- The SEC suffered its second loss of the summer in a crypto court case Tuesday.

- Regulator has 45 days to decide whether to appeal landmark ruling.

- BlackRock, Fidelity and ARK Invest hope to win approval for Bitcoin ETFs by next week.

Grayscale beat the SEC. The agency unlawfully rejected its application for a spot Bitcoin exchange-traded fund. That much is known. What comes next is another question.

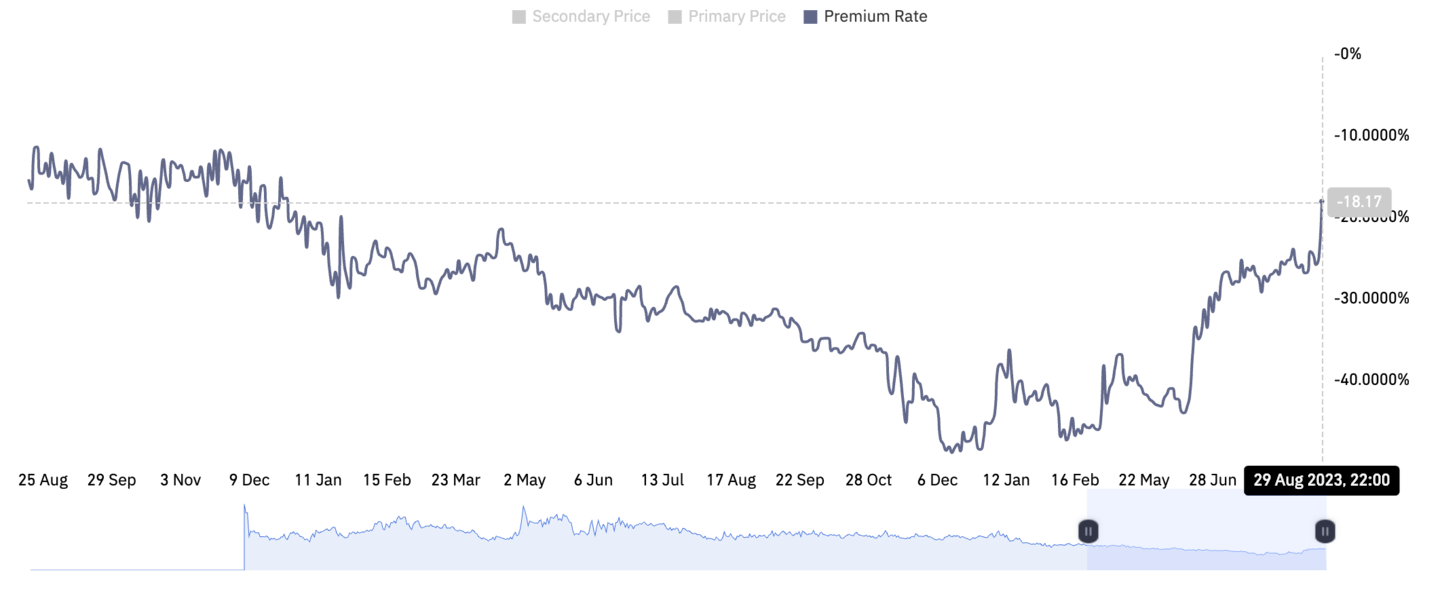

The day after Grayscale won a unanimous ruling from a three-judge appellate court in Washington against the US Securities and Exchange Commission, crypto supporters were buzzing. As were investors: Grayscale’s Bitcoin Trust (GBTC) soared more than 11% since the news hit Tuesday.

Rite of Passage

“Congrats!” tweeted Brian Armstrong, the co-founder and CEO of Coinbase, to Michael Sonnenshein, Grayscale’s chief. “Strange world we live in where winning against this SEC in court is seen as a rite of passage in our industry.”

Kathryn Haun, a crypto venture capitalist in Silicon Valley and former federal prosecutor, pointed out that the unanimous ruling should deter the agency from appealing the ruling.

Now Read: Grayscale defeats SEC in court as ruling clears obstacle to Bitcoin ETF

“Next step is the SEC either grants or denies Grayscale’s petition,” tweeted Haun, a onetime partner at a16z who now heads her own firm. “In the event, the SEC denies the petition they’ll need a much more compelling explanation than they provided originally.”

Now the focus will shift to how SEC Chair Gary Gensler and his team react to this landmark decision. In its ruling, the court sent the matter back to the SEC and essentially directed it to take another look at Grayscale’s application to convert GBTC into an ETF based on the spot price of the top cryptocurrency.

‘Next step is the SEC either grants or denies Grayscale’s petition.’

— Kathryn Hahn

And the clock is ticking. The SEC has 45 days to decide whether to appeal the ruling to the US Supreme Court or an expanded tribunal of the appellate judges in the DC Circuit.

The agency could accept the legal defeat in a “face-saving way” and approve Grayscale’s application, said Noelle Acheson, former head of market insights at Genesis, in her daily newsletter – Crypto is Macro Now.

Losing battle

Jake Chervinsky, chief policy officer at the Blockchain Association, shares this view. The SEC may use the ruling as an opportunity for a “(semi-)graceful exit from their anti-ETF position,” he said Tuesday.

“‘We disagree, but we’re following the rule of law,’ is a convenient excuse to back out of a losing battle,” Chervinksky said.

Then again, the agency could stick to its position and reject Grayscale’s application once more. But that would be messy considering that the SEC has already approved ETFs for Bitcoin and Ether based on futures contracts, and Wall Street players ranging from BlackRock to ARK Invest to Fidelity have submitted their own applications for spot Bitcoin ETFs.

Indeed, Grayscale had argued the SEC acted in an “arbitrary and capricious manner” by approving futures ETFs and rejecting its spot price offering.

As a result, Acheson is betting the regulator will go ahead and allow the listing of spot Bitcoin ETF.

NOW READ: CoinShares CEO: We can beat the big firms on our own turf

“We’ve already heard rumours that they are willing to grant this concession to the crypto industry, given that the regulator has publicly acknowledged that Bitcoin (and only Bitcoin) is not a security,” she said in her newsletter.

There is a possibility the SEC might revisit its approval of the Bitcoin futures ETFs, Acheson said.

“The judge’s ruling was based on the lack of coherence between approval of those and denial of the spot equivalents,” she said. But that would be messy and would “further sharpen the regulator’s unpopularity.”

Politically untenable

One thing that is crystal clear is the public relations hit from the decision. That could sap the SEC’s political clout on Capitol Hill as more than a half-dozen crypto bills vie for consideration.

Eric Balchunas, an ETF analyst at Bloomberg Intelligence, said the widely covered outcome of the case could make a denial of Grayscale’s application “politically untenable.”

As for Grayscale, a representative from the firm told DL News the win was a “monumental step forward for American investors,” and that it would be “actively reviewing the details outlined in the Court’s opinion and will be pursuing next steps with the SEC. We will share more information as soon as practicable.”

Now Read: The Guidance, Crypto firms face the BlackRock Bitcoin land grab

Meanwhile, deadlines are approaching for decisions on the Bitcoin ETF applications submitted by BlackRock and Fidelity. The SEC may give them a thumbs up or down as soon as this weekend with a 45-day deadline looming.

ARK Invest faced a similar deadline earlier in August, receiving a delay on the Friday before the deadline.

Whatever the SEC decides, yesterday’s result was a “turning point in crypto sentiment,” Acheson said. “A spot Bitcoin ETF is now even more likely than just a week ago, and it was pretty likely then.”

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.