- Ark Invest filed for several new crypto ETFs.

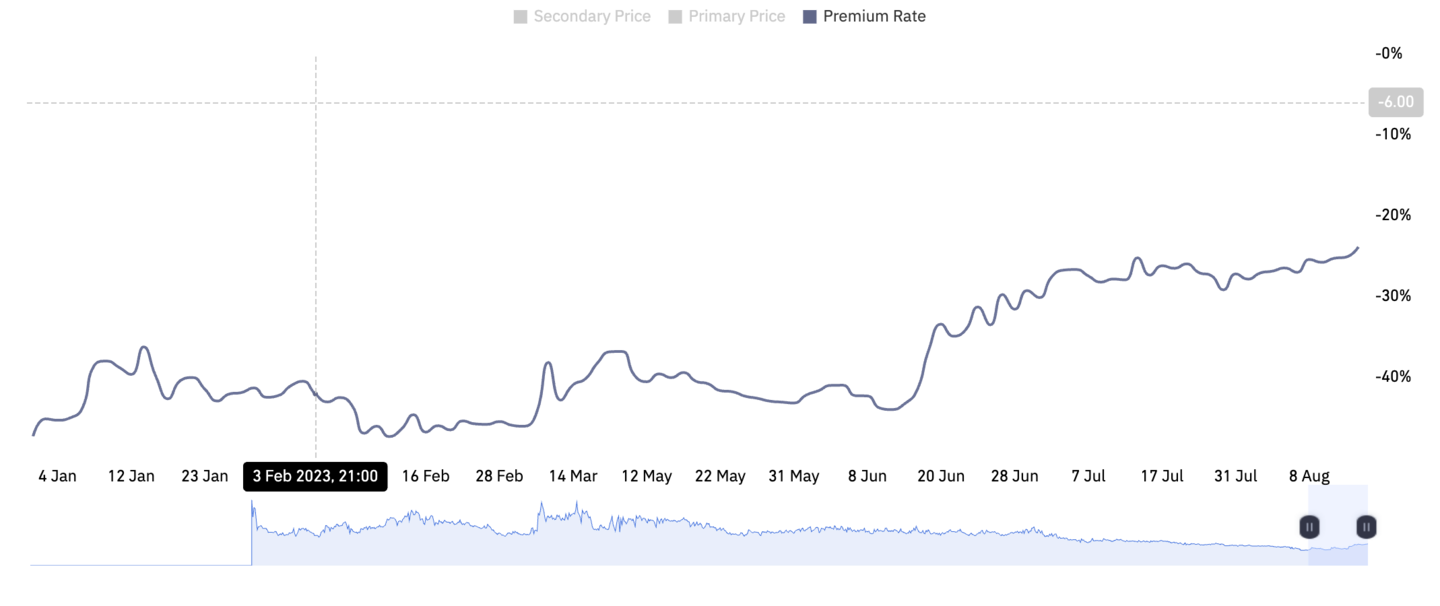

- Grayscale’s discount to net asset value has fallen 20% since June as a decision in its case with the SEC may be imminent.

- The price of cryptocurrencies linked to SEC cases or dubbed securities by the agency have jumped over the past week.

Happy Tuesday!

Ark Invest filed for several new crypto-related exchange-traded fund products last week, as the Securities and Exchange Commission delayed its decision on the investment firm’s spot Bitcoin application.

Elsewhere, Grayscale’s discount to net asset value has been slashed as a decision in its case with the regulator could be imminent.

We’ve got a lot to dig into today, so let’s get to it!

Ark ETF application

Cathie Wood’s Ark Invest filed for several new crypto-related ETFs last week, new filings reveal.

The asset manager applied to two Bitcoin-related funds — the Ark 21Shares Active Bitcoin Futures ETF, which would invest in cash-settled futures on the CME, and the Ark 21Shares Active On-Chain Bitcoin Strategy ETF, which would also invest in futures contracts.

The Ark Active On-Chain Bitcoin Strategy ETF would use a trend indicator developed by Ark to decide whether the market was bullish or bearish.

The indicator will assess on-chain data to determine this, and allocations will be made accordingly.

The firm also filed for the Ark 21Shares Digital Asset and Blockchain Strategy ETF, which would invest in equities related to digital assets and blockchain technology.

Nate Geraci, president of investment advisor ETF Store, said that the equities-based filing was an odd one from Ark. Particularly given how “saturated” the space is. Geraci suggested that Ark might not be too confident about its spot Bitcoin ETF application.

Odd filing given how saturated this space is...

— Nate Geraci (@NateGeraci) August 14, 2023

Wonder if there's anything to read into here re: ARK's confidence around spot btc approval (which if that happens, these blockchain ETFs would face an addn'l headwind in terms of competition).

So maybe ARK not that confident.

Grayscale discount

The Grayscale Bitcoin Trust’s discount to net asset value has narrowed to about 23% from over 43% since June as investors flocked to buy shares in the trust.

GBTC trades at a discount to the net asset value, as shares in the fund don’t grant the holder access to the underlying assets. Basically, GBTC shares aren’t exchangeable one-to-one for the Bitcoin held by Grayscale.

Therefore, the market price of GBTC shares is around 23% lower than the value of the Bitcoin in the fund, or its net asset value. Basically, if you could exchange your GBTC shares for Bitcoin, then they’d be worth about 23% less than the market value of Bitcoin.

Grayscale is currently embroiled in a legal battle with the SEC to convert GBTC into a spot Bitcoin ETF. The case with the SEC could have an outcome today, following its hearing in March.

Analysts at Bloomberg Intelligence and a lawyer at Davis Polk suggested last night that tthe asset manager could expect a ruling in its case against the SEC soon.

They argued that similar cases are settled around 160 days after the initial hearing. The Grayscale case was heard in March — a little over 160 days ago.

Scott Johnsson, an associate at Davis Polk, noted that these rulings are typically filed on Tuesdays and Fridays at 11 am New York time.

So keep an eye out!

Crypto market movers

- Bitcoin was flat over the past day, trading around $29,300.

- Ethereum was down just 0.1% to about $1,850.

- Cryptocurrencies the SEC branded securities,SEC securities coins, as CoinGecko has dubbed them, have experienced sharp price increases in the past week. Solana’s SOL gained 1.8% in the past day, while it was up 7.6% over the past seven.

What we’re reading

- Singapore imposes rules to make stablecoins ‘credible digital medium of exchange’ – DL News

- The Decentralised: Coinbase’s layer 2 launches and Goldfinch in trouble – DL News

Adam Morgan McCarthy is a London-based markets correspondent for DL News. To contact him with story tips, reach out at adam@dlnews.com.