- Investors will pour $12 billion into crypto startups in 2024, experts say.

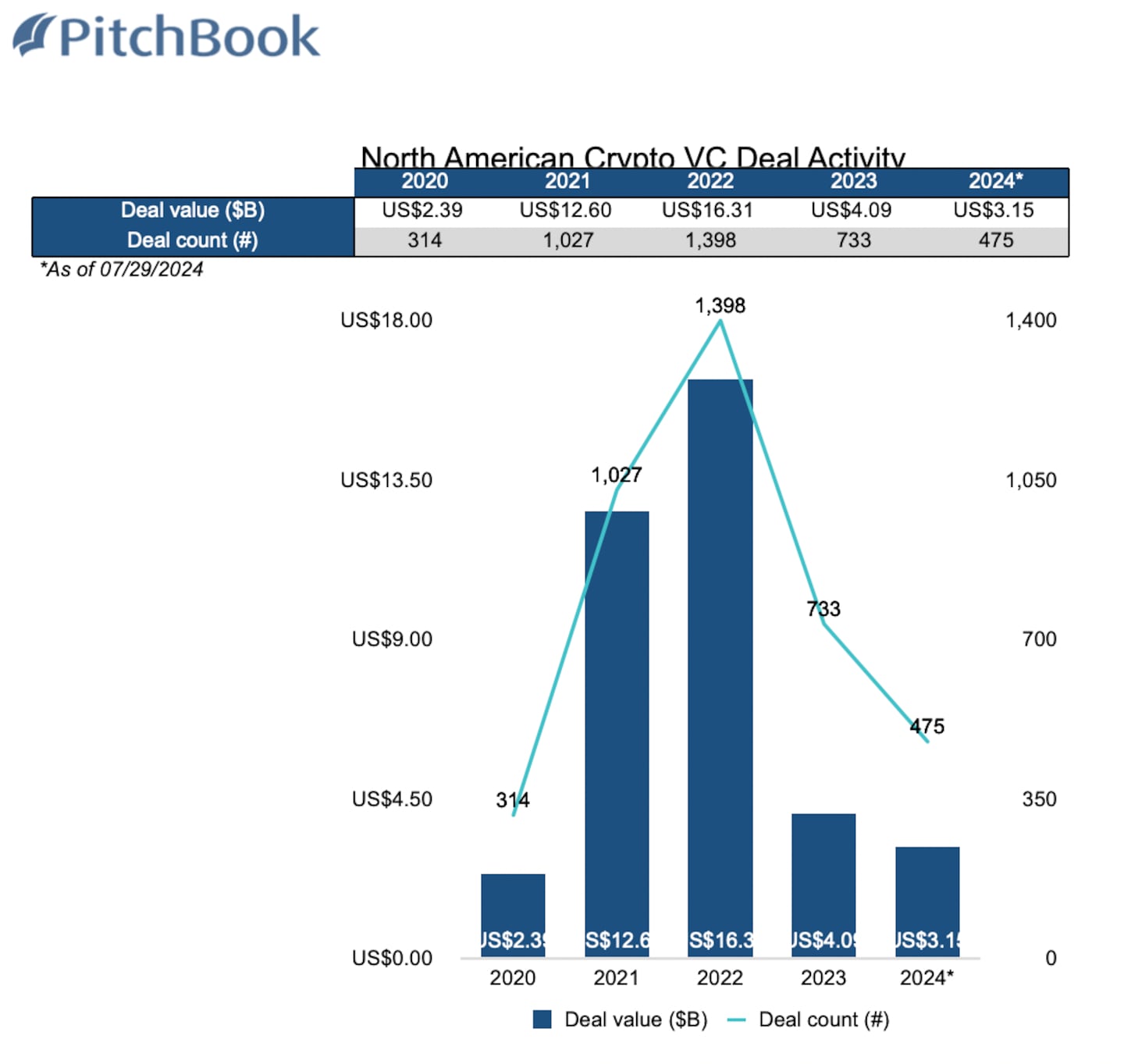

- North American startups have already bagged $3.1 billion this year.

- The US election may trigger even more funding.

Crypto startups are on track to outstrip the $8.2 billion raised in 2023.

Investors will pour over $12 billion into industry projects this year, and firms have already secured over $5.5 billion in 2024, according to PitchBook data.

However, others say the US election may trigger an even bigger payday — especially in North America, which has grabbed more than half of all funding.

The argument? A win from pro-crypto candidate Donald Trump will trigger a wave of bullish investment.

“Should Trump win the presidential election, we might see an acceleration of VC funding into crypto,” Joshua de Vos, research lead at digital asset data provider CCData, told DL News.

“The removal of current administrative uncertainties could lead to clearer regulations, new opportunities, and enhanced funding and tax breaks.”

Several strong tailwinds have bolstered industry confidence in 2024 after it elbowed itself into the US election cycle.

The launch of spot Bitcoin and Ethereum exchange-traded funds, and signs that the Federal Reserve may cut interest rates have strengthened the narrative that a new bull market is on the way.

North America takes lead

North American crypto startups have secured more funding than projects in any other continent, according to new PitchBook data.

“America dominates global innovation, harbouring the largest capital markets and facilitating investment into growing, nascent industries such as crypto and AI,” de Vos said.

The continent’s crypto companies have grabbed 56%, or $3.1 billion, of all global funding so far this year, up from almost 50% in 2023.

It’s still below the 63% slice of global investments North American crypto projects grabbed in 2022.

Europe and Asia came in a shared second place. Projects in those regions both received $1.2 billion this year.

Australian and South American startups secured $40 million and $30 million, respectively.

Election boom

The data comes as the US gears up for the November election, which has been marred by criminal convictions, an assassination attempt, and incumbent Joe Biden’s withdrawal from the race.

The crypto industry has muscled into the election, arguing that crypto is a key issue that could determine the outcome.

While Biden’s heir-apparent Vice President Kamala Harris has taken no public stance on the sector, Trump has come out as an ally.

He has pledged to create a national Bitcoin stockpile and to oust Gary Gensler, the Securities and Exchange Commission chair who has launched a barrage of enforcement actions against crypto heavyweights.

Those promises have earned Trump the support of many in the industry.

Keld van Schreven, co-founder and managing director of digital asset investor KR1, told DL News: “This election could be a pivotal moment for the industry.”

Crypto market movers

- Bitcoin is down 0.7% over the past 24 hours to trade at $66,097.

- Ethereum is down 0.5% to trade at $3,320.

What we’re reading

- Inside Caitlin Long’s never-say-die bid to beat the Fed on crypto banking — DL News

- SEC Charges BitClout Founder With $257 Million Crypto Fraud — Milk Road

- Terra Blockchain Briefly Halted After IBC Hooks Exploiter Steals Tokens — Unchained

- Mt. Gox Moves Over $2 Billion In Bitcoin, BTC Price Remains Steady — Milk Road

- Solana protocol offers way to short $53b memecoin market — and it’s teasing an airdrop — DL News

Eric Johansson is DL News’ News Editor. Got a tip? Email at eric@dlnews.com.