- The regulator has told Consensys that it’s planning to sue

- Among its beliefs? That Metamask is serving the function of a broker

- Consensys founder says SEC stance means that DeFi would be ‘profoundly killed’

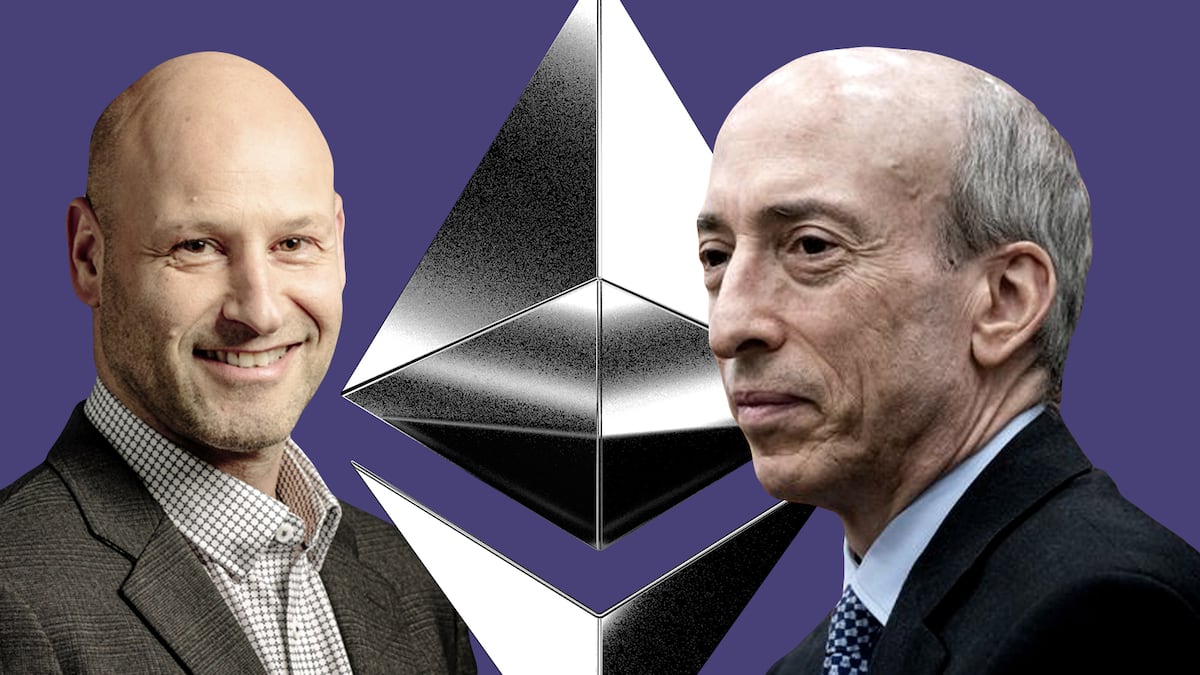

The Securities and Exchange Commission’s claims that Consensys’ wallet violates securities laws is “preposterous,” the company’s founder and CEO Joseph Lubin said on Thursday.

Consensys said in April that it had been served with a Wells notice — an SEC letter informing recipients of looming enforcement action.

Lubin said the markets watchdog believes that Consensys’ Metamask wallet serves the function of a broker-dealer, a type of regulated securities market intermediary.

“That’s a preposterous notion,” Lubin said, who was speaking during an event hosted by the Financial Times.

Metamask — partly backed by banking giant JPMorgan — is a popular wallet option for crypto investors, especially those in decentralised finance. Consensys estimates there are around 30 million active DeFi users globally.

Lubin said it isn’t clear if the SEC is contemplating that Consensys will have to register Metamask as a broker-dealer with regulators.

If that’s the case, that’s chilling to development on the Ethereum network generally, he said.

“If we have to register our wallet as a broker-dealer, then virtually every application on Ethereum that does similar things with tokens will have to register themselves as a broker-dealer,” Lubin said.

“And so an entire tech industry would be profoundly killed in the United States.”

Preemptive strike

Instead of waiting for the SEC to strike with an enforcement action, Consensys recently announced it was suing the regulator in a preemptive strike.

The lawsuit, filed in Texas, accused the SEC of “waging a campaign to seize control over the future of cryptocurrency.”

“The SEC has no authority— nor should it — to regulate global, peer-to-peer computer networks,” Consensys said.

‘The SEC appears to have reclassified Ether as a security without really telling anybody that that’s the case.’

The threatened court battles are playing out against a wider debate about the status of Ethereum as a security.

While SEC Chair Gary Gensler has been clear that he considers most tokens beside Bitcoin to be securities, he’s refused to explicitly state what he thinks about Ether.

“The SEC appears to have reclassified Ether as a security without really telling anybody that that’s the case,” Lubin said on Thursday.

“They are going about doing a strategic series of enforcement actions rather than open discourse and rulemaking.”

ETH ETFs

The issue is gaining urgency as the SEC must approve or deny VanEck’s application to provide a spot Ethereum exchange-traded fund by May 23 — the first of a series of such deadlines.

Bloomberg Intelligence analysts say there’s not much chance of the SEC approving these products.

Lubin said he believes the SEC’s Wells notice to his company may be timed to head off lawsuits that will ensue from the regulator’s denials.

“We believe there’s a flurry of activity designed to enable them to say that their action wasn’t capricious in the very likely event that they’re going to deny these Ether spot ETFs,” he said.

Coinbase Wallet

Consensys is not the only company to be told that its wallet constitutes a broker-dealer.

That was a charge the SEC levelled against Coinbase in its June lawsuit against the exchange.

A federal judge denied Coinbase’s request to throw out the lawsuit, but she agreed with the exchange that its Wallet service did not constitute brokerage services under federal securities laws.

‘We’re being gaslit to slow progress in the US or kill disintermediation.’

In another echo of Coinbase — where CEO Brian Armstrong has said his business did all it could to propitiate the regulator before being slapped with the lawsuit — Lubin said on Thursday that Consensys has repeatedly engaged with the Gensler SEC.

Consensys has submitted “over 100,000 pages of documents at great expense and helping them understand the technology better,” he said — to no avail.

“We’ve done our best over the years to be good actors, to be very cooperative. We’re being gaslit to slow progress in the US or kill disintermediation.”

Reach out to the author at joanna@dlnews.com.