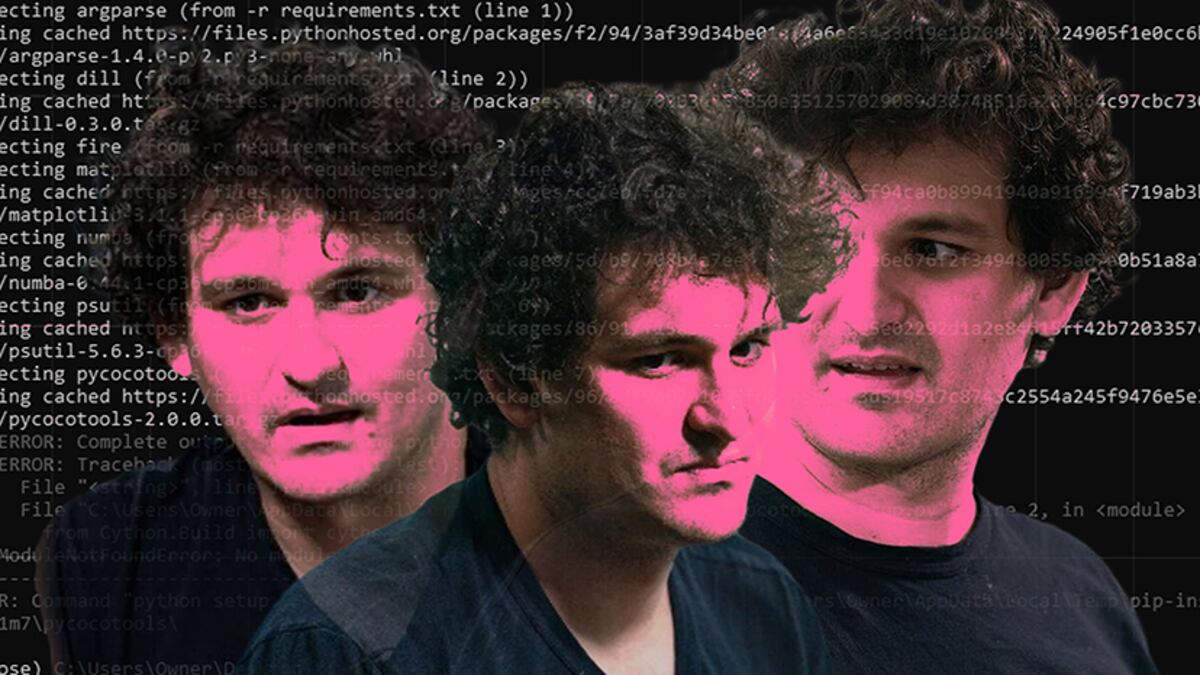

- Lost money in the FTX crash? Don’t expect Sam Bankman-Fried’s trial to make you whole anytime soon.

- As crypto’s former golden boy faces the court this week, the case highlights how hard it is for creditors to get what they’re owed.

- The industry’s complexity makes it challenging for anyone, save for lawyers, to come out as winners from the bankruptcy.

A version of this story appeared in our The Guidance newsletter. If you want to read this or our other newsletters before your friends do, don’t hesitate to sign up.

Happy Monday!

Joanna here.

As the world awaits the Sam Bankman-Fried’s trial, which starts tomorrow, DL News took a closer look at FTX’s bankruptcy case.

The FTX estate is suing Bankman-Fried’s mom and dad for millions they allegedly misappropriated.

Frankly, FTX’s lawsuit filing is wild.

It paints a picture of two opportunistic Svengalis, closely advising the college grads running FTX while treating it as their piggy bank — funding luxury homes, lavish travel, and campaign donations.

But behind the juicy details and general media frenzy are FTX’s depositors.

I’m not talking about big firms like BlackRock or Sequoia — somehow, I think they’ll be fine — but rather the million-odd ordinary people screwed out of $8 billion.

Many invested their life savings in FTX. They weren’t gullible fools. They saw the fawning media coverage, celebrity endorsements, appearances at prestigious conferences, and the disregard for professional dress codes that apparently marked “SBF” as an iconoclastic boy genius.

They just wanted in on what the cognoscenti seemed to think was a good thing.

And now the creditors of FTX — along with those of Celsius Network, Voyager Digital, Gemini Trust, BlockFi, and so on — can only wait for the decisions of courts or restructuring teams.

Bankruptcy under Chapter 11 of the US tax code is never smooth, exactly, but it is a path well worn with precedent and clear laws facilitating the orderly winding down or restructuring of a business.

Debtors can remain in possession of their companies, protected against asset grabs from creditors. Creditors might have to wait to get what they are owed, but they have a better chance of eventually reclaiming it.

Crypto throws a spanner in the works.

Cryptocurrencies are difficult to value. No one is quite sure whether to treat them as commodities or securities. And it’s not always clear who owns crypto — the failed lender/exchange or the user.

All of these factors have implications for whether a depositor can get their crypto back, even in part.

Crypto creditors are often treated as “unsecured,” meaning they’re at the back of the queue when the bankruptcy estate finally distributes assets.

And distributions in unsecured claims are often pennies on the dollar.

Celsius filed for bankruptcy in mid-2022. In January, a federal judge ruled that Celsius, rather than certain of its depositors, owned most of the crypto on its platform, classifying the depositors as unsecured creditors.

Celsius creditors overwhelmingly voted recently to approve a restructuring plan that will see a new company formed. Investors will get back around $2 billion worth of Bitcoin and Ether, plus equity in the new company.

FTX has managed to gather $7.3 billion in assets. A Delaware court ruled that customers may claim these assets from the restructuring plan.

So these are happy(ish) endings.

It’s worth remembering, though, that for many people who trusted Bankman-Fried and another seemingly legit founder, Celsius CEO Alex Mashinsky, it’s too little too late.

The only real winners are the lawyers.

For an interview with one Celsius customer’s personal hell as the lender foundered, click here.

Have you been burned in a crypto Chapter 11 case and want to talk about it? Or just have a question or opinion to share? Email joanna@dlnews.com or Telegram @joannallama.

How crypto lawyers plan to counterattack the SEC after Grayscale and Ripple court wins

The Securities and Exchange Commission has sued crypto industry players large and small. But attorneys for associations like the DeFi Education Fund told DL News they are planning a counteroffensive. Their weapons? Obscure administrative laws and challenges to enforcement actions.

Post of the week

Sam Bankman-Fried used stolen money from working class people to pay off corporate media and politicians, who portrayed him as a visionary entrepreneur. This fake portrayal was then used to raise hundreds of millions of dollars from institutional investors which was used to…

— Nick Tomaino (@NTmoney) September 28, 2023

Comments

“You [the blockchain industry] really have to up your game. We have ambitions for the European blockchain sector to be in the lead,” Pearse O’Donohue, director for the future networks at the European Commission’s department for communications networks, content and technology, told a summit recently. O’Donohue said the EC wants to build an EU-wide blockchain, but the industry must provide the know-how.