- Alameda Research’s 2018 pitch to investors outlines the hedge fund’s strategy and “no downside” ask for funds.

- The firm boasted robust banking, legal, and accounting practices.

- It also contained early red flags, such as a 15% guaranteed return on loans.

Happy Tuesday!

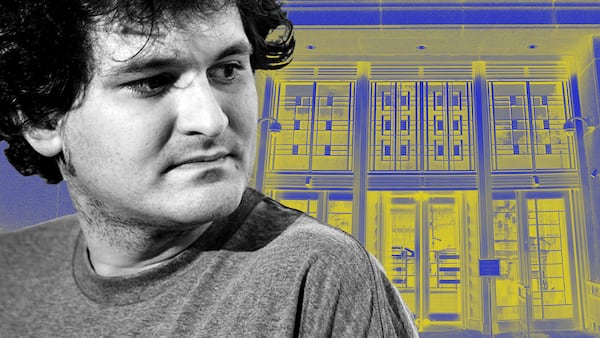

Alameda Research, the crypto trading firm launched by Sam Bankman-Fried, offered 15% in interest to any company willing to lend it funds, a 2018 pitch to investors obtained by DL News shows.

Let’s dive into it.

15% returns

Alameda Research boasted of being “among the most serious firms across the globe” in the very first paragraph of its pitch to investors.

The trading firm, which was launched by Bankman-Fried and Tara Mac Aulay in November 2017, offered 15% annualised fixed-rate loans to investors — with no lockups.

The company said it could discuss even higher rates of return on investments north of $50 million.

Alameda also said in the document that it employed a market-neutral approach.

“We avoid making directional bets and never have more than 10% of our AUM in unhedged positions,” the pitch deck says, using shorthand for assets under management.

“These loans have no downside,” wrote Alameda, before giving investors the option of recalling their funds if the firm ever experienced a 2% drawdown over a month.

Alameda’s former CEO Caroline Ellison testified last month that Alameda Research used FTX customer funds to cover its billions in losses.

DL News was not able to independently ascertain the authenticity of the document.

Alameda also boasted of having a “solid operational framework with robust banking, legal, accounting, and exchange-partnership infrastructure.”

However, Michael Lewis, in his book “Going Infinite: The Rise and Fall of a New Tycoon,” wrote that that Alameda had already misplaced $4 million worth of XRP tokens in early 2018. The issue led to Mac Auley’s departure from the firm.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” bankruptcy expert and current FTX CEO John Ray said after poring over the collapsed exchange in 2022.

Bankman-Fried was convicted in an initial trial last week of all seven fraud and conspiracy charges brought against him by the Department of Justice. He will face more DOJ charges, including bribery and campaign finance violations, in a separate trial.

Bankman-Fried’s is scheduled to be sentenced in March. He faces a lifetime in prison.

Ellison, FTX co-founder Gary Wang, and FTX head of engineering Nishad Singh, who testified against Bankman-Fried, are also showcased in the Alameda pitch to investors.

Ellison, Wang, and Singh pleaded guilty to various counts of fraud.

Crypto market movers

- Bitcoin is down 1.4% in the last 24 hours, falling to $34,702.

- Ethereum slumped 1% in the same period, at $1,874.

- Toncoin is up 4%.

What we’re reading

- Why they hate you — DL News

- See how Lido’s deposits soared 188% this year and blew away the rest of DeFi — DL News

- Solana airdrops signal market U-turn as token surges more than 70% — DL News

Tom Carreras is a Markets Correspondent at DL News. Got a tip? Reach out at tcarreras@dlnews.com