- The Senate Banking Committee advanced the Genius Act with a big majority.

- Elizabeth Warren tried to amend the bill.

- The act would reshape the stablecoin market in the US.

A landmark stablecoin bill is winning over Democrats. At least some Democrats.

On Thursday, the Senate Banking Committee voted 18 to 6 to advance the Genius Act to the full chamber for a vote.

Five of the committee’s 11 Democrats joined the Republican majority in clearing the important hurdle.

Senator Bill Hagerty, one of the bill’s authors, called the bill a “critical first step” in making the US “the world capital of crypto.”

Senator Elizabeth Warren, a Massachusetts Democrat and crypto critic, said she and was prepared to support the bill if it could be changed.

She argued that the bill in its current form failed to protect consumers from fraud.

And she said it failed to protect national security by not addressing the ways North Korea and terrorists use stablecoins to finance their activities.

Democrats also said the act would empower big tech firms such as Meta and Elon Musk’s X to violate users’ privacy and crush competition.

“Under this bill, stablecoin issuers can invest in risky assets, including the very assets that were bailed out in 2008 and again in 2020,” Warren said.

“Anyone who thinks the US taxpayer won’t be called on directly or indirectly to bail out these guys is kidding themselves.”

Warren led a last-minute charge among committee Democrats to amend the bill.

Every amendment failed in a series of party-line votes.

Republicans said several of the proposed amendments were beyond the bill’s scope and could be addressed in future legislation addressing the crypto industry more broadly.

Hyperbole

In other instances, they said Democrats’ concerns were “hyperbole” or had already been addressed by earlier changes.

“I want to assure everybody that Machiavelli is not going to get raised from the dead to issue stablecoins so we can destroy our planet with drugs,” Senator Cynthia Lummis, a Republican from Wyoming and one of the crypto industry’s strongest supporters in Congress, said.

“This is an innovative, important financial product that has safeguards built into the bill.”

Big tech and crypto bros

President Donald Trump and Republican lawmakers have pledged to advance two significant pieces of crypto legislation this year: one addressing stablecoin issuance and the other addressing crypto market structure.

After years of false starts, lawmakers are tackling stablecoins first.

In addition to the Senate’s Genius Act, Republicans in the House of Representatives are pushing their own bill addressing the dollar-pegged tokens called the Stable Act.

Democrats slammed that bill in a House committee hearing on Tuesday, calling it a giveaway to “crypto bros” and Big Tech, specifically Elon Musk.

“The alternative is letting banks dominate the stablecoin space, stifling innovation and allowing no competition in this innovative market.”

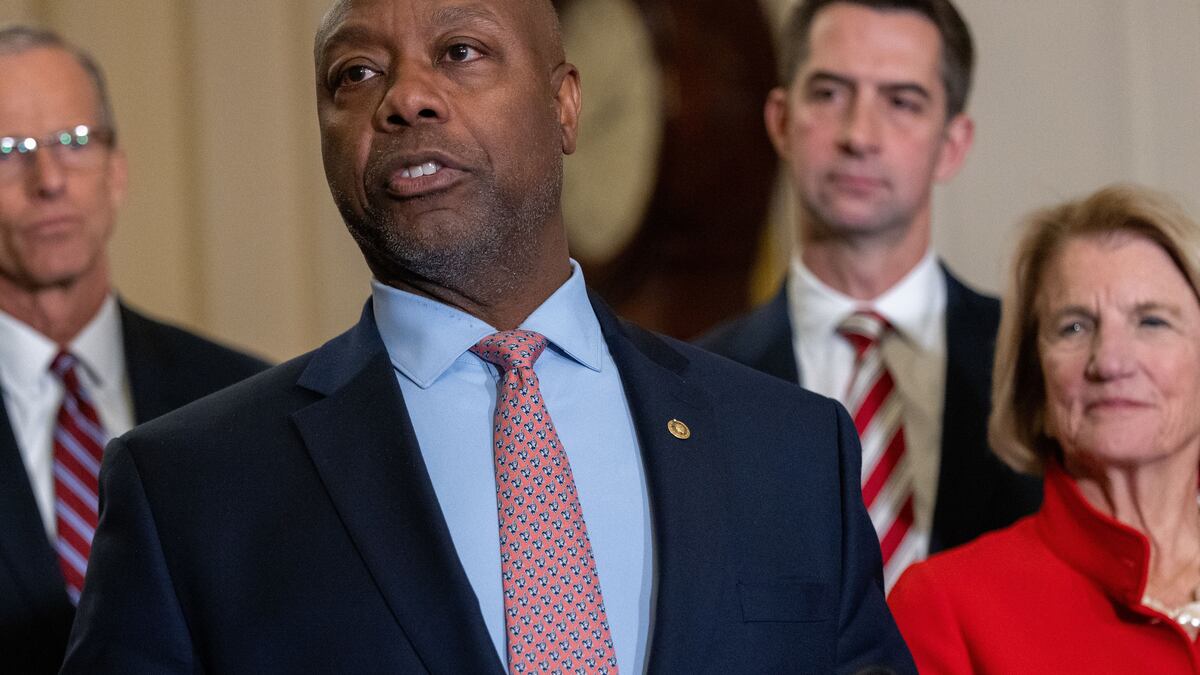

— Senator Tim Scott

The Genius bill, in particular, also casts competition between stablecoin giants Tether and Circle in a new light.

Given the stricter federal supervision these two issuers would fall under should the Genius Act become law, experts have said it will be much harder for Tether to continue operating in the US without significant changes to its business.

Come to God moment

“For USDT, this is a big come to God moment,” Bryan Keane, the lead compliance officer for crypto onramp Transak, told DL News in February. “With the US requiring these regulatory oversights and audits, I can see big issues for Tether in the future.”

Deloitte has been auditing Circle, which is backed by Goldman Sachs, since 2022.

Warren continued Democrats' line of attack against Big Tech on Thursday.

“For years, my Republican colleagues have shared their concerns about companies like Facebook censoring conservative voices and engaging in election interference,” she said.

“Just imagine if these companies are issuing their own currencies.”

The bill would not limit the issuance of stablecoins to banks, a provision Warren attempted to introduce ahead of Thursday’s vote.

But Republicans said there was little sense in doing so, likening stablecoins to “traveler’s checks on the blockchain.”

Issuers would be prohibited from offering lending or credit products, and would be required to back stablecoins one-to-one with highly liquid assets, according to banking committee chair Tim Scott, a Republican from South Carolina.

“The alternative is letting banks dominate the stablecoin space, stifling innovation and allowing no competition in this innovative market.”

Amendments thwarted

Among the amendments Democrats proposed Thursday was a requirement that stablecoins could only be backed by “ultra-safe” assets such as cash-insured bank deposits and short-term treasury bills.

Lummis said that requirement would make stablecoin issuance “not economically viable.”

Other amendments floated by Warren would have denied licenses to businesses with a “history of facilitating sanctions invasion, drug traffickers moving fentanyl into our streets, funding weapons programs to North Korea or Iran, or making it easier to distribute child pornography.”

Hagerty countered that the bill already forces regulators to consider “the integrity of the officers and directors” when reviewing applications for stablecoin licenses.

Dems seal stablecoin win

Despite their reservations, five Democrats voted to advance the bill.

Senator Mark Warner, a Democrat from Virginia, voted for each of the proposed amendments. Nevertheless, the bill had already received substantial revisions that “dramatically” increased anti-money laundering requirements, he said.

And a bipartisan committee vote would boost the odds that members of both parties collaborate when the Genius Act and other crypto bills come before the entire Senate.

“I’ll tell you, this one is easy compared to market structure,” Warner said. “Mixers, exchanges — this is much more gnarly.”

Aleks Gilbert is DL News’ New York-based DeFi Correspondent. You can reach him at aleks@dlnews.com.