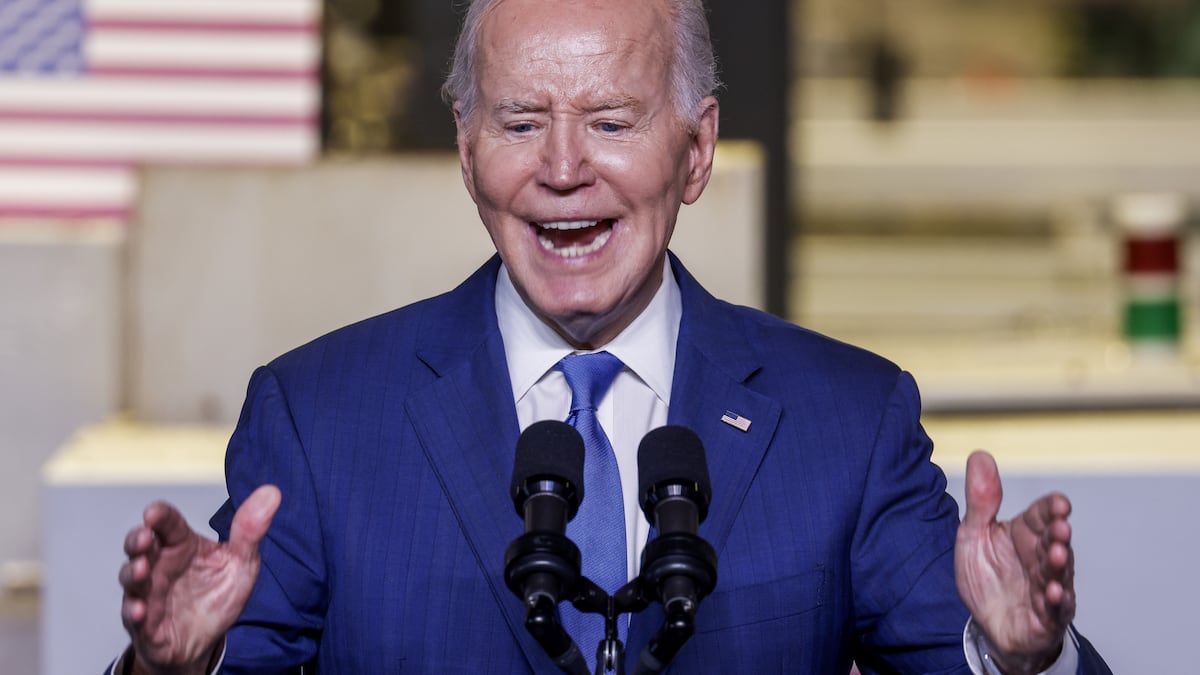

- President Joe Biden faces a backlash after saying he will veto a pro-crypto resolution.

- The resolution seeks to overturn a controversial SEC policy.

- Critics say the SAB 121 policy risks putting unjust compliance costs on crypto.

US President Joe Biden frustrated the crypto community on Wednesday by saying he’d veto a bill that just passed the lower chamber of the Congress.

The bi-partisan resolution seeks to repeal a controversial Securities and Exchange Commission accounting policy named Staff Accounting Bulletin No 121, or SAB 121.

“There is nothing less American than politicians impeding innovation and progress,” Hunter Horsley, CEO of crypto investment firm Bitwise Asset Management, said Wednesday.

“Frustrating posturing from the White House here,” he said.

Similarly, Paul Grewal, chief legal officer at crypto exchange Coinbase, labelled the veto threat as “inexcusable.”

The latest congressional crypto clash highlights the rift between the pro- and anti-industry camps on Capitol Hill as the US gears up for the presidential election in November.

While Biden has positioned himself squarely in the anti-crypto camp, his main rival for the presidency Donald Trump spent Wednesday calling upon crypto supporters to vote for him if they want the industry to thrive in the US.

It comes as the SEC — spearheaded by Chair Gary Gensler — has pursued crypto firms for allegedly operating as unregistered securities entities in a barrage of enforcement actions.

The crackdown has led crypto pundits to call for Gensler’s removal, branding his actions as regulatory overreach.

What is SAB 121?

SAB 121 is part of Gensler’s attempt to bring the industry to heel.

The policy requires financial institutions custodying digital assets on behalf of customers to record those assets as liabilities on their balance sheet.

As of March 2022, banks and custodians must hold additional capital to offset those liabilities, which the industry says puts an unjust strain on their capital ratios and drives up administrative costs.

SAB 121 makes it “extremely” difficult for custodians to hold digital assets, Ji Kim, chief legal and policy officer at advocacy group Crypto Council for Innovation, said Wednesday.

“The SEC’s attempt to bypass established rulemaking processes under the guise of issuing ‘staff-level guidance’ undermines trust and due diligence expected in regulatory practices,” Kim said.

Republican Congressperson Mike Flood sought to overturn SAB 121 with his resolution H.J. Res 109, which was voted through the House of Representatives on Wednesday.

Whatever celebratory mood may have trickled through the pro-crypto camp following the vote proved short-lived after the White House announced that Biden would veto the bill if it ever hit his Oval Office desk.

The administration said the resolution risks hampering the SEC’s ability to “protect investors” and “constrain” its ability to address financial stability.

Crypto champions have previously accused the Biden Administration’s policies of stifling innovation and failing to provide a clear regulatory framework for the crypto industry.

Since the collapse of FTX in November 2022, the crypto industry has made some efforts to shore up safer practices for storing customers’ digital assets, arguing for clearer regulation.

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.