- The US has accused an exiled Chinese billionaire of running a billion-dollar fraud.

- Early this year, the DOJ announced his arrest and the seizure of hundreds of millions of dollars tied to the alleged fraud.

- That includes money held by customers of Himalaya Exchange, a purported crypto exchange.

- A lawyer who has previously taken on “fringe” causes is representing some of those customers in an attempt to get the money released.

- But prosecutors aren't sure they're really customers.

Customers of defunct crypto exchange Himalaya are demanding the US government return at least $262 million it seized from the exchange earlier this year.

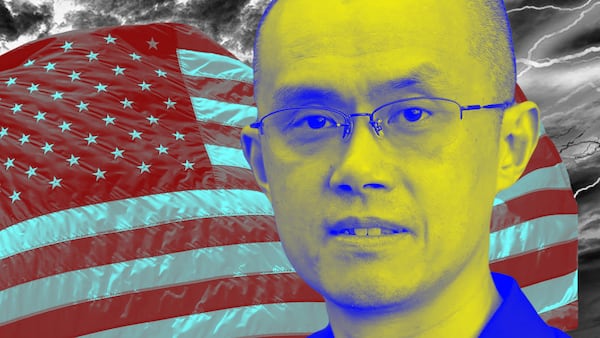

The funds were confiscated just before prosecutors accused Himalaya founder Ho Wan Kwok, also known as Miles Guo or Wengui Guo — an exiled Chinese businessman and prominent critic of the Chinese Communist Party — of a billion-dollar fraud.

“The Department of Justice has claimed that seizing the funds will protect the ‘victims,’” attorneys representing the 3,300-plus customers wrote in a motion filed last week.

“Unfortunately, the effect is the opposite and the consequences of their actions will cause catastrophic losses to the Petitioners and many other customers of the Exchange.”

But prosecutors say they aren’t even sure the 3,300-plus people are customers of the exchange.

Background

Kwok fled China in 2014, after stories about corrupt business practices started appearing in newspapers there. He has denied the allegations.

He has since become one of the Chinese Communist Party’s most prominent critics.

Earlier this year, the Department of Justice accused him of running a billion dollar fraud via an assortment of companies, including Himalaya Exchange, a company that launched in November 2021 and billed itself as a crypto exchange.

Himalaya issued two tokens: a dollar-pegged stablecoin, Himalaya Dollar, or HDO, and Himalaya Coin, or HCN.

Neither were true cryptocurrencies, the DOJ alleged. Furthermore, Kwok and his financier, Kin Ming Je, lied to customers, according to prosecutors.

In one example included in the indictment, Je allegedly faked a Ferrari purchase with HDO in order to demonstrate its utility as a method of payment. In fact, the payment had been made via wire, prosecutors said.

The US seized a total of $634 million from 21 bank accounts, including $262 million connected to Himalaya Exchange.

‘Catastrophic’

In a motion filed on December 6, attorneys say Himalaya customers have been devastated by the seizure.

Much of the seized money was used as the reserve for HDO, according to the motion. With HDO effectively unbacked, Himalaya Exchange has paused redemptions.

Additionally, HCN could only be purchased with HDO or sold for HDO; since the seizure, HCN has fallen from $24 per token to $14 per token, according to the action.

“These total losses are catastrophic,” attorney Bradford Geyer, of New Jersey-based law firm FormerFeds, said during a live-streamed press conference last week.

Geyer and attorney Jamie Scher, of New York law firm Myer and Scher, are representing the customers.

Customers were required to undergo “rigorous” know-your-customer and anti-money laundering checks during registration, according to the motion, and “have no association with organised crime or illicit trade anymore [than] this can be alleged against customers of the New York Stock Exchange.”

‘Put the court on notice’

But prosecutors say they aren’t even sure whether Geyer’s clients are Himalaya customers.

During a December 6 phone conversation, prosecutors asked one of the attorneys whether he had verified that all 3,345 clients were, in fact, customers, according to a response filed on December 7.

The attorney — unnamed in prosecutors’ response — said he had, by verifying directly with Himalaya seven-digit identifiers his clients had supplied.

But the attorney “declined to share any of the information about the petitioners with the government, or to explain how he was able to verify their status as exchange customers using such identifiers,” prosecutors said.

“When the Government offered to confer to find a way to address counsel’s privacy concerns, counsel stated, in substance, that he would be filing the motion to ‘put the court on notice’ that ‘there are people getting stomped on.’”

In any case, it is too early to consider releasing the funds, according to prosecutors. The money was seized “for later disbursement and restitution to victims.”

“When such distribution should occur, and the mechanism for doing so, will be determined after the completion of the pending criminal proceedings and as the law directs.”

The DOJ declined to comment. FormerFeds and Himalaya Exchange did not immediately return requests for comment.

The China connection

Like Kwok, many of them are Chinese expats united in their opposition to the CCP, however.

“There is a suspicion within the community, ill-founded no doubt, that the US government is working with the CCP to expose exchange customers who are viewed by the CCP as dissidents,” the action reads.

Geyer, a former federal prosecutor, has previously courted controversy by likening vaccination mandates to the Holocaust. In that case, the presiding judge admonished Geyer for his “bombastic” and “fringe” statements.

During his press conference, he briefly touched on “jab victims” and the concern that central bank digital currencies might be used to surveil US citizens.

Kwok has previously railed against Covid vaccines on GTV, a media site he founded and which prosecutors say was part of the alleged billion-dollar fraud.

Guo also has ties to Steve Bannon, a former adviser to President Donald Trump and far-right personality. The pair founded an organization dubbed “Rule of Law Fund” to investigate deaths and disappearances of high-profile public figures in China, according to the Wall Street Journal.

When asked during the press conference whether the action was being funded by Kwok, Geyer said “absolutely not.”

“And it’s really no one’s business what the nature and scope of my relationship is with my clients.”