- SEC enforcement actions ramp up toward the end of the government's financial year.

- This year “marked the SEC’s most aggressive stance."

- SEC Chair Gary Gensler has cracked down on crypto, and wants more money for next year's list.

It’s September, and that means you should brace for an onslaught of Securities and Exchange Commission lawsuits.

“It’s typical in September to see a flurry of enforcement actions” as regulatory agencies like the SEC “shore up their performance reports and budget requests for Congress,” Variant chief legal officer Jake Chervinsky posted on X recently.

Reminder that the SEC, CFTC, and other regulators have their fiscal year end on September 30.

— Jake Chervinsky (@jchervinsky) September 4, 2024

It's typical in September to see a flurry of enforcement actions as they shore up their performance reports and budget requests for Congress.

It could be a busy month.

The SEC’s enforcement activity gets more frenetic as the leaves turn brown.

Autumn uptick

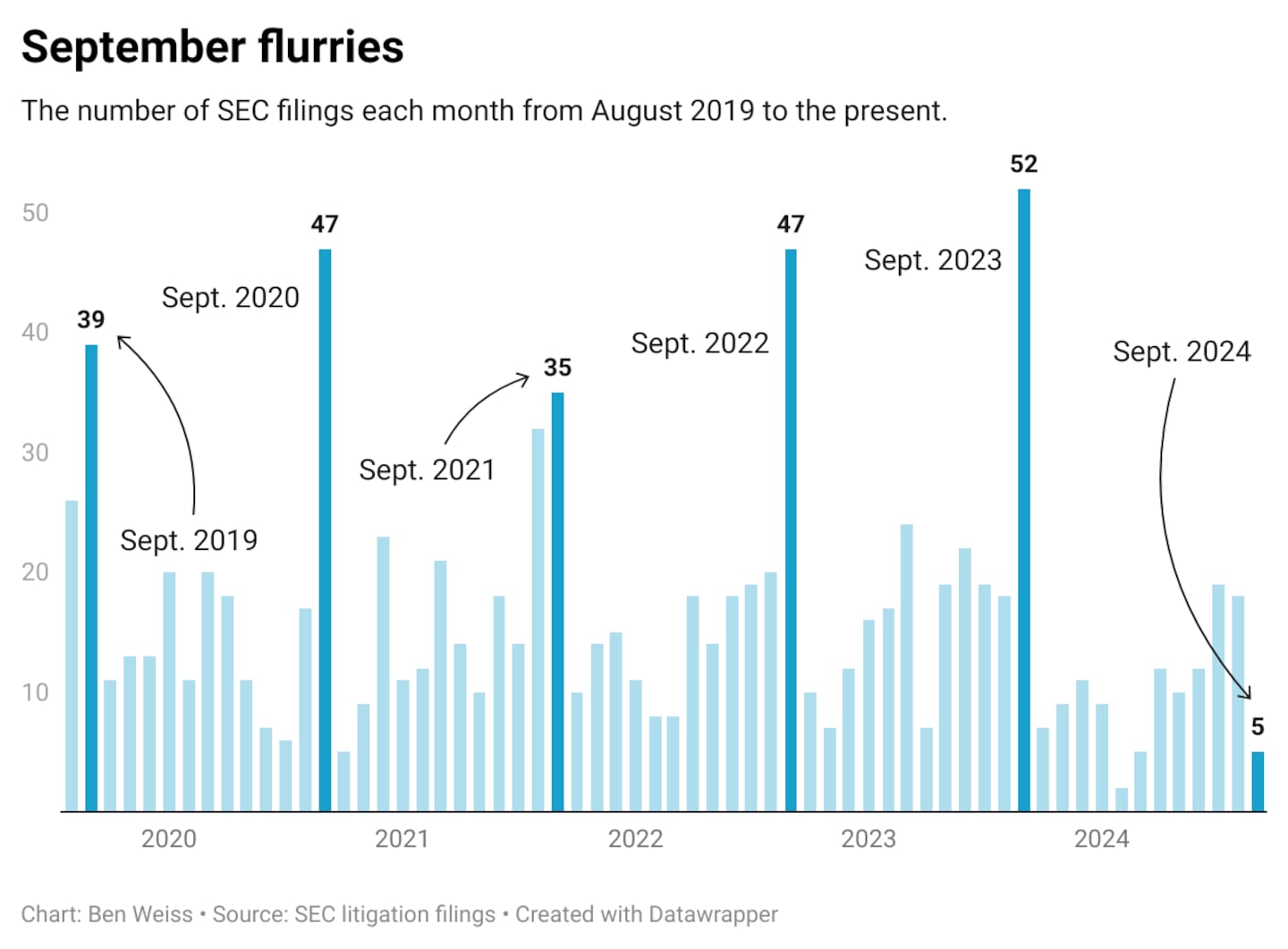

We tabulated five years’ worth of the SEC’s litigation releases. And then deleted all entries unrelated to new enforcement actions.

The graph is clear — there’s a definite uptick in enforcement actions every September.

The federal government’s annual accounting calendar is called the fiscal year, and it ends on September 30. The more work an agency can show it’s doing, the more budget it can justify asking from Congress.

SEC Chair Gary Gensler asked for $2.6 billion for the 2025 fiscal year to remediate a staffing shortfall, and to strengthen its ability to police what he called “the Wild West of crypto markets.”

Fines ramp up

In the wake of the FTX scandal, the SEC cracked down on crypto’s biggest players, including major exchanges Binance and Coinbase.

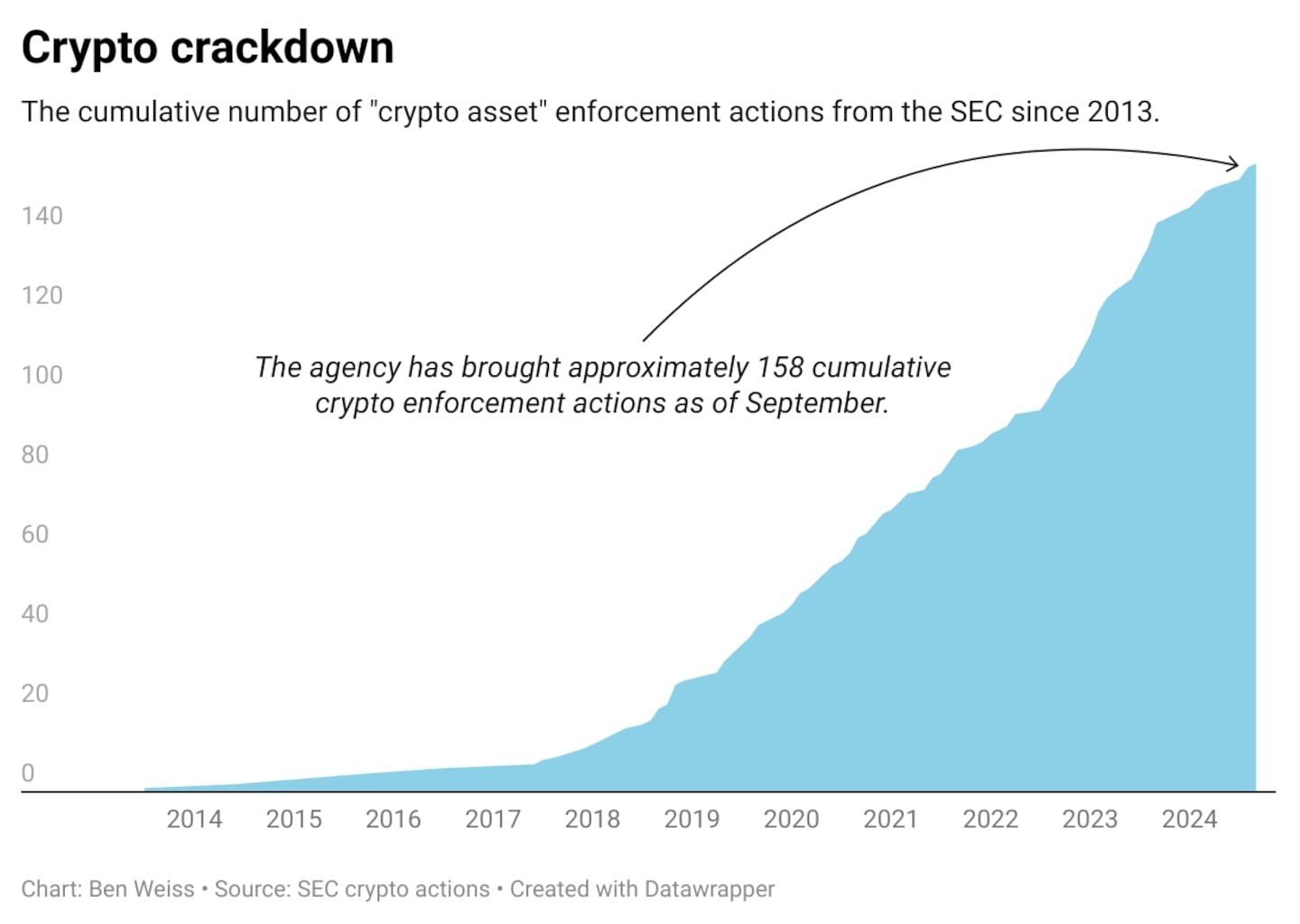

The agency’s data shows it has brought some 158 cases against firms and individuals involving crypto.

Around 50 of these were levied since late 2022, when the agency strengthened its crypto enforcement team.

More aggressive enforcement is not the preserve of the Gensler SEC, however.

The SEC started ramping up activity against the industry during former Chair Jay Clayton’s term.

Clayton, who was appointed chair in 2017 by then-president Donald Trump, presided over the markets watchdog during the initial coin offering boom.

From 2017 to 2018, thousands of new blockchain projects raised huge amounts of capital by issuing tokens. Some projects from that era remain, but the boom also created a wave of scams.

Until that point, the SEC’s fines had been relatively low and aimed at relatively small-time projects.

As the ICO boom took hold, fines ramped up to $7 million, new research from Social Capital Markets shows.

The agency also started targeting bigger projects.

In 2020 and 2021, it sued stock-trading app Robinhood and Ripple Labs, Social Capital Markets analyst Sudhir Khatwani wrote.

Mega-fines

Still, when it comes to imposing fines, Gensler’s SEC means business.

This year “marked the SEC’s most aggressive stance, clearly focusing high-profile cases and unregistered securities violations,” according to Khatwani.

Some more insights from the report:

- Since 2013, the SEC has levied over $7.42 billion in fines against crypto firms and individuals. Sixty-three percent of that — $4.68 billion — came in 2024 alone.

- The biggest fine against crypto defendants was against TerraForm Labs and its founder Do Kwon — $4.7 billion. That “set a new precedent for enforcement, showcasing the SEC’s willingness to impose record-breaking penalties for severe infractions,” Khatwani wrote.

Joanna Wright and Ben Weiss write about regulation and do data analysis for DL News. Reach out to them at joanna@dlnews.com and bweiss@dlnews.com