated an unregistered securities exchange, and failed to properly register its staking service.

The final decision is now in hands of commissioners Hester Peirce, acting Chair Mark Uyeda, and Caroline Crenshaw. The former two have signaled they are advocates for the cryptocurrency industry.

After a pre-market jump, Coinbase’s stock is down 1% to $254. It is down 30% from its all-time high of $345.

“Case dismissed,” tweeted chief legal officer for the company, Paul Grewal on X. “There will be no settlement or compromise — a wrong will simply be made right.”

If approved, the dismissal would represent the crypto industry’s biggest regulatory victory to date under US President Donald Trump. It’s a sign of potential outcomes for other platforms facing similar SEC scrutiny, as well as tokens labelled as unregistered securities.

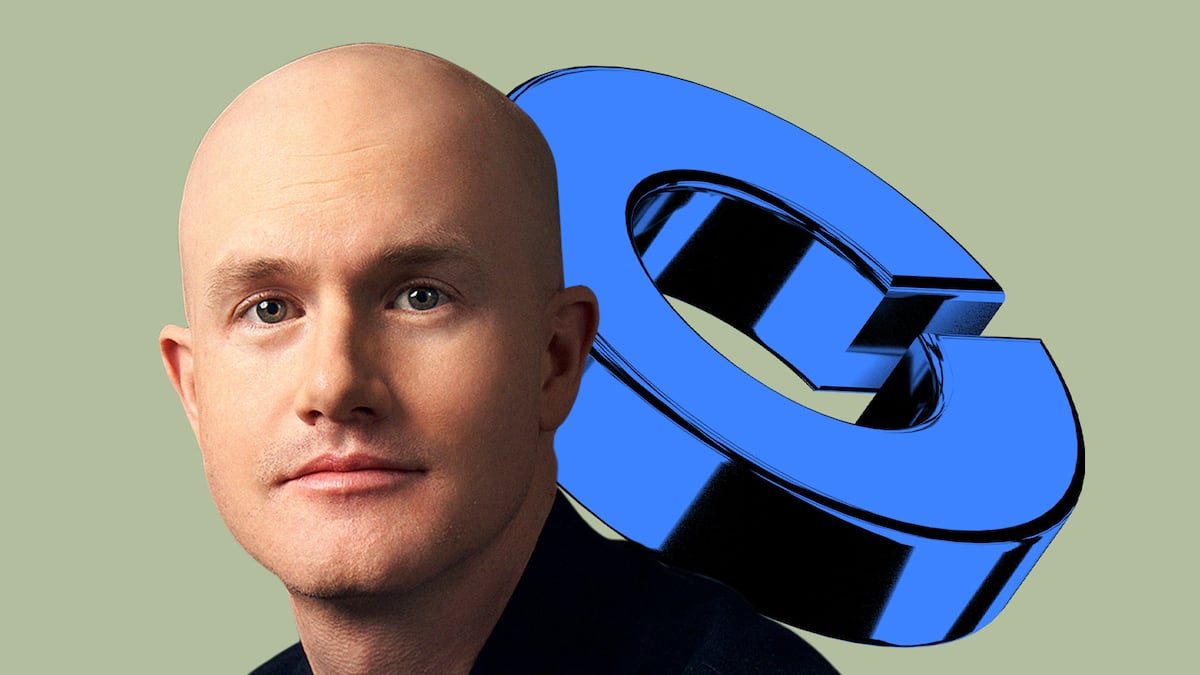

Coinbase CEO Brian Armstrong also celebrated the news, noting on X that “this isn’t the end. It’s the beginning.”

Armstrong was a big donor to crypto-supportive candidates in the 2024 election. The Fairshake political action committee spent tens of millions on races, making the crypto industry one of the biggest spenders.

Some aren’t happy, however. Former SEC official and cybersecurity expert John Reed Stark lamented the ‘SEC funeral’ as Gensler’s enforcement unit closes and major cases come to an end.

Revived lawsuit

Coinbase isn’t in the clear entirely, however.

The company is facing renewed legal trouble after a federal judge rejected its latest attempt to dismiss a class action court case that accuses the exchange of selling unregistered securities.

Originally filed in 2021, the lawsuit accuses Coinbase of illegally offering and selling cryptocurrencies that should have been registered as securities under US law.

The plaintiffs allege that Coinbase operated as an unregistered broker and failed to disclose the risks associated with these tokens.

Coinbase has denied any wrongdoing.

‘New dawn’

Still, Coinbase recently notched another win.

The company celebrated a 130% quarterly revenue jump that meant revenue more than doubled to $2.2 billion.

“It’s the dawn of a new era for crypto,” Coinbase CEO Brian Armstrong said.

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.