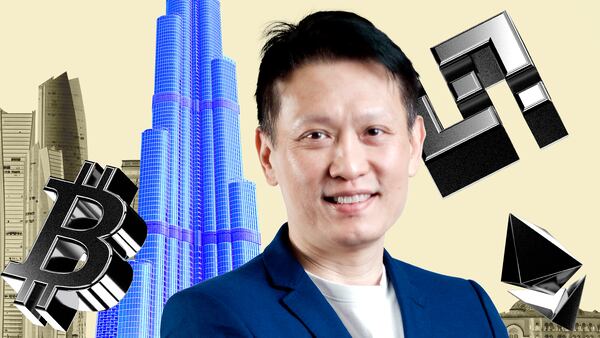

- The SEC, Binance, and Changpeng Zhao have asked for an unusual ruling in long-running lawsuit.

- The move signals big changes on crypto policy at the CEO.

- Hester Peirce's crypto task force is taking shape.

Did the crypto crackdown just end?

It sure looks that way after the US Securities and Exchange Commission on Monday asked a judge to hit the pause button on its lawsuit against Binance and founder Changpeng Zhao for 60 days.

In a motion filed jointly with the world’s biggest crypto exchange and Zhao, the SEC said that a new crypto task force may alter the course of the litigation.

“The work of this task force may impact and facilitate the potential resolution of this case,” the agency said in court papers.

Hester Peirce takes charge

There weren’t any other details about why or how that may happen.

Yet SEC Commissioner Hester Peirce, a pro-crypto official who often disagreed with the “regulation by enforcement” approach taken by former Chair Gary Gensler, heads the task force.

Chances are this move means the SEC, operating under acting chair Mark Uyeda, is poised to pull the plug on litigation filed against all leading crypto players in recent years.

In addition to Binance, the agency accused Coinbase, Ripple, and other ventures of unlawfully trading or issuing unregistered securities for their customers.

Crypto targets

Under Gensler, the SEC argued that many cryptocurrencies should be registered and regulated the same way as stocks and bonds. If they weren’t, Gensler contended, ordinary investors were at risk of suffering big losses by unscrupulous crypto issuers.

Binance, Coinbase, Ripple and other targets have denied the SEC’s allegations.

Last July, Donald Trump embraced the industry’s argument that Gensler’s push undermined US competitiveness in the global crypto market.

Shortly after taking office as president in January, Trump nominated Paul Atkins, a pro-crypto lawyer, to head the SEC.

The SEC’s request for a pause in the Binance litigation is striking because in November 2023 the exchange pleaded guilty to violating US banking law by accommodating criminals and terrorists on its platform.

Guilty plea

The company paid $4.3 billion in penalties and Zhao, who also pleaded guilty, served four months in prison.

With new crypto legislation introduced in Congress and the SEC reviewing its approach to the industry, the SEC’s time-out in the case is not unexpected.

In November, John Reed Stark, the former head of the SEC’s Internet Enforcement Office and an outspoken crypto critic, predicted that the agency’s cases “will grind to a screeching halt.”

Binance will be hoping for a swift resolution to its regulatory troubles in the US.

“We are grateful to Interim Chairman Uyeda for his thoughtful approach to ensuring digital assets receive the appropriate legislative and regulatory focus in this new, golden era of blockchain in the U.S. and around the world,” a Binance spokesperson said in a statement shared with DL News.

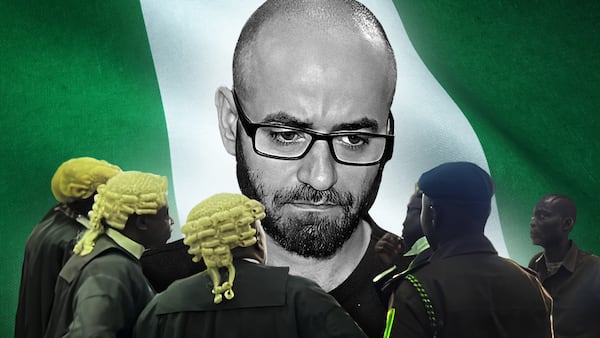

Still, Binance is confronting legal challenges in other nations.

Last month, authorities in France began probing the crypto exchange. And Binance is facing money laundering and currency manipulation charges in Nigeria.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. Got a tip? Please contact him at osato@dlnews.com.