- Crypto exchange Coinbase has been approved to offer access to futures trading by the National Futures Association.

- The approval opens up a new market for the exchange amid dwindling volumes in the spot market.

- The firm first applied to register with the NFA in September 2021.

Brian Armstrong’s firm has a regulatory win in Washington, DC.

Coinbase plans to offer eligible customers in the US access to crypto futures, according to a blog post published Wednesday by Greg Tusar, vice president of institutional product at the exchange.

This month, Coinbase obtained approval for the offering from the National Futures Association, a registered futures association supervised by the US Commodity and Futures Trading Commission.

The move by the top listed crypto exchange in the US comes as it pushes into new sectors in the hunt for growth. Last week, it released Base to the public to garner more revenue from DeFi traders. Base, an Ethereum layer 2 protocol, is designed to lower gas fees for users making transactions on layer 1 blockchains like Ethereum cheaper.

$60 million

Analysts at investment bank Needham and Co. estimated that Base could bring in $60 million in annual revenue, $15 million net, in March when the project was first announced. Early signs suggest it could exceed this estimate, analysts told DL News.

Meanwhile, Coinbase is engaged in a legal fight with the US Securities and Exchange Commission that could shape the trajectory of crypto. In June, the agency sued Coinbase for allegedly operating an unlawful exchange and permitting investors to trade in assets that failed to be registered as securities.

NOW READ: Singapore imposes rules to make stablecoins ‘credible digital medium of exchange’

Coinbase is pushing into the futures market as volumes in the spot crypto market, where assets are traded immediately at a set price, sink to multi-year lows.

Coinbase saw retail trading volumes fall to $14 billion in the second quarter of this year, down from $46 billion a year previous. Institutional volumes fell about 55% to $78 billion.

Crypto access

The approval will allow more people to “access the cryptoeconomy” in the US, Tusar said.

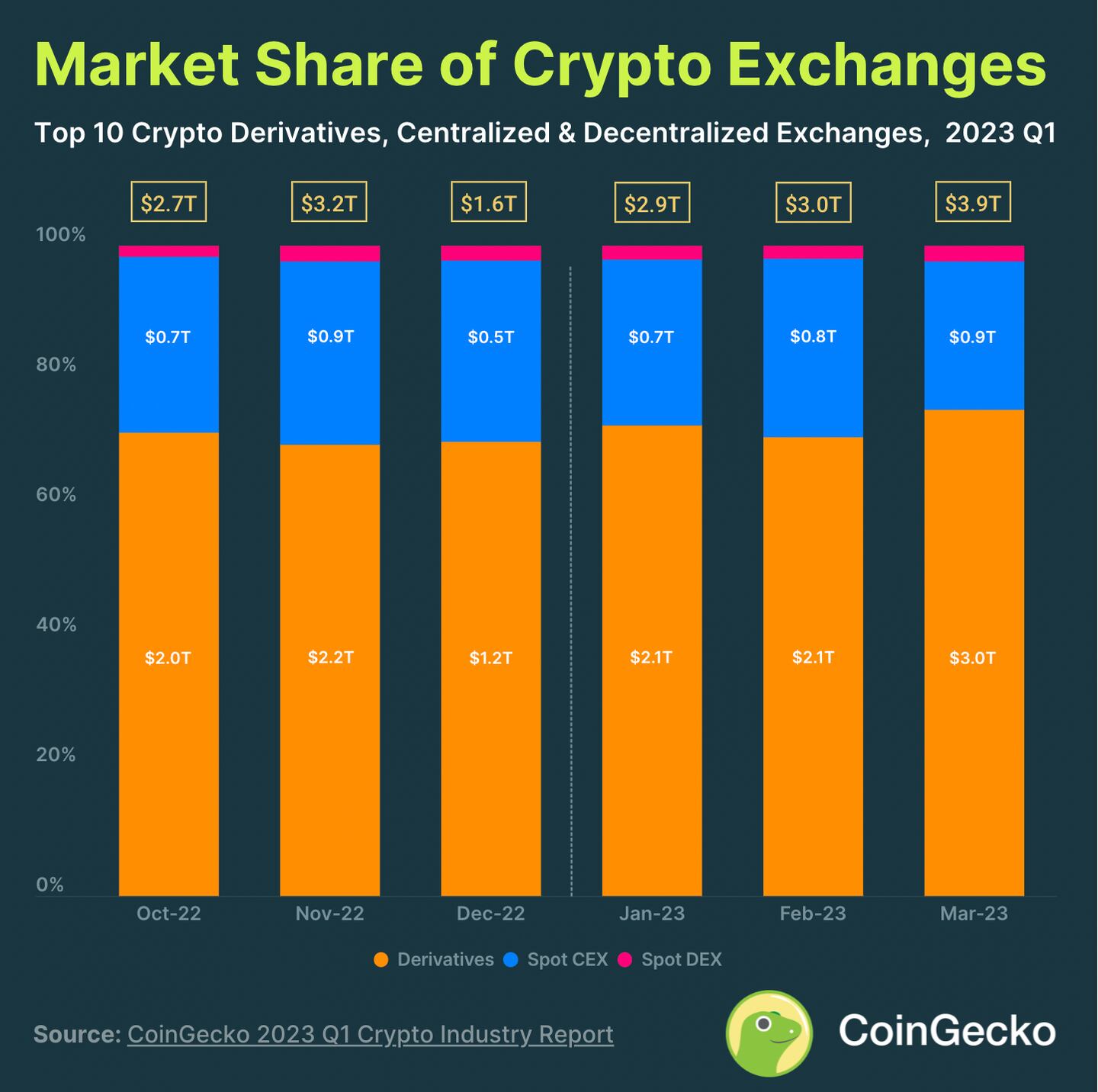

Tusar, the former global head of electronic trading at Goldman Sachs, isn’t exaggerating. The benefit of offering derivatives trading is substantial – it makes up nearly 75% of all trade volume in crypto, according to CoinGecko data.

Binance holds the lion’s share of that market, with nearly 60% of volume on the platform, per CoinGecko’s report.

On the regulated side of things, the Chicago Mercantile Exchange (CME) also offers Bitcoin and Ethereum futures products. The contracts have proven popular since the collapse of FTX last November, as investors flock to regulated venues.

NOW READ: The CFA now has crypto questions. See if you can get them right

The CME’s Bitcoin futures products saw $55 billion in volume in July, and open interest — the number of outstanding derivative contracts for an asset that are yet to be settled — is currently around $2.2 billion, according to Coinglass data.

“Such product benefits are why we acquired FairX in 2022, a CFTC-regulated futures exchange now known as the Coinbase Derivatives Exchange,” Tusar said.

Nano contracts

Coinbase has launched nano Bitcoin and Ethereum futures contracts since then, aimed at retail investors. Nano Bitcoin futures contracts are smaller and more accessible to retail investors. In June, the exchange launched larger versions for institutional investors.

Since then, the exchange has successfully launched nano Bitcoin and Ethereum futures contracts, sized for the retail investor, and on June 5, launched larger versions for the institutional market.

Coinbase’s derivatives exchange is open to third-party brokers, futures commission merchants, and market makers. It has a liquidity pool of $4.7 billion Bitcoin and $2 billion in Ethereum futures traded in notional volume so far in 2023, Tusar concluded.

Adam Morgan McCarthy is a London-based markets correspondent for DL News. To contact him with story tips, reach out at adam@dlnews.com.