- The SEC sued Consensys for allegedly violating securities laws.

- The federal agency alleges that MetaMask is an unregistered broker of securities.

- It also claims that Consensys sold unregistered securities on behalf of Lido and Rocket Pool.

The Securities and Exchange Commission sued crypto firm Consensys Friday for alleged violations of securities law.

In the lawsuit, filed in the New York Eastern District, the federal agency targeted MetaMask, the crypto wallet that Consensys developed and manages.

It said that its MetaMask Swaps service, which lets users exchange one cryptocurrency for another, is an unregistered broker of securities.

In addition, the SEC alleged that MetaMask has sold unregistered securities on behalf of Lido and Rocket Pool, two liquid staking services.

The services offer tradeable cryptocurrencies stETH or rETH.

Consensys offers and sells both tokens through its MetaMask Staking platform. It created its staking service to offer and sell Lido and Rocket Pool’s staked Ether, the SEC said.

“By allegedly collecting hundreds of millions of dollars in fees as an unregistered broker and engaging in the unregistered offer and sale of tens of thousands of securities, Consensys inserted itself squarely into the U.S. securities markets,” Gurbir Grewal, director of the SEC’s division of enforcement, said in a press release.

In a statement, a spokesperson for Consensys said the company wasn’t surprised: “The SEC has been pursuing an anti-crypto agenda led by ad hoc enforcement action. This is just the latest example of its regulatory overreach,” the spokesperson said.

Consensys vs. SEC

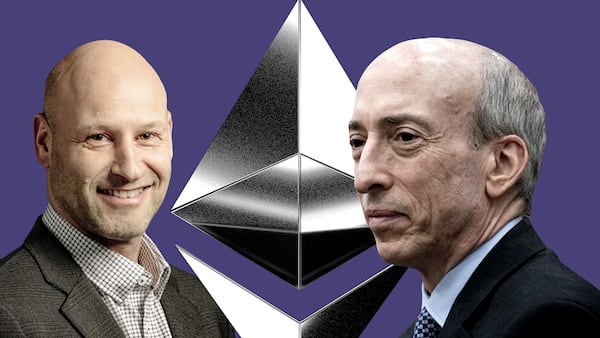

The SEC’s lawsuit against Consensys is the culmination of a protracted legal back-and-forth with the developer of MetaMask.

Joseph Lubin founded the company in 2014 to build applications on the Ethereum blockchain, which he co-founded with Canadian computer programmer Vitalik Buterin.

One of its most popular products is MetaMask, a decentralised wallet for cryptocurrencies, according to its GitHub.

This past April, Consensys revealed that it had received a Wells Notice from the SEC, a formal notification from the agency that a company or individual is the target of forthcoming litigation.

In the notice, the SEC said MetaMask and MetaMask’s platform for staking, a method for putting cryptocurrencies in escrow to support a blockchain network, were the targets of its investigation.

In a preemptive move, Consensys sued the SEC in Texas and asked a judge to force the SEC to declare that Ether, the native cryptocurrency of Ethereum, was not a security.

Moreover, it asked the judge to force the SEC to declare that its investigation into MetaMask exceeded the agency’s authority.

Less than two months later, after the SEC’s surprise about-face on Ether exchange-traded funds, Consensys said that it had received notice from the SEC that its investigation into whether Ether was a security was over.

However, that didn’t mean that the SEC had scuttled its case against Consensys for its creation and management of MetaMask.

“We are confident in our position that the SEC has not been granted authority to regulate software interfaces like MetaMask,” the Consensys spokesperson said after the lawsuit was filed. “We will continue to vigorously pursue our case in Texas for ruling on these issues.”

Update, June 28: The story was updated to provide background on the SEC’s legal battle with Consensys.

Ben Weiss is a Dubai Correspondent at DL News. Got a tip? Email him at bweiss@dlnews.com.