- The House is expected to vote on the FIT Act later this week.

- It would be the first time a standalone crypto bill was voted on.

A version of this story appeared in our The Guidance newsletter on May 20. Sign up here.

Republican congressman Patrick McHenry’s landmark crypto bill, the FIT21 Act, is heading to the House floor for a vote.

That’s a big deal because it’s the first time a standalone crypto bill has been heard by the full House.

According to McHenry, the FIT21 Act is poised to bring much-needed clarity to the crypto industry.

However, not everyone is convinced. Democrat Representative Maxine Waters called it a “wish-list of big crypto and is undeserving of any of our support.”

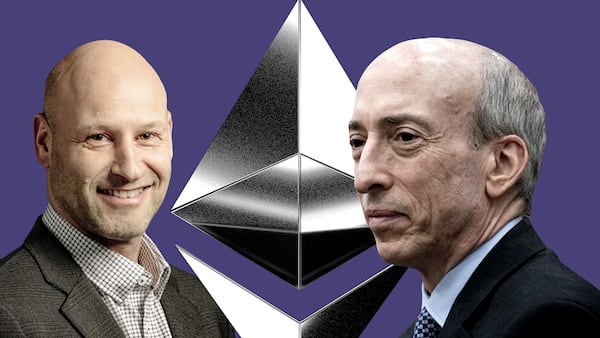

With the Securities and Exchange Commission on a fly-swatting mission — aiming at ConsenSys, Coinbase, and Robinhood’s crypto businesses over alleged securities violations — McHenry’s bill couldn’t have come at a better time.

Three takeaways for FIT

Here are the three key takeaways.

First, the act will clarify who should regulate crypto and how. If a network can prove it’s sufficiently decentralised, for example, it will be under the Commodity Futures Trading Commission’s purview.

If not, it would be handed over to SEC Chair Gensler. According to FIT21, that wouldn’t be a bad thing because crypto companies would finally be able to launch and trade coins lawfully.

This leads to the second key takeaway.

If passed, FIT21 would create a clear registration process for crypto companies to work with the SEC — something the industry says is too onerous at present.

Dan Gallagher, Robinhood’s chief legal, compliance and corporate affairs officer, said his team had spent years trying to register with the SEC. The commission appears to be moving ahead with an enforcement action against Robinhood’s crypto business.

Finally, key takeaway three: Crypto investors will also stand to benefit from FIT21.

The act would require crypto companies to file disclosures about ownership and structure and require exchanges to keep company and customer funds separate, a clear nod to the chaos that caused the collapse of FTX.

Basically, some transparency for anyone looking to do business with a crypto company.

What are the odds?

But how likely is it to pass?

It has a strong chance to make it out of the House, thanks to Republicans’ general pro-crypto stance and majority in the lower chamber.

However, the Senate, with firebrand Democrat Elizabeth Warren leading the anti-crypto charge, will be a higher hurdle.

Cracks in Warren’s coalition are showing, though — take a look at the 32 Democrats who crossed party lines to overturn regulatory guidelines that make holding crypto a costly, cumbersome endeavour for banks.

Liam Kelly is a DeFi Correspondent at DL News. Got a tip? Email at liam@dlnews.com.