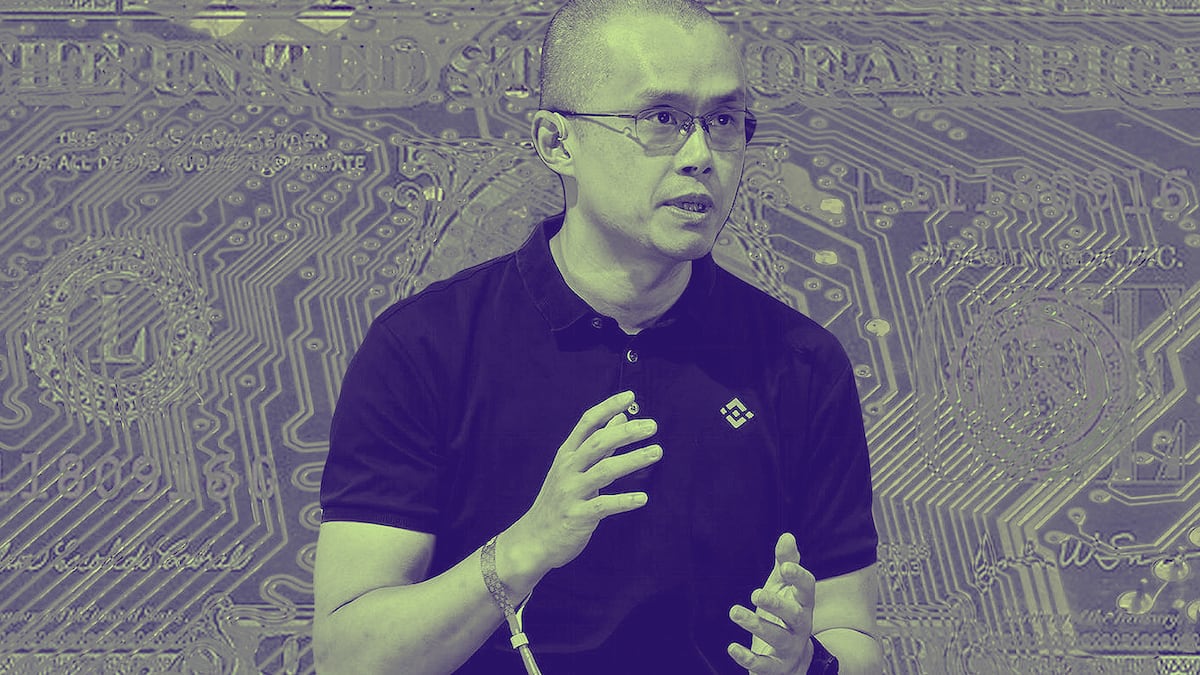

Staff of a trading company set up by Binance boss Changpeng “CZ” Zhao had to get his approval to buy Binance-branded hoodies.

Such extreme levels of micromanagement highlight the lengths Binance went to dodge US regulation, the Securities and Exchange Commission said in a complaint on Monday.

The complaint describes how increasingly disgruntled staff of the purportedly independent entity BAM Trading were in fact micromanaged by Zhao and his team at Binance.

NOW READ: A 162-page bill would give the CFTC big chunks of US crypto markets. Here’s what else is in it

This was to the point of having to seek his approval on routine business expenses, including rent, legal expenses, cloud hosting fees — and the $11,000 purchase of the hoodies.

The agency has levelled a raft of allegations against Zhao and what the SEC says are his companies — Binance, Binance US, and BAM Trading.

The case hinges on the companies’ offerings of trading and other services to US customers while failing to register with the SEC — while at the same time lying to investors, mishandling funds, and manipulating markets.

Central to the SEC’s case, which was filed yesterday in federal court, is the allegation that Zhao was intimately involved with the funding of BAM Trading via an elaborate network of shell companies, as well as the company’s day-to-day management.

NOW READ: Stablecoins and Binance next in SEC crosshairs after Coinbase warning

The complaint alleges that Zhao and his team at Binance decided to set up BAM in 2018 explicitly to dodge US regulatory scrutiny. At that point, Zhao and his team were aware they were offering their services to US persons illegally.

The complaint quotes Binance’s CCO bluntly admitting to another Binance compliance officer in December 2018 that “we are operating as a fking unlicensed securities exchange in the USA bro.”

‘We are operating as a fking unlicensed securities exchange in the USA bro.’

On the advice of a consultant who dubbed the strategy the Tai Chi Plan, Binance set up a network of companies domiciled in tax havens. One of these was BAM, which was registered in Delaware.

The strategy behind the Tai Chi plan was that BAM would be presented as partnering with Binance to launch a compliant US exchange, Binance US. This exchange would be touted as fully independent of Binance, albeit leveraging its trading technology.

But all the while, Zhao and his team were making sure to retain lucrative US customers, the complaint alleges.

Zhao brought on BAM’s first CEO, Catherine Coley — referred to in the complaint as “BAM CEO A” — in June 2019.

For her entire tenure, the complaint said, she was directed by Zhao and his chief financial officer. Coley even referred to Binance as the “mothership”, the complaint said. Coley was allegedly strong-armed into allowing Binance’s BNB token, which is not registered with the SEC as a security, to list on Binance.US, against her advice.

NOW READ: Bitcoin, Coinbase tank as SEC’s Binance complaint spooks traders

And BAM employees grew increasingly unhappy with the level of involvement that Zhao had in the business, which included making a $400 million transfer from BAM to a company controlled by Zhao.

By early 2020, they had started to compile a list of what they called “shackles” — functions that required approvals from Binance and “demonstrated BAM’s lack of independence and knowledge of the platforms’ operations”.

Breaking point

Coley told her bosses that her team was at breaking point, and began working to propose a plan for independence that she later called “Project 1776″ — referring to the US Declaration of Independence — under which BAM would take control of its operations.

In October 2020, Forbes reported details of the Tai Chi plan, which it said was intended to “deceive regulators and surreptitiously profit from crypto investors in the United States.”

Morale tanked at BAM, with staff allegedly telling Coley they felt they had been “duped into being a puppet.” Zhao was intransigent and apparently fired Coley.

NOW READ: Silvergate short seller says he’s betting against Signature: ‘Binance is next’

Brian Brooks, a controversial former banking regulator and “CEO B” in the complaint, was brought on instead. Brooks said at the time that BAM Trading was “not an alter-ego of Binance.”

He attempted to migrate functions like the matching engine from Binance to BAM, but Zhao overruled him, and Brooks resigned just three months into his tenure.

Binance responded to the SEC’s allegations in a post on its website headed “SEC complaint aims to unilaterally define market structure”.

“While we take the SEC’s allegations seriously, they should not be the subject of an SEC enforcement action,” the post said.

Binance is also facing a civil enforcement action from the Commodity Futures Trading Commission, while the US Justice Department is investigating the exchange for money laundering.