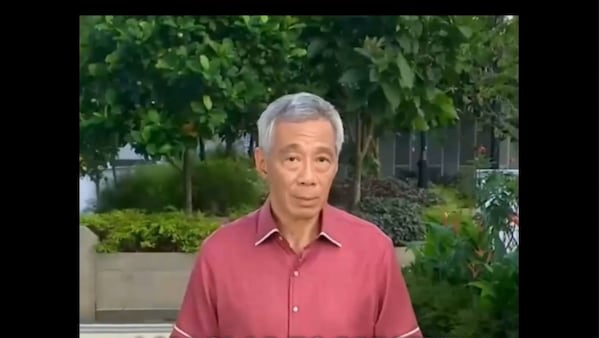

- Deepfake crypto crime may top $25 billion this year.

- Most average crypto users lack skills to detect deepfakes.

Crypto crimes using deepfakes are projected to exceed $25 billion this year, according to a study by crypto derivatives exchange and copy trading platform Bitget.

Deepfakes generated by artificial intelligence are increasingly being weaponized by criminals, the study said. Losses reached $6.28 billion in the first quarter, almost half of the $13.8 billion for the entire year of 2022.

Deepfake technologies are often used to gain the trust of crypto users by impersonating influential figures, creating an illusion of credibility and substantial project capitalisation that helps lure investments from victims who fail to conduct thorough due diligence.

“Deepfakes are moving into the crypto sector in force and there is little we can do to stop them without proper education and awareness,” said Bitget CEO Gracy Chen. “The vigilance of the users and their ability to discern scams and fraud from real offerings is still the most effective line of defence against such crimes, until a comprehensive legal and cybersecurity framework is in place on a global scale.”

A surge in such fraudulent transactions and financial losses suggests quarterly losses may increase to an average of $10 billion by early 2025.

While corporate solutions for deepfake detection became available in 2022, average users lacking the necessary knowledge and skills have remained vulnerable to such frauds.

Competition in sophistication between fraudsters and security solution providers persists to this day, according to the study.

New techniques for identifying fake photos, videos, and audio materials will be needed to mitigate losses resulting from deepfake usage, especially during bullish market periods, when such frauds seem to increase, the study noted.