- Tether CEO Paolo Ardoino told DL News his company is determined to cooperate with law enforcement.

- State oil giant PDVSA is trying to use Tether to sidestep IS sanctions.

- 'We're not the police.'

When the US hit Venezuela’s state-run oil producer with a new round of sanctions this week, the company did what many targeted entities do — it turned to Tether’s stablecoin, USDT.

As a super liquid substitute for the dollar with a market value of $110 billion, USDT offers entities booted from the international financial community with an alternative.

But if Tether’s CEO, Paolo Ardoino, has his way, this lifeline won’t last long.

Wallet freeze

On Tuesday, Tether said it would freeze wallets linked to any entity that is trying to evade sanctions.

Ardoino told DL News earlier this month that Tether is committed to working closely with law enforcement worldwide and cracking down on illicit financial transactions that use USDT.

“We don’t sleep at night. We monitor everything we can, but we are not a country,” said Ardoino.

In working with different agencies and law enforcement, Tether said it has frozen about $500 million in USDT tokens.

And it’s careful not to interfere with ongoing investigations by freezing assets too soon, he said.

“The more stuff moves, the more breadcrumbs you create,” making it easier to follow the money.

Ardoino hopes Tether’s new stance will ease pressure from lawmakers and regulators on a stablecoin provider that has attracted a lot of controversy.

In May, Senator Elizabeth Warren, a Democrat from Massachusetts and leading crypto critic on Capitol Hill, pointed to Tether and Bitcoin’s role in the lethal fentanyl trade.

A United Nations report published earlier this year found that $17 billion of USDT was tied to underground crypto exchanges, illegal trades, and criminal activities in Southeast Asia.

Currency of choice

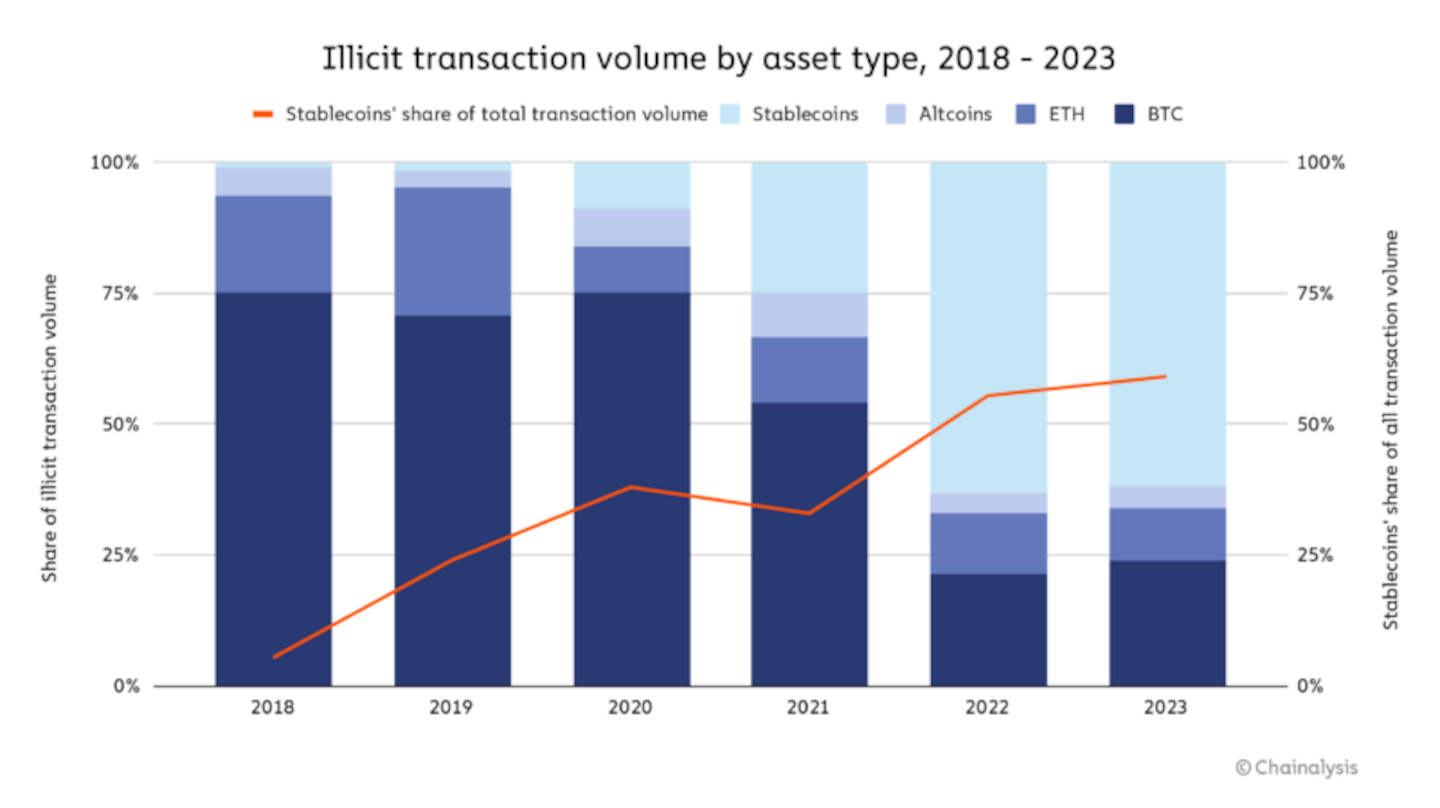

TRM Labs, a crypto sleuthing company, called USDT the “currency of choice” for terrorism financing. A Chainalysis report showed that stablecoins, including Tether, make up roughly 60% of illicit transactions.

Sanctioned entities “have a greater incentive to use stablecoins, as they may face more challenges accessing the U.S. dollar through traditional means but still want to benefit from the stability it provides,” the report states.

JPMorgan Chase analysts told clients that USDT’s dominance is “negative for the stablecoin universe and the crypto ecosystem more broadly.”

It doesn’t help that the company continues to rely on quarterly “attestations” rather than formal audits of its reserves.

This is why Ardoino is keen on persuading one of the Big Four accounting firms to audit its books to demonstrate it has ample dollar reserves to back up USDT’s peg.

Now, the Venezuela situation threatens to cast more doubt on Tether just as Ardoino is trying to turn the page.

And this time, the stablecoin has been swept up in a US foreign policy confrontation.

On Tuesday, Reuters reported that PDVSA’s shift to Tether began last year, and the Biden Administration’s new round of sanctions accelerated its use of the stablecoin.

Crucial economic motor

The oil sector is a crucial economic motor for the South American country, which boasts the world’s largest oil reserves.

The US has imposed economic sanctions to punish President Nicolas Maduro, a strongman who took over after Hugo Chávez in 2013, for failing to hold free and fair elections.

Nicolas Maduro and his representatives have not fully met the commitments made under the electoral roadmap agreement. Therefore, General License 44—which authorized transactions related to the oil and gas sector with Venezuela—will expire after midnight and not be renewed.

— State Department Spokesperson 2013-2025 (@statedeptspox_a) April 17, 2024

In response, Venezuela’s oil giant urged new customers to set up a digital wallet and hold cryptocurrencies to circumvent those new sanctions, Reuters reported.

Tether wasted no time in stating that it respects the sanctions list maintained by the US Treasury Department.

“[Tether] is committed to working to ensure sanction addresses are frozen promptly,” a spokesperson told DL News.

Ardoino said Tether had never worked directly with a sanctioned entity. Instead, he said these entities use USDT outside its own platform where market forces, and not the company’s policies, prevail.

“Secondary markets are the blockchains and the other exchanges,” he told DL News. “But there is no legislation that says that Tether is responsible for those tokens.”

The company has, however, frozen tokens on secondary markets in the past.

In October, Tether froze roughly $873,000 in tokens that were linked to donations to Hamas and illicit activity in Ukraine.

Similarly, in November, Tether froze $225 million in stolen USDT linked to crypto romance scams.

Yet given the $17 billion in suspicious USDT identified by the UN, these relatively small sums show Tether has a long way to go.

Tether says there’s only so much it can do.

“We are not the police,” says Ardoino. “We are not law enforcement.”

Liam Kelly is a Berlin-based DL News’ correspondent. Contact him at liam@dlnews.com.