- Lummis warns US is falling behind EU in crypto regulation.

- Criticises SEC's enforcement actions without clear rules.

- Advocates for Congress to step in with a regulatory framework.

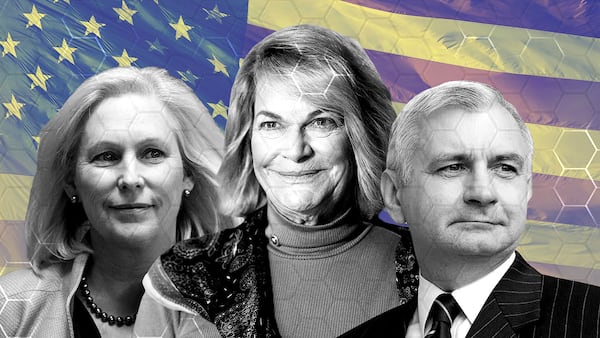

Senator Cynthia Lummis cautioned that the United States is falling behind in regulating digital assets, especially compared to the European Union, during a recent interview on CNBC’s Squawk Box.

“The EU is ahead of us,” Lummis stated, stressing the importance of the US taking the lead in financial services and digital asset regulation.

She went on to criticise the Securities and Exchange Commission (SEC) for its heavy-handed enforcement strategy, particularly under Chair Gary Gensler.

“They’re regulating by enforcement actions with penalties against the industry,” she said, noting the absence of clear rules for the sector.

Lummis also predicted a shift in leadership at the SEC depending on the outcome of the 2024 election, particularly if Donald Trump wins.

She believes that Congress must step in and create a comprehensive regulatory framework.

“Congress needs to regulate this and weigh in,” she emphasised, advocating for a clear distinction between assets like Bitcoin and Ethereum, which she argues are clearly commodities.

Lummis suggested that Republican leadership in the Senate would accelerate progress.

“Tim Scott, as chair of the Banking Committee, would push for a statutory framework for digital assets,” she added.

She concluded by stating that empowering the Commodity Futures Trading Commission with additional resources would ensure proper oversight, contrasting it with the current fragmented approach that hampers the industry’s potential for growth.