- Crypto enthusiasts panicked as erroneous news reports said the EU was banning anonymous crypto wallets.

- The dismay expressed online demonstrates how important privacy is to DeFi users.

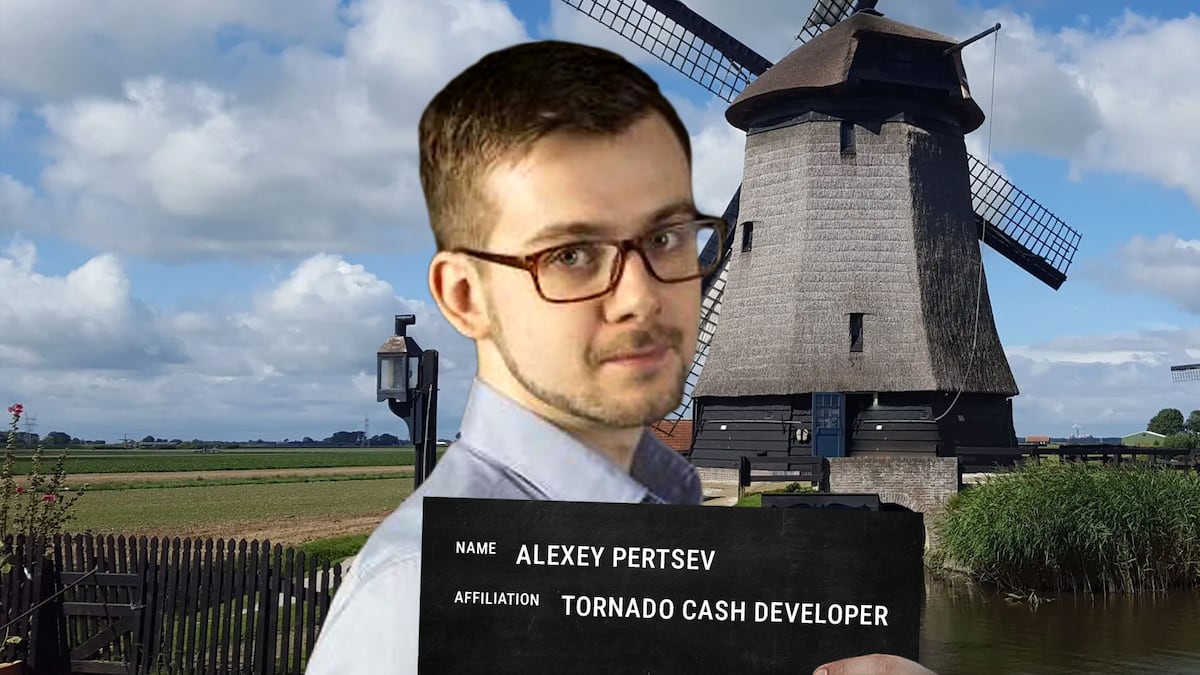

- These important concepts are on trial this week, as developer Alexey Pertsev begins his court battle.

A version of this story appeared in our The Guidance newsletter on March 25. Sign up here.

Experts are racing to soothe online hysteria that the European Union’s Anti-Money Laundering Regulation, or AMLR, bans crypto wallets.

The fuss, triggered by erroneous news reports, was a storm in the crypto Twitter/X teacup.

1/ Yesterday was a prime example of why crypto Twitter (and often crypto media) should not be trusted when it comes to crypto policy. Let's debunk claims that the EU is banning anonymous crypto transactions or self-custodial wallets.

— Patrick Hansen (@paddi_hansen) March 24, 2024

Here is what’s actually in the EU Anti Money… pic.twitter.com/dsNZQzl9Mx

But the panic demonstrates that for many crypto enthusiasts, privacy is the major lure of decentralised finance.

These fundamental concepts will be tested in the EU this week as Tornado Cash developer Alexey Pertsev goes on the trial in the Netherlands.

Read Inbar Preiss’s deep dive here into why Pertsev’s trial will set precedents with far-reaching consequences for DeFi — and for open-source development and privacy more generally.

To recap:

- In 2022, the US sanctioned crypto mixer Tornado Cash, alleging it was a key tool for money laundering by groups like North Korea’s Lazarus.

- Shortly after, Pertsev was arrested in the Netherlands.

- He is accused of laundering $1.2 billion.

Pertsev’s supporters say all he did was contribute code to an open-source project — it’s hardly his fault that his code was misused by bad actors.

They worry this case could set a precedent that chills the development of privacy-centred tech — and open-source development in general.

Bad press

But Pertsev’s trial comes amid a slew of bad press for crypto’s privacy features.

- In November, crypto exchange Binance was fined a record-breaking $4.3 billion for violating the Bank Secrecy Act.

- The US government has mobilised the notorious Patriot Act to crack down on mixers, amid reports that militant group Hamas was partly funded via crypto.

- And perhaps surprisingly for a government that produced groundbreaking data-protection laws, EU lawmakers have worked to curb DeFi projects via regulation, including the AMLR.

The AMLR, which passed a committee vote last Tuesday, is expected to go into affect by 2027.

Experts say its impact on the industry is narrow, and lobbyists have helped to water down some of its most significant provisions.

Nevertheless, the AMLR draws in crypto asset service providers, including decentralised autonomous organisations, non-fungible token platforms, and wallet service providers, and compels them to crank up the identification and tracking of customers’ transactions.

The regulation also addresses risks from self-custody wallets, though it doesn’t ban them.

The language of the legislation makes it clear that this is about curtailing the anonymity features of crypto assets, which it says “exposes them to risks of misuse for criminal purposes.”

The EU’s anti-privacy efforts extend beyond crypto.

For example, in 2022, lawmakers proposed to effectively ban end-to-end encryption.

These assaults on privacy face credible opposition from activists and lawmakers.

But users should be worried that in the current political climate, singling out crypto as a national security threat might be an effective way of limiting its pseudonymous features.

Email me joanna@dlnews.com, or Telegram @joannallama.