- Binance is among the crypto providers struggling to comply with the FCA’s complex new rules on marketing promotions.

- The regulator warns that many firms fall afoul of the ad rules and that they need to get their act together ahead of a January deadline.

- Consequences for non-adherence include jail time and fines.

The UK’s leading financial markets watchdog warned that it expects “cryptoasset firms to take their regulatory obligations seriously” after it found that many companies are failing to comply with new advertising rules.

And the clock is ticking — the industry only has until January to meet the demands of the new rules introduced by the Financial Conduct Authority on October 8.

If they don’t, that’s a criminal offence, punishable by hefty fines or even up to two years in prison.

Crypto providers — like the world’s leading exchange Binance and payments giant PayPal — have responded to the rules by pausing services entirely to UK customers.

Industry stakeholders say the new rules are “impossible” to follow and raise questions about how viable Prime Minister Rishi Sunak’s pledge to transform London into a hub for digital assets really is.

“This all comes back to the idea of what the UK wants to be,” Oliver Linch, CEO of Liechtenstein-based exchange Bittrex Global, told DL News.

“We have a situation where the UK has said, ‘We want to be a global hub, come invest in the UK, we’re going to be the crypto guys.’ And then just a few months later, tells you that you might have to entirely switch off the UK and not serve any customers there.”

Ad rules too complex

Financial firms like banks must follow strict rules when advertising investment products to consumers in the UK — whether those ads are online, in print media, or plastered on buses and railway stations.

In 2022, the FCA grew concerned that crypto firms were ramping up their marketing in Britain, and consulted on expanding existing marketing rules to crypto.

The expanded rules went into effect on October 8, but the regulator has since noted several common breaches to them.

But the industry says the rules are simply too convoluted to follow.

The worst complexity stems from the rules’ third-party approval regime for unregistered crypto companies, Linch told DL News.

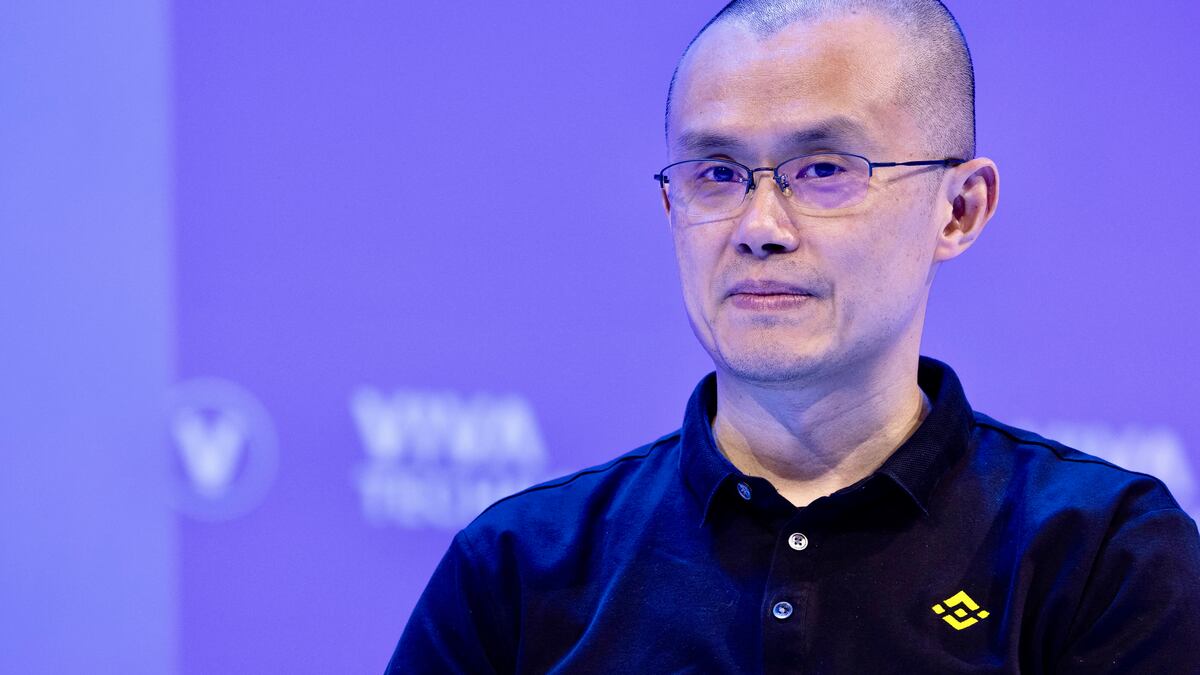

Firms that want to promote financial products to UK consumers must be registered with the FCA. But many crypto firms, such as Binance, are not.

If they want to promote their services in the country, these unregistered companies can go through firms that are registered with the FCA and empowered to greenlight the marketing communications of others.

These third parties are known as “Section 21 approvers.”

Binance, for instance, engaged peer-to-peer platform rebuildingsociety.com as its Section 21 approver, announcing a new domain for UK customers as the FCA rules went live.

But Binance’s partnership with rebuildingsociety.com was short-lived.

Just two days after announcing the new domain, the FCA imposed new restrictions on rebuildingsociety.com, and it could no longer act as a Section 21 approver.

Binance said it would not accept new UK customers until it found another approver.

Many other businesses have also chosen to suspend services to UK customers as they wrap their heads around the Section 21 regime ahead of the FCA’s January 8, 2024 compliance deadline.

Payments giant PayPal said it would halt some services in the UK in October. ByBit and Digital Currency Group-owned Luno soon followed.

Linch said the Section 21 approver concept is new in crypto. Of the few approval providers that exist, many are reluctant or inexperienced in providing the service for crypto.

“So there’s a lot of scrabbling around, frankly, trying to piece together how this is going to work,” Linch said.

Firehose of misinformation

The FCA, for its part, has argued that the new rules are essential to protect UK consumers from being exposed to a firehose of financial promotions via Meta and Google.

“Consumers are often targeted with adverts that are unclear, unfair or misleading, and this can lead consumers to access products that do not suit their circumstances,” the regulator said in a policy note.

The cost-of-living crisis has made consumers more vulnerable and in some cases prone to poor decision making, it added.

“We aim to use our regulation to address the imbalance in knowledge about financial services between firms and consumers.”

An FCA spokesperson told DL News that the regulator has been engaging extensively with registered and non-registered firms throughout the implementation period.

“Where necessary, we’ve also set clear expectations for what we expect when these rules come in,” they said.

Ian Taylor, who is head of crypto and digital assets at KPMG and a board adviser at CryptoUK, told DL News that the industry association is working closely with the Treasury, FCA, and the industry to “iron out the kinks” in the promotions rules.

“And there are some kinks with regard to the Section 21 approval,” Taylor said.

“But this industry is not even a teenager. We’re toddlers in terms of the time that we’ve been around, that our members have been actively engaged in providing services. So it’s going to take a bit of time to see the regulator working with us.”

Do you have an opinion or a tip about crypto legislation, in the UK or worldwide? Contact me at joanna@dlnews.com.