- As MiCA goes live, gaps are opening between the EU and US on how their respective regulators will treat stablecoins.

- MiCA’s stance on central banks deposits could create a tilted playing field for token service providers.

- It’s also one of the contentious issues dividing US lawmakers as their efforts to write stablecoin laws flail.

If the US’s approach to stablecoins goes ahead as indicated by a bipartisan draft bill published last month, it could give US firms an advantage over those in the European Union, industry participants said.

“Ultimately, the US proposal could create a competitive advantage for the US dollar over the EU, as it seems to prioritise fostering innovation and growth rather than protecting banks’ interests,” Jon Helgi Egilsson, co-founder and chairman of e-money provider Monerium, told DL News.

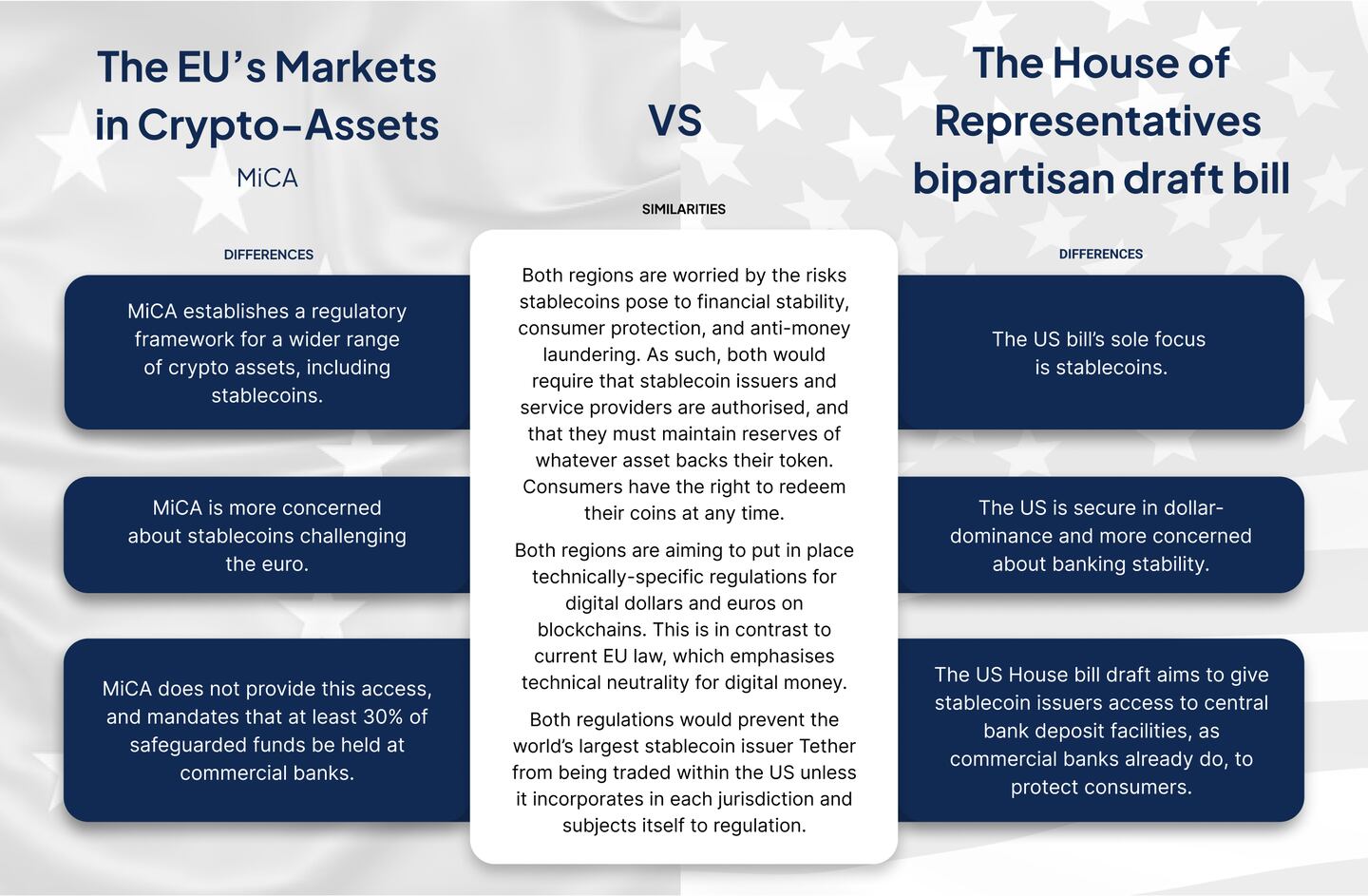

The EU and the US share worries about stablecoins relating to consumer protection, anti-money laundering, and financial stability — fears underscored by the collapse of Terra LUNA and FTX exchange, and an ongoing banking crisis.

But the regions’ approaches to stablecoin laws differ fundamentally in places. Most crucially, they clash on issuers’ access to central bank deposits, Egilsson said.

The US draft bill is the result of a joint effort during last year’s congress between Democrat Maxine Waters and Republican Patrick McHenry, then House Financial Services Committee chair and ranking member respectively. They switched roles this year.

The bipartisan draft bill instantiates the Federal Reserve as the regulator of stablecoins, and gives the central bank the power to set strict risk and liquidity requirements on issuers.

But the draft bill also grants issuers of payment stablecoins, tokens backed by treasuries or dollars, a significant benefit of Federal Reserve oversight. They would be able to stash their cash in its deposit accounts, which are more protected from economic turmoil and bank runs than commercial banks’ accounts are.

MiCA, on the other hand, does not provide the equivalent access for non-bank stablecoin issuers.

“And worse, MiCA mandates that at least 30% of safeguarded funds be held at commercial banks,” Egilsson said.

“This minimum 30% requirement undermines one of the main advantages of blockchain technology, which is to enable payment transactions without the need for intermediaries such as banks.”

This requirement could create barriers to entry for non-bank payment service providers like Monerium, stifling competitiveness, Egilsson said.

NOW READ: We compared the ‘unbridgeable chasm’ between Europe and US crypto laws

Different primary concerns

The blocs’ different approaches stem from different primary concerns, Mark Lurie, CEO and co-founder of decentralised exchange provider Shipyard Software, told DL News. While the EU is more worried about threats to the Euro’s dominance, the US is focused on banking stability.

“MiCA is more concerned about stablecoins challenging the power of the Euro itself, perhaps prompted by Facebook’s attempted Libra issuance and the dominance of USD-backed stablecoins,” Lurie said.

As such, MiCA imposes strategic constraints on “significant” stablecoins, including those backed by one currency and those backed by a basket of assets, like Libra would have been.

NOW READ: Stablecoins and Binance next in SEC crosshairs after Coinbase warning

“Meanwhile, reserves can be kept in normal banks and invested in a TBD set of low-risk securities,” Lurie said.

The US, on the other hand, is secure in the dominance of the mighty dollar, and more concerned about banking stability, Lurie said — hence its stance on central bank deposit account access.

Long road ahead

Egilsson and Lurie emphasised, however, that the US bill is still very much in draft form and has a long way to go before being approved.

“While the EU’s approach to stablecoin regulation is indeed taking shape with the passage of MiCA, the same can’t be said of the US,” Lurie said.

“While the EU’s approach to stablecoin regulation is indeed taking shape with the passage of MiCA, the same can’t be said of the US.”

Part of the reason US efforts have stalled is that issuers’ access to Federal Reserve accounts is a bone of contention within Congress, he added.

“The biggest disagreements seem to be around whether stablecoin reserves can be issued by or held in depository accounts of banks that operate on a fractional reserve basis,” Lurie said.

“Bank runs are already happening faster. There is real disagreement as to whether stablecoins might worsen the problem. Don’t expect a bill before that nut is worked out.”

NOW READ: Bank meltdown crushes crypto regulation hopes: ‘Crypto in the US is dead’

Waters and McHenry partially negotiated the draft bill, which sought to establish a regulatory framework specifically for stablecoins, in the last congress. During the process, McHenry called it “an ugly baby” that was struggling to grow as compromises were worked out.

The bill was circulated internally among committee members in September 2022, but negotiations stalled. And following the midterm elections, that bill was put on the same regulatory bonfire as all the other bills presented during the last congress.

The bipartisan bill was eventually published in April. But at a hearing that same week, Waters said Congress should “start from scratch” on stablecoin regulation, as the bill didn’t take cognisance of seismic events that roiled crypto in 2022, such as the collapse of Terra Luna and of FTX.

Waters also said she was frustrated that Republicans were working on their own version of the bill, which was published days after the hearing. House Democrats, also, are reportedly working on their own version.