- Coinbase’s outlook for 2024 outlines transitions that hint at wider adoption and more use cases for blockchain technology.

- Bitcoin’s surge ahead of potential spot ETF approval is among big shifts ahead.

Coinbase released its 2024 Crypto Market Outlook on Thursday — and it says summer is coming sooner than expected for the crypto industry.

The 83-page report bookends a year in which crypto prices have seen a steady recovery from the bear market that started in 2022.

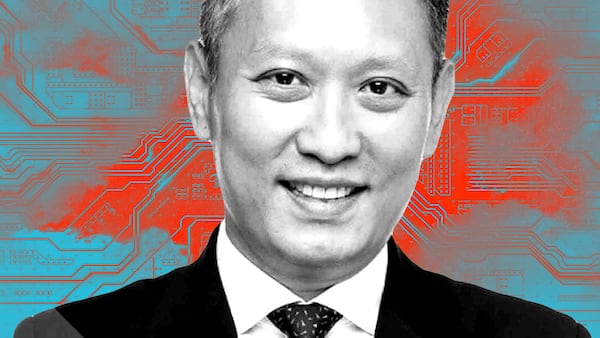

“The total crypto market cap doubled in 2023,” wrote David Duong, Coinbase’s head of institutional research. “The asset class has already exited its ‘winter’ and is now in the midst of a transition.”

At the core of the transition, Duong said, is leading cryptocurrency Bitcoin’s resurgent dominance amid “both the US regional banking crisis and the proliferation of geopolitical conflict.”

The coin has reached more than 50% market dominance — not seen since April 2021.

Bitcoin has rallied 153% this year, as institutions have piled applications on the US Securities and Exchange Commission for their own spot Bitcoin ETFs.

“Institutional flows will remain anchored on Bitcoin at least through the first half of 2024,” wrote Duong.

Blockchain infrastructure and L2 dominance

Coinbase paints 2024 as the year when the blockchain projects that gestated through the bear market will produce results.

“Blockchain infrastructure has come a long way in the last two years,” Coinbase said, with predictions that developments will allow for easier onboarding and better scalability, conditions that will lead to an “inflection point.”

Coinbase foresees a transition for many smaller layer one blockchains, which it says will be forced to pivot as market leader Ethereum’s dominance solidifies.

Blockchains built on top of Ethereum, dubbed layer twos, have dominated the market for much of 2023, with more of Ethereum’s Ether token being staked on L2′s than ever before.

“The share of ETH locked on rollup-linked bridges has grown from 25% of all bridged ETH at the start of 2022 to 85% by end-November 2023.”

The report contends that L2 protocols have created more space on the Ethereum network for developers to build applications. Coinbase said that means more dominance of the crypto world by Ethereum, which will put rival L1s in a tough position.

“The proliferation of L2s has diverted very little activity away from Ethereum, instead cannibalising the activity of alt L1s.”

Ethereum’s rival L1s will have to pivot towards specific sectors, such as gaming and NFTs (Immutable X, Blast) or institutional participants (Avalanche’s Kinto) to stay relevant in 2024.

Crypto market movers

- Bitcoin fell 2.2% in the past 24 hours to trade around $42,090.

- Ethereum fell 3.5% to $2,235.