- Plaintiffs appealed dismissal of their lawsuit against the US Treasury Department.

- Coinbase joins campaign to get US government to recognise smart contracts are a tool and not a 'legal entity.'

- Hackers appear to be moving on from crypto mixers to chain-hopping tools.

In August, a federal judge in Texas delivered a blow to six crypto users on a quixotic quest.

They wanted a legal judgment finding the US government was wrong to sanction Tornado Cash. Instead, Judge Robert Pitman dismissed their case without going to trial.

On Monday, the six plaintiffs led by Ethereum core developer Preston Van Loon appealed the decision and asked a higher court to reinstate their lawsuit.

While beating the US government in a case that involves national security issues is a long shot, the devs do have a powerful ally in their corner — Coinbase.

Core values

The listed US digital assets exchange is not only bankrolling their lawsuit, it is also calling on the crypto community to recognise how core values such as financial privacy and economic freedom are at stake in the case.

Moreover, Paul Grewal, Coinbase’s chief legal officer, said Monday that the integrity of smart contracts, which are the linchpin of the Ethereum ecosystem, is in jeopardy if the US Treasury succeeds in restricting different types of blockchain technology.

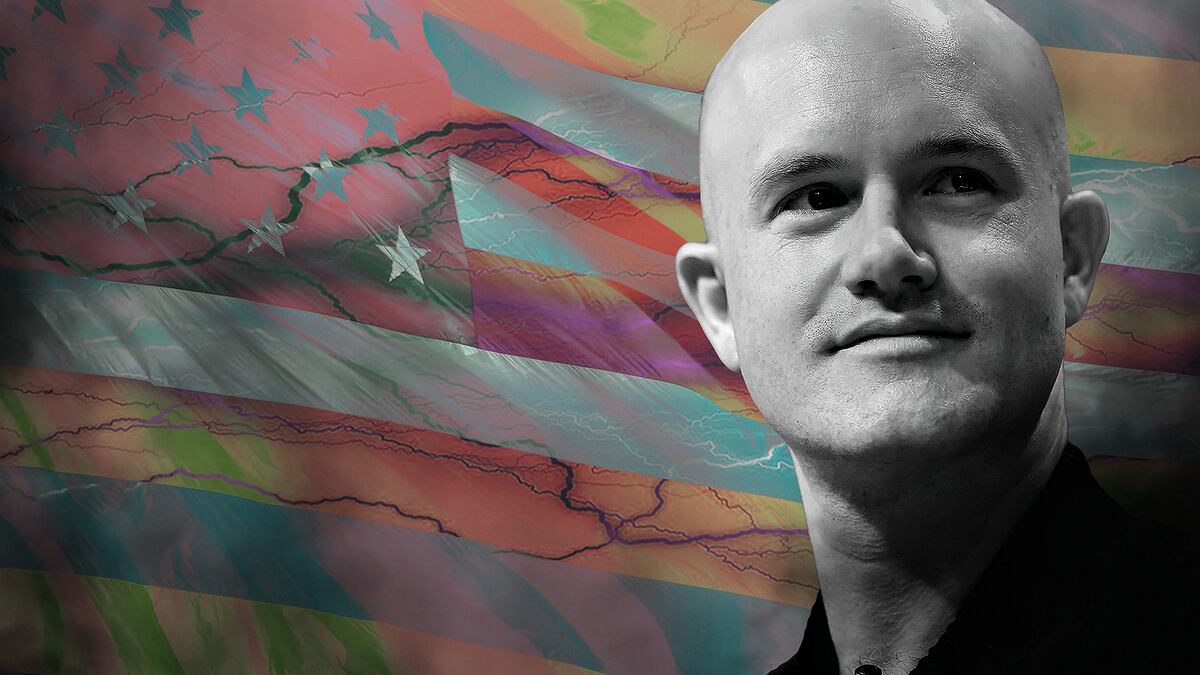

“If these sanctions stand, the damage will extend beyond these six individuals, and even beyond Tornado Cash,” Coinbase CEO Brian Armstrong said on X last year. “Even though we’re not the ones facing the brunt of these damages, we couldn’t stand by.”

The Van Loon case has become the latest flash point in the intensifying legal battle around Tornado Cash, a so-called crypto mixer that enables users to hide their identities when executing transactions.

In August 2022, the US Treasury Department’s Office of Foreign Assets Control sanctioned Tornado Cash after finding that it laundered more than $7 billion in illicit digital assets since its launch in 2019.

This included $455 million worth of crypto assets stolen by the Lazarus Group, a hacking organisation sponsored by North Korea, which has been sanctioned by the US and most other Western nations for funding nuclear arms.

Alexey Pertsev, a Tornado Cash co-founder, is awaiting trial in March in the Netherlands in connection with the sanctions.

The enforcement action, and Pertsev’s arrest, enraged users and members of the DeFi community. Six of them, led by Van Loon, sued the US Treasury Department in US Court in Texas last year.

Attorneys told DL News at the time that the case was “nigh impossible to win.”

Still, the six — who also include Joseph Van Loon, Kevin Vitale, Tyler Almeida, Nate Welch, and Alexander Fisher — pressed forward and were joined by Coinbase and other industry stalwarts.

Fundamental misunderstanding

Two of the industry’s top advocacy groups, the Blockchain Association, and DeFi Education Fund, said the Treasury’s sanctions represented a fundamental misunderstanding of what Tornado is and how it works.

In a brief filed on behalf of the plaintiffs, the organisations said Tornado Cash was simply a tool.

“This software has no owner or operator, and it functions automatically without any human intervention or assistance,” the groups said in court papers.

“Like any tool — indeed, like the internet itself — software like Tornado Cash can be misused for illicit purposes. But it is used primarily for legitimate and socially valuable reasons.”

Similar case

At the same time, Coin Center, a non-profit focused on policy issues, told DL News earlier this month that it would be appealing a Florida court’s decision to also throw out a similar case against the Treasury Department in connection with Tornado Cash.

The hope in crypto circles is that the Van Loon Six case will become a test for how courts view decentralised autonomous organisations and smart contracts.

Crypto leaders such as Armstrong have long argued that blockchain technology and the assets tied to it must be addressed by tailor-made laws and regulations and not the longstanding statutes that control traditional securities such as stocks and bonds.

In fact, this contention lies at the heart of Coinbase’s defence against a lawsuit brought by the US Securities and Exchange Commission against the exchange earlier this year. The agency alleged Coinbase has unlawfully failed to register as a broker-dealer, an exchange, and is making unregistered securities available to investors.

Coinbase has denied the allegations. And it is eager to make its case in as many forums as possible.

Tornado is not property

As for the legal particulars, the Treasury is relying on the International Emergency Economic Powers Act and the North Korea Act to sanction Tornado Cash.

Yet the Van Loon Six contend that under those laws the transactions must involve “property” in which a foreign “national” or sanctioned “person” — that can be a real person or an “entity” — has an “interest.”

But Tornado Cash doesn’t fit these definitions, the plaintiffs argue.

‘The vast majority of the software’s users are ordinary people like the plaintiffs who seek online privacy for entirely legitimate reasons.’

— The Van Loon Six

For one, the law defines “entity” as a group of individuals united for a common purpose — but Tornado Cash is a set of smart contracts on the Ethereum blockchain with no central operator, the plaintiffs argue. And just because criminals may use Tornado Cash that does not justify outlawing it for everyone.

“Although some bad actors have used the Tornado Cash software in the past — for example, to benefit the North Korean government — the vast majority of the software’s users are ordinary people like the plaintiffs who seek online privacy for entirely legitimate reasons,” the plaintiffs said in their appeal on Monday.

Even as the litigation moves into a new phase, North Korean hackers have “largely abandoned [Tornado Cash] in favour of more traditional Bitcoin mixers,” crypto analytics firm TRM Labs said in a report published last month.

Sinbad has since become cybercriminals’ go-to crypto laundering platform, according to Ari Redbord, head of legal and government affairs at TRM Labs.

Another crypto forensics firm, Elliptic, has said Sinbad was likely a rebranded version of another sanctioned crypto mixer, Blender.

Reach out to the authors at aleks@dlnews.com or joanna@dlnews.com.