- Crypto prices are in the red across the board as September looks to deliver another down month.

- Investors will keep a close eye on Wednesday’s inflation data ahead of the Fed’s next interest rate decision on September 20.

Happy Monday!

Altcoins led the decline in crypto prices as the market contracted over the weekend and into Monday. US inflation data is slated for release this week and analysts expect prices to have risen month-on-month.

Let’s dig in!

Macro matters

US Inflation data for August will be released on Wednesday, the first of several important economic indicators to drop this week.

Retail sales data is scheduled for Thursday, with consumer sentiment data slated for Friday.

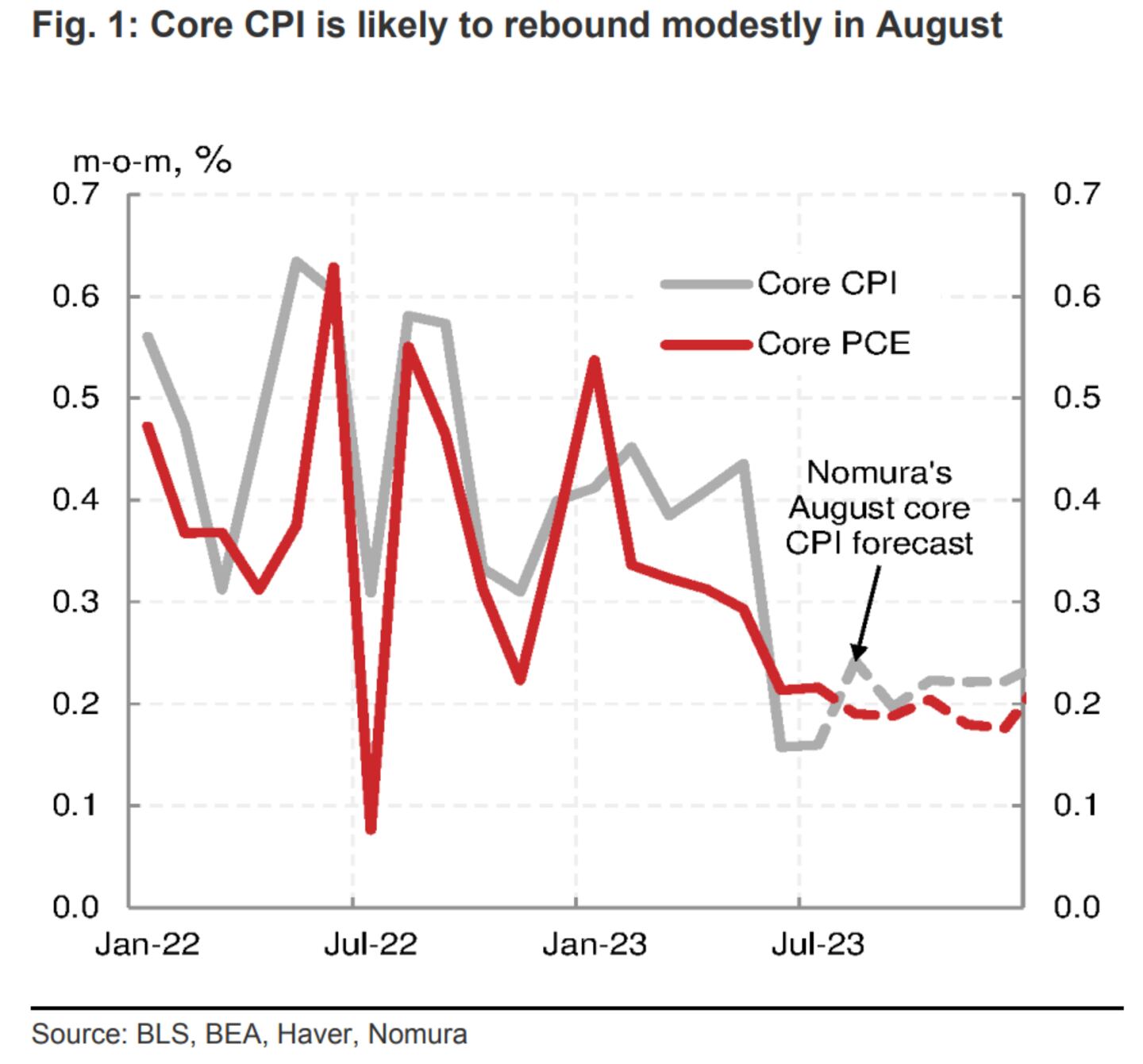

Analysts at investment bank Nomura expect core inflation — which excludes food and energy sectors — to have rebounded slightly in August, rising around 0.24% month-on-month.

“We expect headline inflation accelerated to 0.6% month-on-month, driven largely by rising gasoline prices,” the investment bank said.

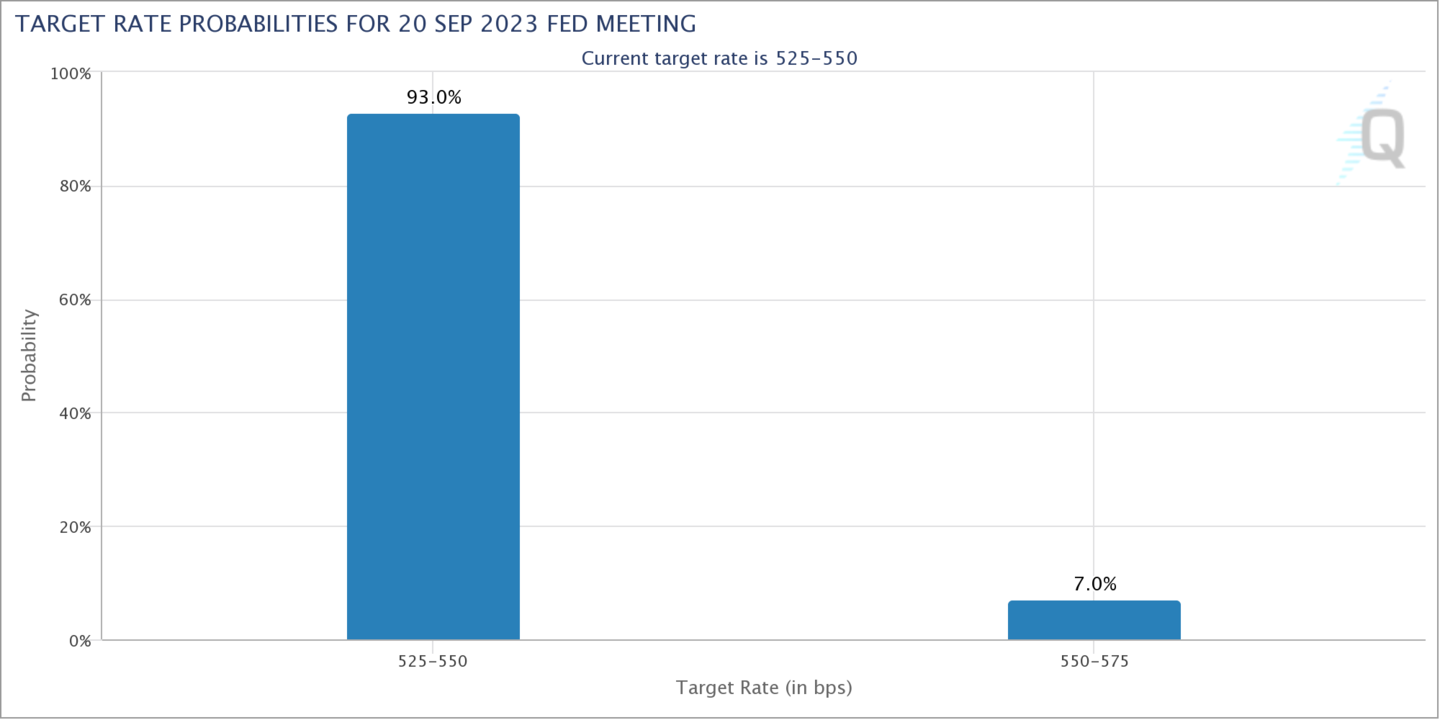

Despite a projected slight uptick in prices, the US Federal Reserve is expected to pause interest rate increases at its meeting on September 20.

The CME’s FedWatch says the probability of a pause is 93%. The tool analyses the probability of changes to the central bank’s interest rate as implied by 30-Day Fed Funds futures pricing data.

The Fed entered its latest blackout period over the weekend, ahead of next week’s decision, referring to how the central bank limits the extent to which participants of the Federal Open Markets Committee, its policy setting team, can speak publicly during these blackouts.

It begins the second Saturday before a FOMC meeting and end the day after the meeting.

Crypto market movers

- Bitcoin slid 0.6% over the past 24 hours, to trade around $25,700. Stock market returns are historically bad in the month of September and Bitcoin is no different. It has averaged a 6% loss in September over the past ten years.

- Ethereum dropped 2.1% to trade below $1,600. Its now down 3% over the last seven days.

- Altcoins experienced sharper declines since Sunday. The Binance-affiliated BNB dipped 2.2%, Ripple’s XRP was down 5.3%, and Solana’s SOL fell 3.7%. Paradigm, the crypto derivatives platform, said the decline was “probably due to discussions around FTX liquidations,” in its “edge” Telegram group.

What we’re reading

- Ethereum co-founder Vitalik Buterin’s X account compromised as over $700,000 drained via suspicious link — DL News

- Gold ETF launch holds lessons for Bitcoin investors — DL News

- ‘Pig butchering’ crypto scams and those who fight back — DL News

- Anyone involved in DeFi would be scrutinised under sweeping policy proposal — DL News