- Crypto stalwart joins industry offensive regulator moves to legally define Ethereum.

- SEC signalled it is poised to make a move on MetaMask.

- Staking is new front in legal war between DeFi and Washington.

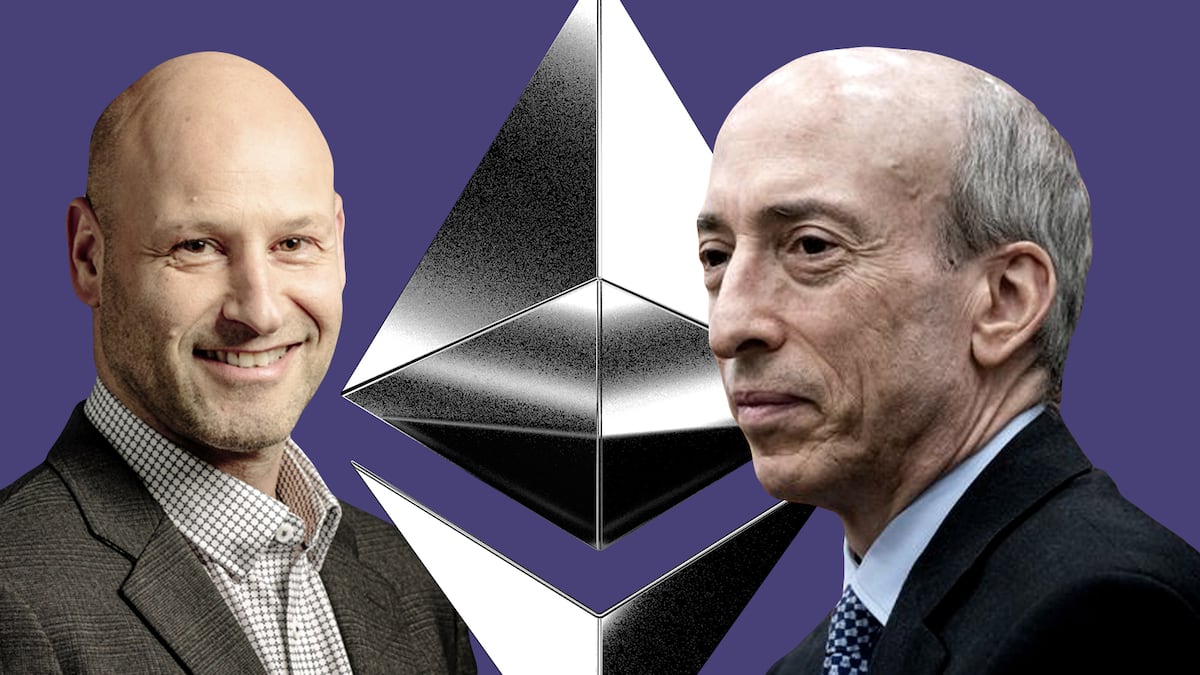

Consensys has joined the anti-SEC brigade.

On Thursday, Consensys, the company behind the popular crypto wallet MetaMask, sued the US Securities and Exchange Commission for allegedly waging a “campaign to seize control over the future of cryptocurrency.”

The firm, which is led by Ethereum co-founder Joe Lubin, has locked arms with Coinbase, Greyscale, and the Blockchain Association in the vanguard of crypto industry stalwarts that have challenged the agency’s three-year campaign to clamp down on digital assets.

In the process, Consensys hopes to protect its own position and one of its crown jewels — MetaMask, a wallet provider with 30 million users.

Ad hoc enforcement

Consensys alleged the SEC is unlawfully deploying “ad hoc enforcement actions against Consensys and others.”

In its lawsuit, which was filed in federal court in Texas, Consensys said the SEC is trying to legally define Ethereum as a security.

The move alarms industry players because it would force projects to register Ethereum-linked tokens the same way traditional firms do with stocks and bonds.

For the crypto community, this is anathema because they consider blockchain-based assets as a separate class that deserves its own statutory regime, and rules and regulations. This idea is at the heart of Coinbase’s defence against a lawsuit brought last year by the SEC.

“The SEC’s unlawful seizure of authority over ETH would spell disaster for the Ethereum network, and for Consensys,” read the complaint.

New front

Staking has opened a new front in the battle between the SEC and the industry since Ethereum switched to a Proof of Stake consensus method for maintaining its blockchain in 2022.

The SEC has been on a warpath to define Ethereum as a security ever since the network introduced staking that year.

Staking refers to earning rewards from a blockchain network by locking up a cryptocurrency to support the network’s validating nodes.

A person familiar with the case explained that the crypto company had considered several options before moving to file.

Certain elements of the SEC’s investigation into the Ethereum protocol compelled Consensys to defend itself and the ecosystem before the Commission did any real damage, the person said.

Consensys’ complaint came after the SEC notified it was preparing to sue the firm over MetaMask, one of the industry’s most widely used crypto wallets.

The SEC alleged in its notification that given MetaMask’s “swap” and “stake” features, which let users trade cryptocurrencies and earn rewards on their holdings, Consensys is operating as an unlicensed broker-dealer, according to the filing.

‘Ethereum is not a security’

Consensys says the non-custodial wallet is akin to a web browser rather than a trading platform like an exchange.

“Any investigation or enforcement action premised on Consensys operating as a ‘broker’ under the Exchange Act through its MetaMask wallet software would exceed the SEC’s authority,” said the complaint.

The crypto firm is asking the court to find that Ethereum is not a security, a move that would ripple across the industry.

That’s because the SEC has made a series of legal attacks against some of the biggest firms in the industry.

Coinbase, the publicly traded crypto exchange, and the SEC are locking horns after the commission alleged that Coinbase is also operating as an unlicensed broker and exchange.

Earlier this month, the SEC notified Uniswap, crypto’s largest decentralised exchange platform, that it was operating as an unlicensed broker.

Now, the SEC appears to be turning to peer-to-peer protocols and applications.

Liam Kelly is a Berlin-based DL News’ correspondent. Contact him at liam@dlnews.com.