- The hot button issue got a hearing on Capitol Hill.

- Crypto leaders have decried the alleged practice of losing their accounts.

- Banks have long 'derisked' problematic accounts from their balance sheets.

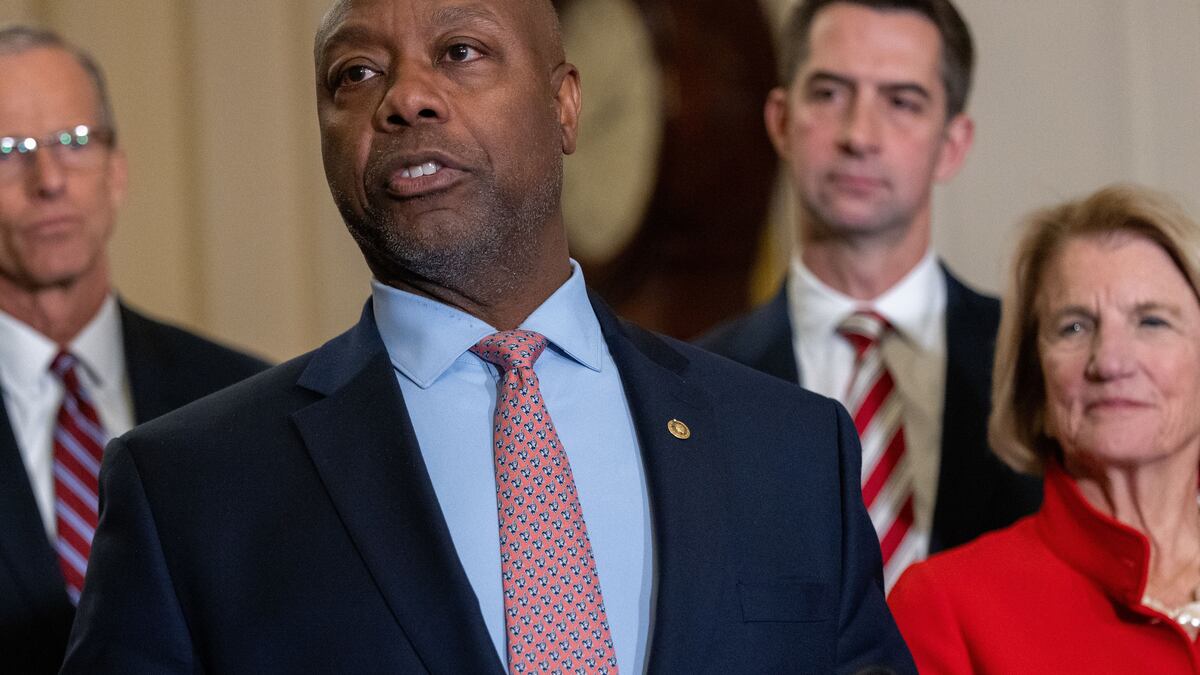

The US Senate Banking Committee held a hearing on Wednesday on an issue that’s become a hot potato over the past few months: debanking, especially as it relates to crypto-tied business and individuals.

Asked by Committee Chairman Tim Scott of South Carolina how widespread debanking in crypto really is, Nathan McCauley, CEO and co-founder of Anchorage Digital Bank, an institutional crypto bank and the only bank with a national bank charter, responded plainly.

“An anecdote I can share,” McCauley said, “is I was speaking at a meetup of about 100 crypto founders in San Francisco. As a show of hands I asked, ‘Who here has had trouble getting an account or with debanking?’ All of the hands in the room went up.”

The net effect is flight of business to friendlier jurisdictions, McCauley explained later in the hearing.

Choke Point 2.0

McCauley said his company was in active talks to expand crypto activities at various institutions, but that debanking, referred to as Operation Choke Point 2.0, prevented those talks from moving forward.

While lenders routinely decline to provide accounts to companies and individuals as a form of “derisking” their balance sheets, the crypto industry has accused banks of colluding with the Biden administration to freeze them out of the financial system.

The hearing on Wednesday vacillated between Republicans advocating for crypto banking rulemaking and excoriating alleged debanking, while Democrats argued for Elon Musk’s current work on federal payments systems be curtailed immediately.

In a letter sent to the FDIC yesterday, Coinbase characterizes the status quo for crypto banking as untenable, and called for transparent banking regulations for crypto.

“Instead of issuing clear, durable rules through the proper notice and comment process, banking regulators have chosen to issue opaque, inconsistent guidance, leaving crypto C&E [custody and execution] service providers and banks in regulatory limbo,” the crypto exchange wrote.

‘Unacceptable things’

The issue of debanking received significant social media fuel after Marc Andreessen, the co-founder of the VC firm Andreessen Horowitz, or a16z, appeared on The Joe Rogan Experience podcast in late November.

During that conversation, Andreessen described the experiences of those close to him with debanking and characterised it as a deeply partisan issue.

“You have this thing called the CFPB, the Consumer Financial Protection Bureau,” Andreessen told Rogan. “It’s sort of Elizabeth Warren’s personal agency that she gets to control.”

Warren, the Democratic senator from Massachusetts who made her name lobbying for consumer financial protections, originated the idea for the CFPB in the aftermath of the 2008 global financial crash. But there is no evidence she controls the agency.

Indeed, Warren, a former bankruptcy law professor at Harvard University, has worked for years to end debanking.

“The CFPB is the only agency working to stop debanking,” Warren said during the Wednesday hearing.

End of enforcement

CFPB enforcement was halted this week by Treasury Secretary Scott Bessent, who now oversees the agency.

Ripple CEO Brad Garlinghouse’s description of his debanking experience was perhaps more stark.

“I personally have been debanked,” he said at an industry conference in October.

“They were like ‘Look, you are a notable person in crypto, and having notable people in crypto and banking the crypto industry means more scrutiny from federal regulators. So we don’t want it.’ ”

The House Financial Services Committee is scheduled to hold its own hearing on debanking on Thursday.

Andrew Flanagan is a writer at DL News. Contact him at aflanagan@dlnews.com.