- The agency slapped the exchange with a five-count lawsuit alleging failure to comply with federal law.

- The action comes a day after a similar suit was filed against Binance and CEO Changpeng Zhao.

- Coinbase shares fell 20% in early trading. Bitcoin and Ethereum fell.

The US Securities and Exchange Commission delivered a second blow in as many days to the digital assets industry Tuesday by slapping a lawsuit on Coinbase, the top US crypto exchange.

In a sweeping action, the SEC charges include allegedly operating an unlawful exchange and permitting investors to trade in assets that failed to be registered as securities.

The agency is asking a federal court in Manhattan to order Coinbase to cease operating as an exchange, a broker, and a clearing firm until it complies with securities laws.

Shares in Coinbase, a US crypto industry proxy, fell 12% in mid-morning New York trading. Bitcoin dropped 0.7% on the news and Ethereum slipped 0.4%.

One-two punch

The SEC’s case comes as the crypto industry reels under an unprecedented regulatory crackdown. On Monday, the SEC accused Binance, the top crypto exchange worldwide with $13 billion in daily trading volume, of defrauding investors, concealing its financial activities from regulators, and operating an unlicensed exchange in the US.

Arguing that crypto platforms have failed to comply with securities laws and ripped off investors, SEC Chair Gary Gensler is intent on proving that virtually all digital assets should come under the purview of regulations that oversee stocks, bonds, and other investment instruments.

The 101-page lawsuit filed against Coinbase Tuesday was a catalogue of such claims. It singled out a number of altcoins operating in networks run by Ethereum, Solana, Cardano, amongst others, as securities.

“Coinbase has never registered with the SEC as a broker, national securities exchange, or clearing agency, thus evading the disclosure regime that Congress has established for our securities markets,” the agency said in its lawsuit.

‘Coinbase has never registered with the SEC as a broker, national securities exchange, or clearing agency, thus evading the disclosure regime that Congress has established for our securities markets.’

— SEC lawsuit

In an email to DL News, Paul Grewal, Coinbase’s Chief Legal Officer and General Counsel, said the SEC’s reliance on an “enforcement-only approach” was harming the digital asset industry and that Coinbase has demonstrated a “commitment to compliance.”

“The solution is legislation that allows fair rules for the road to be developed transparently and applied equally, not litigation.” Grewal said. “In the meantime, we’ll continue to operate our business as usual.”

Frederik Gregaard, CEO of the Cardano Foundation, echoed Grewal. “The Cardano Foundation disagrees with the recent qualification of ADA as a security under US law. We look forward to the continued engagement with regulators and policymakers to achieve legal clarity and certainty on these matters.”

Revenue at risk

The SEC alleged Coinbase unlawfully made these tokens available to investors. The agency also targeted staking, the practice of investors making their digital tokens available to tend blockchain networks in exchange for a return. Staking has become a crucial new crypto business for so-called Proof of Stake systems like Ethereum, Solana, Polkadot and Cardano, and investors.

Straight away, it looks like the legal action puts Coinbase’s businesses at risk: More than a fifth of Coinbase’s total revenue is generated by charging trading fees on alt-coin trades, and 10% of of its top line is generated by staking products, said Ryan Coyne, a senior equity analyst as Mizuho, in an email to DL News.

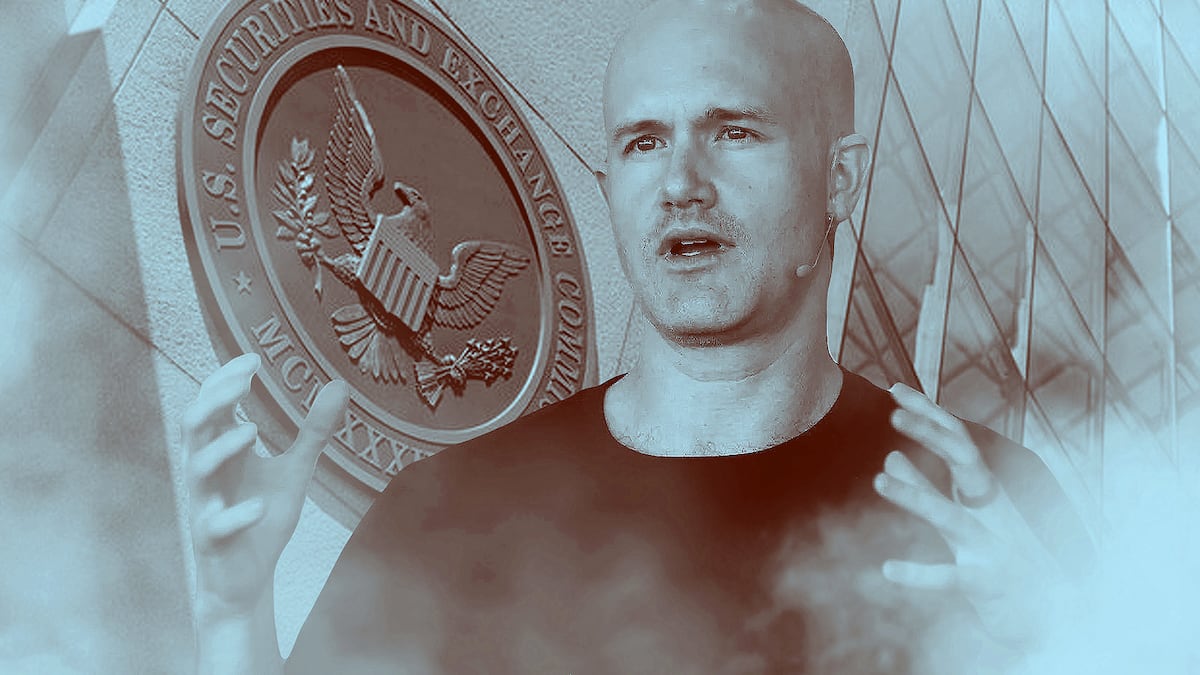

Coinbase CEO Brian Armstrong has long decried the efforts by the SEC to force crypto companies like his to adhere to exiting securities laws. Like many industry leaders, he argues Bitcoin and its ilk represent a new form of financial technology that should be controlled by its own laws.

Alleged failures

Earlier this year, Coinbase sued the SEC in an attempt to define cryptocurrencies as instruments that cannot be regulated like stocks and bonds. Armstrong also mused on social media about moving some of the company’s operations to Bermuda.

But ever since Gensler, a onetime Goldman Sachs partner, took control of the SEC in 2021, he has made it a priority to yoke cryptocurrencies to the same compliance regime as traditional securities.

“The crypto space is largely built on a business model that’s non compliant with the securities laws,” he said in an interview with Bloomberg News on Tuesday,

The news rattled crypto investors a day after the SEC filed a 13-count lawsuit against Binance. The SEC said the exchange defrauded investors by failing to register its activities with regulators, co-mingling deposits with funds controlled by CEO Changpeng Zhao, and hiding its US business activities.

NOW READ: Retail feared that insiders would dump Optimism’s $500m token unlock — so they mass dumped it first

At first glance, the SEC’s lawsuits against Binance and Coinbase look quite similar. Yet the SEC did not allege Coinbase was committing fraud, as it did with Binance. And there are other key distinctions between the two actions that could affect how the litigation plays out.

For starters, Coinbase, as a publicly-traded company, is obliged to disclose its financial operations and details of its businesses every quarter. Binance, a privately controlled company, doesn’t have to share any details about what the SEC calls its “opaque structure,” and famously, Zhao has said the company doesn’t even have a headquarters.

Legal argument

In the SEC complaint against Coinbase, the agency argues that it broke the law by “collapsing” its exchange, brokering, and clearing functions into “a single platform.” By failing to register any of the three functions, Coinbase has defied the regulatory structures and evaded disclosure requirements all such companies must obey, the suit said.

This highly technical legal argument contrasts with the more straightforward allegations the SEC levelled against Binance.

“The SEC Coinbase suit document is almost entirely based on interpretation of securities laws — very, very different from the Binance suit — feels much more like a ‘game on’ moment,” tweeted Noelle Acheson, the editor of an industry market newsletter.

As for what comes next, it appears that as many as 19 tokens have now been red flagged by the SEC in the Coinbase and Binance legal actions.

Updated on June 6 to report Coinbase’s response to the lawsuit, additional details about the litigation, Gensler’s comments, and market commentary.