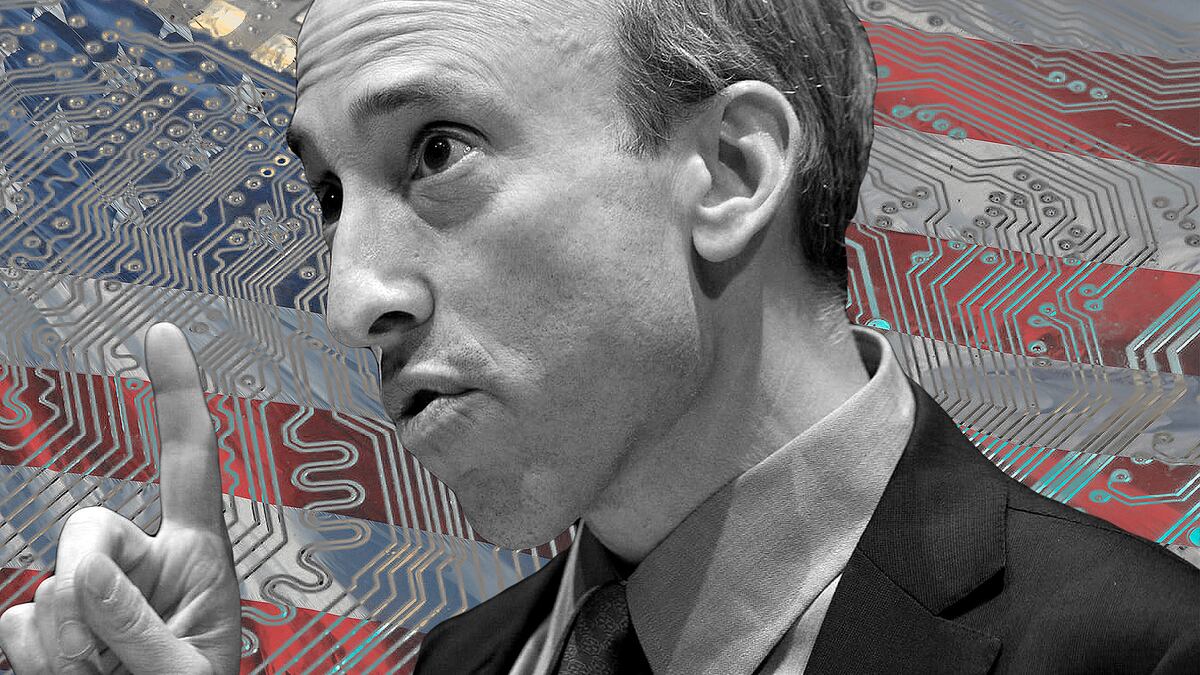

- Since Gary Gensler joined the SEC as chair, the agency has pumped out a battery of rule proposals.

- Some of these could impact crypto and DeFi if they are finalised as drafted.

- DL News took stock of the most significant changes floated so far

The Securities and Exchange Commission is coming for crypto.

While US crypto markets call for tailored laws, SEC Chair Gary Gensler has often said that he considers existing securities regulation to be sufficient to regulate the industry.

During his tenure, the agency has pumped out a battery of proposals, some of which pull centralised and decentralised exchanges, and market participants into the scope of existing rules.

DL News sifted through the major proposals that commission staff are currently considering to see how they could impact crypto and DeFi.

Widening the definition of ‘exchange’

The markets watchdog has proposed a smattering of rule changes that could affect DeFi, but the one that could have the biggest impact didn’t even mention the sector in its first iteration.

In early 2022, the SEC proposed updates to existing laws that govern exchanges in the US to broaden the legal definition of “exchange.” The 600-page document was mainly aimed at traditional markets, and made no explicit reference to crypto, DeFi or blockchain.

However, the proposal was met with howls of protest from crypto lawyers, lobbyists and exchanges like Coinbase who feared that if the proposal became law, it would force decentralised exchanges to register as so-called “broker-dealers” with the Financial Industry Regulatory Authority.

Our turn. Today @coinbase provided comments on @SECGov's proposed expansion of the definition of “exchange.” Here's why the SEC’s approach just doesn't work. #1

— paulgrewal.eth (@iampaulgrewal) April 19, 2022

The proposal proved so unpopular that the commission reopened the comment period in April this year, this time including more information on its thinking about DeFi regulation.

Much of the pushback centred on what market participants see as the commission failing to understand how DeFi works. How can securities laws, which fundamentally regulate intermediaries, be applied to decentralised markets, they said.

Gensler, however, has said most DeFi businesses aren’t as decentralised as they claim to be, and that they look and act very much like the exchanges the SEC already regulates.

“Make no mistake: many crypto trading platforms already come under the current definition of an exchange and thus have an existing duty to comply with the securities laws,” Gensler said in April.

NOW READ: SEC reopens dark pools rule proposal that would regulate DeFi

Defining securities dealers

The regulator has also proposed to change the definition of securities dealers, which could draw alternative market makers and DeFi liquidity providers under its thumb.

Currently, the law distinguishes between two kinds of market participants that trade securities on their own account: dealers and traders. Those that trade “as part of regular business” are considered dealers and must register with the SEC. Those that don’t are considered traders and don’t have to register.

This is a fuzzy standard, which hedge funds and speed trading firms have taken advantage of to categorise their businesses as traders.

But Gensler has proposed updated standards to define firms that provide significant liquidity to markets — including digital assets — as dealers. That’s bad news for both hedge funds and a wide swathe of alternative market makers and even individual software developers, DeFi participants said.

Venture capital firm Andreessen Horowitz’s legal team told the SEC the change could risk hurting individuals who fund liquidity pools or contribute to arbitrage bots, they wrote in a letter.

The investor also said the situation is further complicated by a lack of clarity from the SEC on what it considers to be securities and could kill DeFi and the emerging web3 ecosystem.

“If market participants cannot easily evaluate their obligations under the Exchange Act and commission rules, many will pare back their liquidity-providing activities or leave DEXs altogether,” it said.

“That could shift the competitive advantage to foreign jurisdictions where market participants may have greater clarity as to the obligations accompanying digital asset transactions.”

NOW READ: London loses crypto ‘mojo and momentum’ as Revolut hints at Paris move

Custodying crypto

A third major move that will potentially impact crypto is the SEC’s proposed updates to its qualified custodian rules.

Under SEC rules, investment firms must keep their clients’ assets safe, storing them with businesses like broker-dealers or banks that are registered as “qualified custodians.” These assets must be kept separate from the firm’s own funds.

The updates, proposed in February this year, would compel investment advisor firms to custody all assets, including crypto, with qualified custodians.

Disgraced exchange FTX has notoriously been accused of commingling house and customers’ assets. Now that the business is being unwound, creditors have to line up to be made whole — or might not get their money back at all. This is the kind of situation that the qualified custodian updates aim to prevent.

NOW READ: Coinbase says SEC’s proposed tweak to custody rule ‘unnecessarily singles out crypto’

Beefing up cybersecurity

The SEC believes, like regulators worldwide, that cybersecurity is a massive danger to the capital markets.

Under Gensler it has also proposed a raft of regulations forcing firms to beef up their security processes and policies. These include one published in March that is aimed at broker-dealers, securities exchanges, and other financial market intermediaries.

It includes a section specifically on crypto, saying it is a special risk for financial firms to the extent that they deal in crypto assets.

Crypto is a dream come true for criminals in that it offers pseudonymity, transactions can’t be reversed, and smart contracts are open source, giving wrongdoers insight into potential vulnerabilities associated with the code, the proposal said.

“The size and growth of the crypto asset markets, along with the fact that many participants in these markets … may be acting in noncompliance with applicable law, continue to make them an attractive target for threat actors looking for quick financial gain,” the proposal said.

NOW READ: How hackers turn stolen crypto into cash

Getting consumers the best price

Late last year, Gensler proposed a massive package of reforms to securities market structure that riled Wall Street.

Most of these changes were aimed at updating stock-trading. But there was one exception: the SEC’s proposed “best execution” rule, which specifically includes digital assets.

“Best execution” compels brokers in securities markets to ensure they get the best possible price for clients when executing orders on exchanges on their behalf. The proposed rule would establish a yardstick for dealers to ensure they’re getting “best ex.”

However, the SEC said in the proposal that it doesn’t know how best execution would work in crypto markets.

Consequently, Coinbase’s chief legal officer Paul Grewal said in a letter that the proposal is premature. The crypto exchange is one of several industry players that have challenged the regulator in the courts.

Only a small handful of broker-dealers even offer services in digital assets, he said. And crypto doesn’t have the kind of mature market structure that equities markets do, so it’s unnecessary and often impossible to even determine if best execution has been achieved.

“There is no need to rush through adopting a new rule now,” Grewal said.

Do you have a tip about the SEC, regulation or another story? Reach out to me at joanna@dlnews.com.