- The SEC delayed its decisions on spot Bitcoin ETF applications from Cathie Wood's Ark Invest and GlobalX on Tuesday.

- Earlier in the day, a group of four Congress members wrote a letter to SEC Chair Gary Gensler calling on him to approve spot Bitcoin ETFs “immediately.”

The US Securities and Exchange Commission delayed its decision on spot Bitcoin exchange-traded fund (ETF) applications from Cathie Wood’s ARK Invest and fund manager GlobalX.

Tuesday’s delay took market participants by surprise since the SEC had several weeks left to respond to both applications. A response to Ark’s application, with digital asset manager 21Shares, was not due until November 11.

Hopes that the SEC would approve a spot Bitcoin ETF, after a decade long process, helped drive the price of Bitcoin above $30,000 in June.

Prices popped again in August after digital asset manager Grayscale won its appeal versus the SEC. The regulator previously rejected Grayscale’s proposal to convert its Grayscale Bitcoin Trust into a spot ETF, it has yet to respond to the court’s decision.

A spot ETF would offer investors an affordable way to bet on the performance of Bitcoin, through a highly liquid and low-cost product.

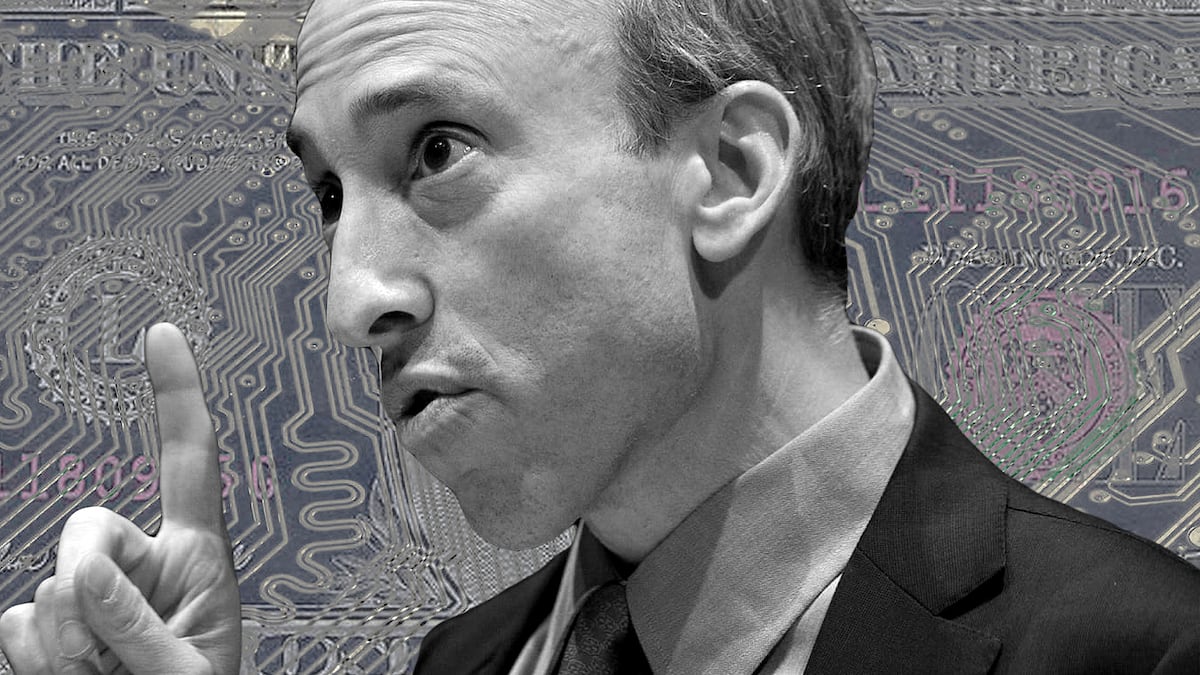

The delays came on the same day that members of the US House Financial Services Committee wrote a letter to SEC Chair Gary Gensler, urging him to approve a spot Bitcoin ETF “immediately.”

The SEC has repeatedly rejected such applications over the years, citing, among other things, the possibility of fraudulent and manipulative behaviour.

A regulated spot Bitcoin ETF would provide “increased protection for investors by making access to Bitcoin safer and more transparent,” wrote Republicans Tom Emmer and Mike Flood, and Democrats Wiley Nickel and Ritchie Torres in their letter on Tuesday.

“Congress has a duty to ensure the SEC approves investment products that meet the requirements set out by Congress,” the letter noted, before urging the SEC to approve the listing “immediately.”

It now looks increasingly more likely that no spot Bitcoin ETF will be approved this year, something which James Seyffart, an ETF analyst at Bloomberg Intelligence raised on X, formerly Twitter.

The regulator might delay decisions on separate applications from BlackRock, Fidelity, VanEck, Invesco, WisdomTree, and Valkyrie — all of which face second deadlines in mid-October.

A potential government shutdown in Washington DC could also impact ETF applications, according to Nate Geraci, president of financial advisory firm the ETF Store.

Federal funding in the US will run out this week, forcing a shutdown, unless lawmakers can reach a compromise before the end of the financial year on September 30.

Updated to include details about the ETF application process and its impact on the market.

Nelson Wang is DL News’ editor based in New York. Reach out to him at nelson@dlnews.com. Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.