- The White House and Congress laid out a bevy of ambitious changes for the digital assets industry.

- Stablecoins lead a flurry of bill writing.

- Some market experts highlighted a surprising ally in the push for new laws.

A version of this story appeared in our The Roundup newsletter on February 7. Sign up here.

After months of mounting expectations about big changes in crypto policy, the Trump administration laid down some markers this week.

On Tuesday, David Sacks, President Donald Trump’s senior adviser on AI and crypto, promised to deliver the “regulatory clarity” long sought by industry leaders such as Coinbase CEO Brian Armstrong.

Flanked by Senator Tim Scott, the powerful chairman of the Senate Banking Committee, and other senior Republican lawmakers, Sacks said now was the moment to establish “rules of the road” for the industry, Aleks Gilbert reported.

As for who, exactly, Sacks is, Andrew Flanagan wrote a profile of the one time PayPal chief operating officer and venture capitalist.

Turns out Sacks, with 1.2 million X followers, has been an influential voice in Silicon Valley’s lurch to the right over the past few years.

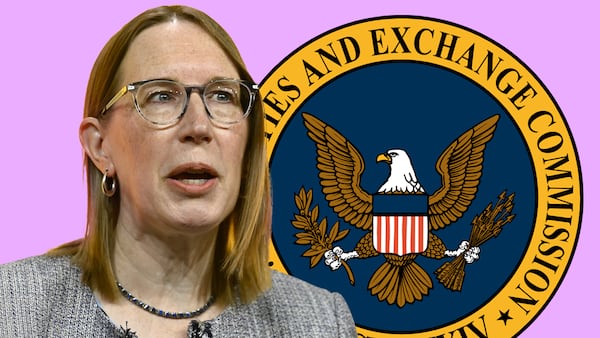

Meanwhile, Hester Peirce, a commissioner on the Securities and Exchange Commission, set the tone for changes to come now that the crackdown pursued by former chair Gary Gensler is finished.

Peirce said investors taking the plunge in Bitcoin and its ilk should accept the market risks and not cry to “Mama Government” for a bailout if they lose their shirts, Ben Weiss reported.

Debanking gets a hearing

There was action on Capitol Hill, too.

On Thursday, Scott’s banking committee held the first hearings on alleged “debanking” of crypto firms and individuals. The issue has become a rallying cry for the likes of Marc Andreessen, the Silicon Valley billionaire VC, and Kraken co-founder Jesse Powell.

Coinbase submitted a letter calling alleged debanking “untenable,” reported Andrew. The House is planning to hold its own hearing on the issue.

On Tuesday, Senator Bill Hagerty, a Republican from Tennessee, introduced legislation that is designed to establish rules for stablecoin issuers in the US.

Moreover, the bill could also be a boost for tokenisation because real-world assets such as stocks and bonds that are placed on-chain would operate similarly to stablecoins, Liam Kelly reported.

Scared Democrats

With industry hopes running high for the bill, it’s bound to become a test for Republicans. But they will get help from a surprising source — the Democrats.

That was Anthony Scaramucci’s take at a crypto conference in London on Monday. He said Congress will pass crypto bills by November, or March 2026 at the latest.

Why? Because Democrats were burned in the 2024 election by crypto industry campaign spending.

“The Democrats are scared out of their minds by crypto political action committees,” Scaramucci said on a panel discussion at the Digital Assets Forum. “There is no reason for them to go hard on this industry.”

Edward Robinson is the story editor for DL News. Contact the author at ed@dlnews.com.