- The SEC is challenging core features of Binance's US operation.

- CEO Richard Teng is scrambling to manage fallout from CZ's legacy.

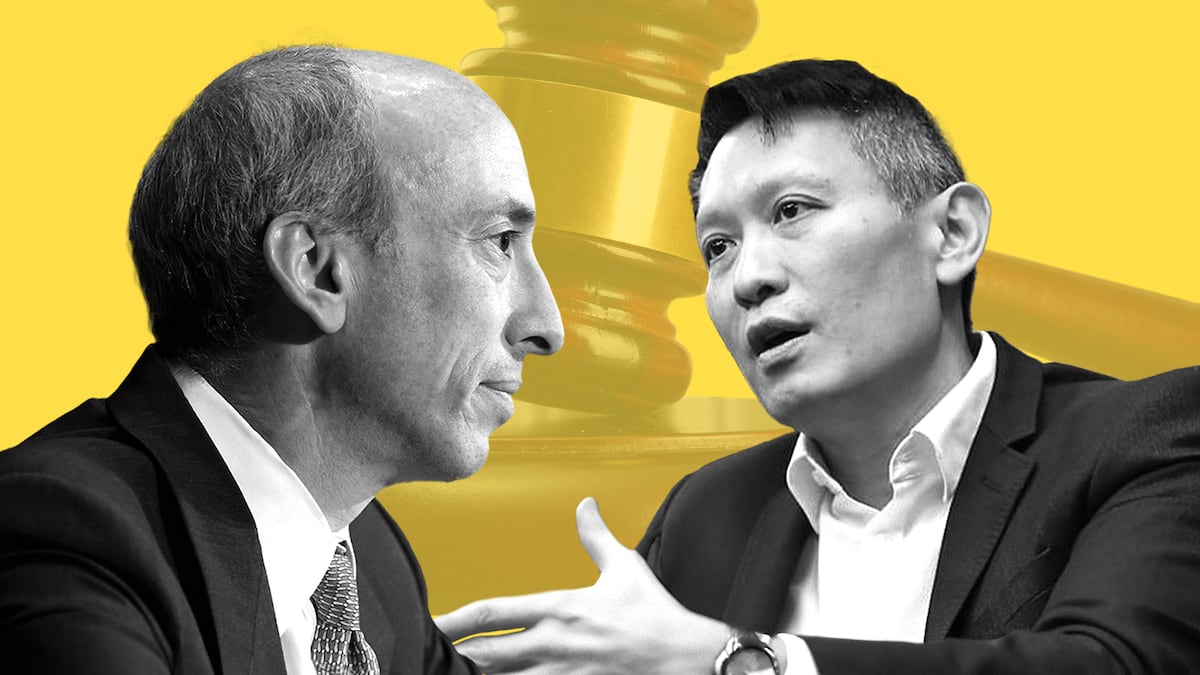

- Binance isn't alone as Coinbase also duels with Gary Gensler.

When Changpeng Zhao faces a judge on Tuesday to be sentenced for violating US banking law, the event may look a lot like closure.

But it won’t be.

Binance, the global crypto exchange Zhao founded and led from 2017 to last November, is still facing civil charges brought by the US Securities and Exchange Commission.

And so is Zhao.

Illegal exchange

While the US Department of Justice got Binance to plead guilty to facilitating money laundering for all manner of bad actors and pay $4.3 billion in penalties, the SEC’s litigation poses a grave threat to the company’s future.

That’s because the regulator is alleging Binance is running an illegal exchange, brokerage, and clearing agency, as well as unlawfully listing digital assets that should be registered as securities.

That includes its own token — BNB — as well as its now defunct stablecoin, BUSD.

‘I just don’t see Binance submitting to the yoke of federal regulators.’

— Kevin O'Brien, Ford O'Brien Landy

If Binance fails to get the case dismissed and then loses at trial, the company will probably retreat from the US rather than comply with obtaining all the licences it would need to keep operating, said Kevin O’Brien, a partner at Ford O’Brien Landy, and a former assistant US attorney.

“I just don’t see them submitting to the yoke of federal regulators. It doesn’t fit with their business model or their rhetoric,” O’Brien told DL News.

The 13-count lawsuit also alleges Binance committed fraud and lied to investors. Binance has denied the allegations. Like Coinbase, Kraken, and the Blockchain Association, the industry’s trade association, Binance argues that it’s wrong to treat digital assets the same as traditional securities.

The company did not respond to requests for comment from DL News.

SEC stands alone

There’s a lot on the line, too, for the SEC and its hard-charging chair, Gary Gensler.

Unlike regulators in the European Union and other jurisdictions, Gensler has rejected the crypto industry’s argument that digital assets deserve their own bespoke rules.

By pursuing litigation against Binance, Coinbase, Kraken, and other big crypto players, Gensler is intent on proving that existing US securities laws govern digital assets the same as stocks and bonds.

Winning that battle may be why the SEC stood apart from its sister agencies when they settled with Binance last year.

On November 21, top officials of the Justice Department, the US Treasury Department, and the Commodity Futures Trading Commission stood shoulder to shoulder in Washington to announce their joint settlement with Binance.

The company admitted it had failed to implement money laundering controls and prevent militant groups, drug traffickers, and producers of child sexual abuse materials to process billions of dollars in transactions on the platform.

Zhao, 47, who also pleaded guilty and paid a $50 million penalty, may receive a 36-month prison term in a hearing scheduled for Tuesday in a federal court in Seattle. His lawyers have asked for probation.

More compliant way

For all the headlines, Binance’s settlement with the DoJ and CFTC did not damage its business.

Binance simply has to implement better know-your-customer controls, anti-money laundering practices, and offer futures contracts in a more compliant way, said Jonathan Schmalfeld, a lawyer at Polsinelli.

Indeed, Binance still commands 42% of the global market share in spot and derivatives crypto trading, and handles about $14 billion a day in volume.

But if the SEC were to get its way, the exchange’s core US platform would be affected.

“Binance isn’t prepared, I would think, to concede that its products have been marketed in violation of the federal securities laws,” O’Brien said.

The SEC wants the courts to affirm its assertion that crypto assets are investment contracts and covered by the 1933 and 1934 legislation that established the legal rules for the modern capital markets.

Now the agency is expanding its focus to the infrastructure of decentralised finance with looming enforcement actions against Uniswap, the leading decentralised exchange, and wallet provider Metamask.

For the crypto industry, this is an existential moment. The fact that the SEC is targeting stablecoins, including BUSD, is especially crucial.

Gensler has moved on stablecoins because Congress has failed to get legislation off the ground. The EU and the UK, meanwhile, are steaming ahead with tailored regulatory frameworks.

The point of a stablecoin

Stablecoins aren’t intended to function like shares of Apple or Tesla, as investments, Schmalfeld said.

They’re more like electronic cash, albeit cash whose value is backed by another asset such as the dollar or a US Treasury bill.

“You can’t go to a grocery store and buy a gallon of milk with $5 of capital stock,” Schmalfeld said. “You don’t use it that way, because to transfer it, you go through the necessary intermediaries.”

Trading a stablecoin the same as stock or bonds would obviate the instrument’s entire point, and kill the industry in the US, he said.

That’s why the SEC’s lawsuit against Binance “is really a battle over whether or not you can use stablecoins — or at least this stablecoin, BUSD, in the United States,” Stephen Rutenberg, also a lawyer at Polsinelli, told DL News.

That probably won’t bother Gensler, though.

“For the most part, Gensler doesn’t think much of this business is legit — he calls them bandits, that they’re essentially lawless,” O’Brien said.

“If they go out of business in the United States, that’s fine, he welcomes that.”

Joanna Wright covers regulation for DL News. Reach out to the author at joanna@dlnews.com.