- SEC Chair nominee Paul Atkins answered Senators’ questions Thursday.

- Few touched on crypto.

- Atkins has deep ties to the industry and pledged to “provide a firm regulatory foundation,” for the asset class.

Paul Atkins, US President Donald Trump’s pick to lead the Securities and Exchange Commission, was largely spared a grilling over his views on cryptocurrency and his ties to crypto firms during a two-hour hearing in the Senate Banking Committee Thursday.

Democrat lawmakers inclined to oppose Trump’s nominees instead questioned the former SEC commissioner over his actions in the lead up to the 2008 financial crisis and his ties to the financial industry writ large.

The SEC is the US’ top financial regulator, and the crypto industry cheered when Trump nominated Atkins.

Former SEC Chair Gary Gensler insisted the vast majority of cryptocurrencies were unregistered securities that should be treated like stocks and bonds.

And he pushed that theory in a series of lawsuits targeting crypto companies large and small, an approach that made him one of the most hated officials among crypto proponents.

Banking Committee Chair Tim Scott, a Republican from South Carolina, said Atkins “will roll back the Biden administration’s disastrous policies.”

“He will promote capital formation and retail investment opportunities and provide long overdue clarity for digital assets,” Scott continued, “ensuring that American innovation does not fall further behind.”

A veteran Washington insider, the 67-year-old Atkins served as an SEC commissioner from 2002-2008.

He later founded Patomak Global Partners, a business consultancy in Washington that counted among its clients banks, credit unions, insurance companies, e-commerce platforms, private equity funds, venture capital funds, crypto firms, and more.

For a Washington lawyer, he was also early to recognise the power of crypto.

Atkins holds up to $6 million in crypto-related assets, according to Fortune, and, since 2017, he has served as the co-chair of the Token Alliance, part of lobby group The Chamber of Digital Commerce.

“Since 2017, I’ve led industry efforts to develop best practices for the digital asset industry,” Atkins said in his opening statement Thursday. “I’ve seen how ambiguous and nonexistent regulation of digital assets create uncertainty in the market and inhibit innovation.”

“A top priority of my chairmanship will be to work with my fellow commissioners and Congress to provide a firm regulatory foundation for digital assets through a rational, coherent, and principled approach.”

Patomak is also listed as a creditor in the FTX bankruptcy for a board-advisory consultancy agreement, dated January 2022 — 10 months before Sam Bankman-Fried’s crypto empire blew up, according to Bloomberg.

It was that relationship that merited one of the brief crypto-related broadsides levelled at Atkins during Thursday’s hearing.

“Mr. Atkins has spent almost his entire career helping billionaire CEOs like Sam Bankman-Fried, who committed one of the biggest financial frauds in US history as the CEO of the failed crypto platform FTX,” said Senator Elizabeth Warren, a Democrat from Massachusetts, the committee’s ranking chair, and one of the industry’s perennial foes in Washington.

Warren had hinted at a more thorough grilling over Atkins’ crypto ties in a 34-page letter earlier this week.

In that letter, she asked the attorney whether he agrees with the agency’s recent decisions to end lawsuits against companies like Coinbase, Kraken, and Consensys.

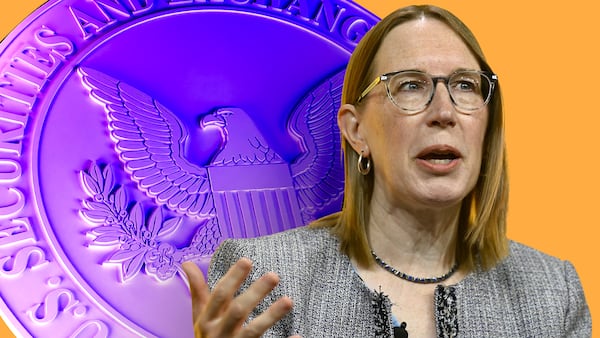

Since Gensler stepped down in January, the SEC has been led on an interim basis by Mark Uyeda, who has sought rapprochement with the industry.

In addition to dropping ongoing lawsuits against and investigations into crypto companies, Uyeda has tapped fellow commissioner Hester Peirce to lead a new crypto task force.

Democrats on Thursday trained most of their fire on Atkins’ tenure at the SEC, when he voted to loosen regulations on the banks that would later go belly-up during the Great Recession.

“Is that an accurate characterisation of your view, that the big problem was over-regulation that led to the 2008 financial crisis?” Senator Raphael Warnock, a Democrat from Georgia, said.

“I think misregulation, I think focusing on the wrong things, was what helped to create that crisis, being distracted by ancillary issues and not focused on what’s really important to the marketplace,” Atkins replied.

Atkins also addressed his ties to Project 2025, the sweeping, pre-election blueprint for a second Trump presidency drafted by The Heritage Foundation, a conservative think tank. Atkins said his participation was limited to “a couple phone calls.”

Aleks Gilbert is a DeFi correspondent based in New York. He can be reached at aleks@dlnews.com.